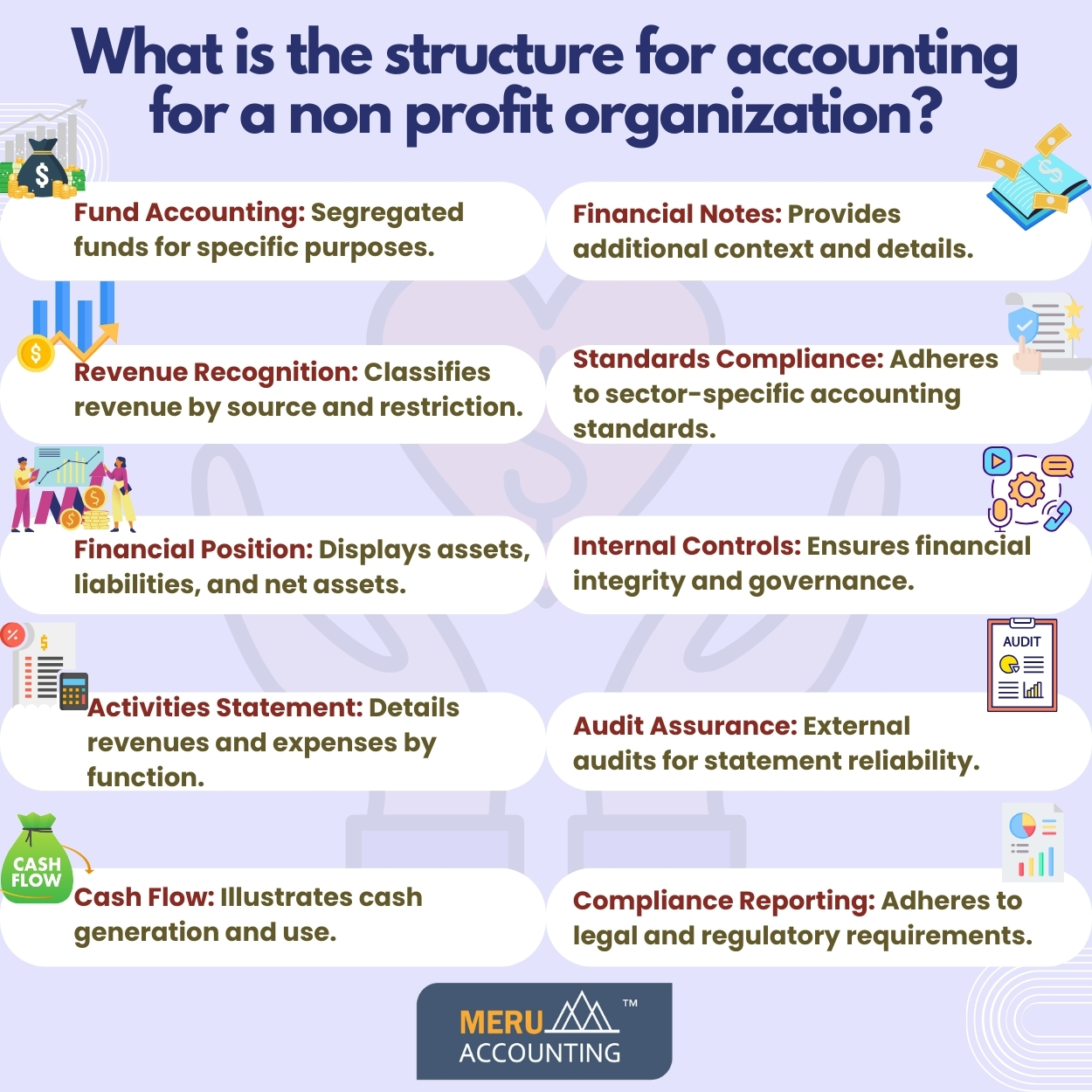

What is the structure for accounting for a non profit organization?

Nonprofit accounting for a nonprofit organization follows a specific format designed to meet the unique needs and objectives of these entities. Nonprofits operate with the primary goal of serving a social or community purpose rather than generating profits for shareholders. The nonprofit accounting framework for nonprofits is centered around transparency, accountability, and demonstrating stewardship of resources. Here’s a comprehensive overview of the format for non profit bookkeeping for a nonprofit organization

Fund Nonprofit accounting

Nonprofits typically use fund nonprofit accounting to track resources dedicated to specific purposes. Each fund represents a separate nonprofit accounting entity with its own set of accounts. Common funds include the general fund, restricted funds, and endowment funds. This segregation helps ensure that resources are used in accordance with donor restrictions.

Revenue Recognition

Nonprofits generate revenue through various sources, such as donations, grants, program fees, and fundraising events. Revenue recognition is based on the type of funding received. Contributions are often classified as unrestricted, temporarily restricted, or permanently restricted based on donor restrictions.

Statement of Financial Position

This statement, also known as the balance sheet, provides a snapshot of the organization’s financial position at a specific point in time. Assets, liabilities, and net assets are categorized, with a clear distinction between restricted and unrestricted net assets.

Statement of Activities

Similar to the income statement in for-profit organizations, the statement of activities outlines the organization’s revenues and expenses over a specific period. Revenues are categorized by source, and expenses are presented by function (e.g., program services, administration, fundraising).

Cash Flow Statement

While not always required, some nonprofits prepare a cash flow statement to illustrate how cash is generated and used during a specific period. This statement provides insights into the organization’s liquidity and ability to meet its short-term obligations.

Notes to the Financial Statements

Nonprofit financial statements are accompanied by detailed notes that provide additional information about nonprofit accounting policies, significant events, and any potential future obligations. These notes enhance the transparency of the financial reporting.

Compliance with Nonprofit accounting Standards

Nonprofits must adhere to non profit bookkeeping standards specific to their sector. In the United States, many follow the Financial Nonprofit accounting Standards Board (FASB) guidelines, particularly the Nonprofit accounting Standards Codification (ASC) 958 for Not-for-Profit Entities.

Internal Controls and Governance

Nonprofits emphasize strong internal controls to safeguard assets and ensure accurate financial reporting. Governance structures, including boards of directors, play a crucial role in overseeing financial management and decision-making.

Audit and Assurance

Many nonprofits undergo external audits to provide stakeholders with assurance about the accuracy and reliability of their financial statements. Audits are often conducted by independent certified public accountants (CPA).

Compliance Reporting

Nonprofits are often subject to various regulatory and compliance requirements, depending on their activities and the jurisdictions in which they operate. Compliance reporting ensures adherence to legal and regulatory obligations.

With help from Meru Accounting there will be emphasis on transparency, accountability, and proper stewardship of resources ensures that nonprofits can fulfill their missions while maintaining the trust of their stakeholders.