Experience Hassle-Free

Accounting for Gems and Jewelry Exporters

With over 9+ years of experience, we are a trusted partner for accounting and bookkeeping services in the UK. Whether you’re a startup, a small business, or an established enterprise, our services can meet the unique needs of your industry. Our deep understanding of UK regulations and best practices can empower your financial journey and drive you toward long-lasting success!

Bookkeeping software expertise

Our Services

We are a group of professionals who offer accounting and bookkeeping services to our clientele across the UK. We offer standard as well as tailored accounting and bookkeeping solutions based on the specific requirements of our clients, ensuring them the best results with our services.

Setting Up Xero/Quickbooks

Fill out our checklist to complete the Setup of your Cloud Software in a day. We provide step by step guidance.

Day To Day Bookkeeping

We will ensure that your books are upto date on the daily/weekly basis so you can stay on top of the Financial position.

Monthly Management Reports

We provide customized reports based upon client requirement. (Sales Perfomance, KPI’s, Overheads reporting, etc)

VAT Returns

We deal with VAT very closely for our clients to ensure that VAT claim is correctly calculated and Submitted Timely.

CIS Returns

Construction Companies enjoy error free and timely submission of CIS returns to HMRC through our services.

Payable Accounting

We track your accounts on a very regular note and also help your business run smoother.

Payroll Setup And Processing

Our procedure will take complete care of your Employee Setup, RTI Filings, Pensions , PAYG Liabilities, P45, P60.

Year End Finalization

We shall provide you complete Financials which can easily be used in preparation and completing Corporate Tax Return.

We provide end to end bookkeeping solutions for CPA’s and bookkeepers in the UK.

Why Are We The 1st Choice Of U.K. Businesses Accounting &

Tax Return Preparation

Reduce 50% in Current Costs

You will see a Cost reduction of at least 40-50% as compared to local Bookkeeper or Accountant.

Self Hosted PMS

Our standardized processes and decent Project Management system helps to communicate with you clearly and efficiently.

Faster Turnaround

We generally reply to every emails same day or within maximum 24 hours.

Starting from

£8

Per Hour Bookkeeping service

Detailed & Regular Work Updates

We send emails that carry all the necessary information you need to carry out business operations.

Monthly Meetings with CPA

We conduct monthly meetings with CPA’s for effective communication and understanding client needs.

Meeting Deadlines

We finish all our work prior to deadlines to prevent any kind of chaos during finalization. .

Detailed Checklists

We prepare a well-defined checklist of all the requirements for you so that you don’t have any confusion.

High Quality of Work

Our Standardized Procedures and Checklists will ensure error free work. .

Cloud AddOns Expertise

Receipt Bank

Receipt Bank converts those annoying bits of paper – receipts and invoices – into Xero data!

Hubdoc

With Hubdoc, you can automatically import all your financial documents & export them into data you can use.

Spotlight Reporting

Attractive performance reports quickly and efficiently. Ideal for organizations that need deeper insight and analysis.

Gusto

Gusto offers fully integrated online payroll services that includes HR, benefits, and everything else you need for your business.

AutoEntry

AutoEntry captures, analyses and posts invoices, receipts and statements into your accounting solution.

Shopify

Connect Shopify and Xero to effectively manage your online sales, inventory and accounting requirements.

Accounting and Bookkeeping for Gems and Jewelry Industry in the UK

The United Kingdom is renowned for its rich history and cultural heritage, particularly in the realm of gems and jewelry. From dazzling diamonds to exquisite gemstones, the UK’s industry has captivated a lot of customers and collectors. With its rich history, exquisite craftsmanship, and timeless beauty, the gems and jewelry industry holds a special place in our hearts. From brilliant diamonds to lustrous pearls, each piece tells a unique story.

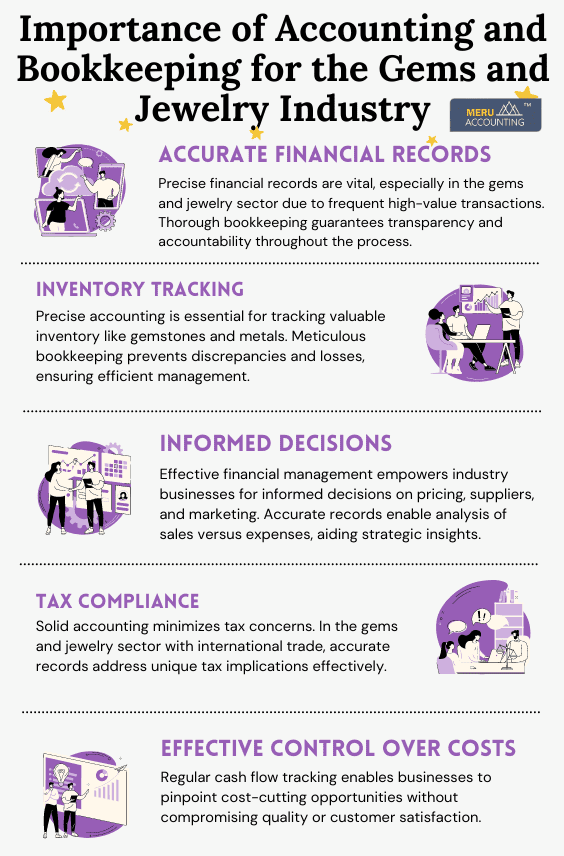

But behind the scenes of this glamorous industry lies an important aspect that keeps it running smoothly – accounting and bookkeeping. Accounting plays a pivotal role in ensuring transparency, accuracy, and compliance within the gems and jewelry industry in the UK. It involves recording financial transactions with utmost precision while adhering to relevant laws and regulations. Bookkeeping further complements accounting by maintaining detailed records of purchases, sales, inventory, expenses, and profits carefully. Let’s explore why accounting and bookkeeping are crucial for the success of businesses in the gems and jewelry sector in the UK and how to find the best accounting and bookkeeping service for the same.

Core Aspects of the Gems and Jewelry Industry in the UK

The Gems and Jewelry Industry in the UK is a growing sector that contains various aspects, from mining and sourcing gemstones to designing and manufacturing exquisite jewelry pieces. Let’s have a look at some of the core aspects:

- Emphasis on quality and craftsmanship: British jewelers are known for their attention to detail and commitment to creating unique, high-quality pieces.

- Contribution to the economy: The industry employs thousands of people across different stages of production, including miners, gem cutters, jewelry designers, manufacturers, wholesalers, and retailers. It also generates significant revenue through exports as British-made jewelry is highly sought after worldwide.

- Innovation: Jewelers constantly strive to create innovative designs using new materials or techniques that push boundaries and capture consumer interest. This focus on innovation helps keep the industry dynamic and ensures its continued growth.

- Sustainability: Sustainability has become an increasingly important aspect within the Gems and Jewelry Industry in recent years. Consumers are becoming more conscious about where their products come from and how they are made. As a result, many jewelers are now adopting sustainable practices such as responsibly sourcing gemstones or using recycled metals.

- Technology: From 3D printing for prototyping designs to advanced machinery for precision cutting gemstones, technology has streamlined processes while maintaining exceptional quality standards.

Overall, the Gems and Jewelry Industry in the UK is characterized by its commitment to quality craftsmanship, integration with technology, sustainable practices, and constant innovation.

Accounting and Bookkeeping for Gems & Jewelry Exporters in the UK

The United Arab Emirates (UK) has long been renowned as a global hub for the gems and jewelry trade. The country’s strategic location, world-class infrastructure, and favorable business environment have attracted numerous gems and jewelry exporters. However, like any other industry, maintaining accurate financial records is crucial for the success and sustainability of gems and jewelry businesses in the UK.

Gems and Jewelry Business is all about elegance, craftsmanship, and making lasting impressions. However, proper financial management is crucial for the success and growth of any business. In the world of gems and jewelry export in the UK, where every piece is a work of art and every transaction is a masterpiece, the importance of accounting and bookkeeping cannot be overstated. These financial practices may not glitter like gemstones, but they provide the foundation upon which the sparkle and allure of this industry rest.

management to safeguard against unexpected financial challenges.

Core Aspects of the Gems & jewelry Exporters in UK

Global Market Presence: One of the core aspects of this industry is its global market presence. UK-based exporters enjoy access to an extensive international customer base, spanning across the Middle East, Asia, Europe, and North America. This global reach not only offers vast business opportunities but also necessitates robust financial management to handle cross-border transactions and varying currencies.

Precious Materials: Dealing with valuable gemstones and precious metals is a defining feature of the gems and jewelry export sector. These materials are not only prized for their beauty but also for their substantial financial value. As such, stringent record-keeping is required due to their high worth and the regulatory requirements that govern their acquisition, processing, and export.

Customs and Compliance: Gems and jewelry exports entail adherence to strict customs and compliance regulations. These regulations are in place to ensure ethical sourcing, fair trade practices, and quality control measures. Accurate documentation is essential to demonstrate compliance, build trust among customers worldwide, and avoid legal complications.

Fluctuating Prices: The gems and jewelry industry is susceptible to fluctuations in the prices of gemstones and metals. The value of these materials can change rapidly due to market dynamics, geopolitical factors, and supply and demand shifts. This emphasizes the need for real-time financial tracking and precise inventory management to safeguard against unexpected financial challenges.

Why do we need Accounting and Bookkeeping for the Gems and Jewelry business?

The gems and Jewelry export industry is very huge. So, a wide range of risks like foreign taxes, gold prices, credit risk, currency fluctuation risk, etc. affect it. We at Meru Accounting believe in providing an all-in-one solution to all these complexions and cover accounting related to all the stated matters and much more.

This industry has a very large exposure and the risk associated with it is huge too. So, it’s very important to update the books of accounts regularly. It is advisable to update books of accounts every fortnight so that receivables can be tracked and chased timely. Then only a company can have a proper look at its business and profitability.

The gems and Jewelry export industry deals with many clients and that too is situated in different countries. This makes the invoicing process a bit tricky and requires being meticulous. For that recurring invoices should be set up so that the invoices are automatically created in the accounting system and are matched with the receipts, and we have expertise in handling the same for our clients.

The gems and Jewelry industry has to deal with the changing prices of Gold in the international commodity markets. As the price changes, it affects the export business as well, and that makes it hard to manage receivables due to complex calculations. We at Meru Accounting carry out the accounting tasks related to it on time and with that managing receivables also becomes easy.

Inventory management is essential and that too becomes a very serious task when inventory costs are in a mammoth amount. Understanding this need, we keep regular track of inventory and trade deals with our experienced team using the best accounting software that is suitable for our clients’ business.

Capital cost is the major contributor to a company’s profit. Gems and Jewelry businesses are generally highly profitable businesses given only if one adequately amortizes the capital cost against the receipts. Accounting for Gems and jewelry Business, We have expert professionals to look after this requirement so that any kind of error can be avoided.

Every business has the aim to make a good profit at the end of a financial year. But that requires neatly crafted financial planning. We aim to generate a high profit margin and budget the revenue accordingly. That leads our Gems and Jewelry clients to leverage their export businesses without any worry. In addition to that, as this is an export industry, we also look after the tax compliances related to many countries to help our clients deal with it very easily.

How can accounting and bookkeeping help the Gems & jewelry Exporters in the UK?

Audit Preparedness: Well-maintained financial records simplify the auditing process, ensuring a smooth experience during regulatory inspections or investor due diligence. This not only saves time but also showcases the business’s commitment to transparency and compliance. It instills confidence in stakeholders, including investors, lenders, and potential partners.

Compliance with Legal Requirements: Accounting and bookkeeping help Gems & jewelry Exporters in the UK meet legal requirements such as tax filings and audits. These financial practices ensure that all financial statements are prepared according to regulatory guidelines, providing an accurate representation of the company’s financial position. This compliance is essential to avoid penalties and legal issues that can disrupt business operations.

Enhanced Internal Transparency and Accountability: Having reliable accounting systems in place enhances transparency within the organization. It promotes accountability among employees by providing a clear view of their performance metrics while also deterring fraudulent activities. This internal transparency fosters a culture of responsibility and integrity.

Building Credibility with External Stakeholders: In addition to these benefits internally, proper accounting practices can also enhance credibility with external stakeholders such as investors, banks, and suppliers. By presenting well-organized financial statements backed by solid record-keeping processes, Gems & jewelry exporters can instill confidence among potential partners or lenders. Credibility and trust are essential when seeking external support for business growth and expansion.

Benefits of accounting and bookkeeping for the Gems & jewelry Exporters in UK

Creditworthiness: Accurate financial records and reporting improve the exporter’s creditworthiness. Banks and financial institutions are more likely to extend credit or offer favorable terms when presented with well-documented financial statements.

Asset Management: Efficient tracking of assets and liabilities ensures that the business can make informed decisions about acquiring, disposing of, or depreciating assets. This includes managing valuable inventory and equipment effectively.

Benchmarking: Comparing financial performance against industry benchmarks and competitors provides valuable insights. Gems & jewelry Exporters can identify where they stand relative to their peers and adjust their strategies accordingly.

Financial Forecasting: Accounting and bookkeeping enable accurate financial forecasting. This helps exporters anticipate potential financial challenges and develop strategies to address them proactively.

Business Continuity Planning: Detailed financial records support the development of business continuity plans. In case of unexpected disruptions or emergencies, having a clear financial picture helps businesses navigate challenges more effectively.

Meru Accounting's Accounting and Bookkeeping services for the Gems & jewelry Exporters in the UK

Accounting for Gems and Jewelry Business – The Gems and Jewelry export industry is very huge. So, a wide range of risks like foreign taxes, gold prices, credit risk, currency fluctuation risk, etc. affect it. We at Meru Accounting believe in providing all-in-one solutions to all these complexions and cover accounting related to all the stated matters and much more.

Books of Accounts: This industry has a very large exposure and the risk associated with it is huge too. So, it’s very important to update the books of accounts regularly. It is advisable to update books of accounts every fortnight so that receivables can be tracked and chased timely. Then only a company can have a proper look at its business and profitability.

Invoices and Receipts: The Gems and Jewelry export industry deals with many clients and that too is situated in different countries. This makes the invoicing process a bit tricky and requires being meticulous. For that recurring invoices should be set up so that the invoices are automatically created in the accounting system and are matched with the receipts, and we have expertise in handling the same for our clients.

Receivables Management considering Gold prices: The Gems and Jewelry industry has to deal with the changing prices of Gold in the international commodity markets. As the price changes, it affects the export business as well, and that makes it hard to manage receivables due to complex calculations. We at Meru Accounting carry out the accounting tasks related to it on time and with that managing receivables also becomes easy.

Inventory Management: Inventory management is very essential and that too becomes a very serious task when inventory costs a mammoth amount. Understanding this need, we keep regular track of inventory and trade deals with our experienced team using the best accounting software that is suitable for our client’s business.

Manage Capital Cost: Capital cost is the major contributor to a company’s profit. Gems and Jewelry businesses are generally highly profitable businesses given only if one adequately amortizes the capital cost against the receipts. Accounting for Gems and jewelry Business, We have expert professionals to look after this requirement so that any kind of error can be avoided.

Increase Profit: Every business has the aim to make a good profit at the end of a financial year. But that requires neatly crafted financial planning. We aim to generate a high profit margin and budget the revenue accordingly. That leads our Gems and Jewelry clients to leverage their export businesses without any worry. In addition to that, as this is an export industry, we also look after the tax compliances related to many countries to help our clients deal with it very easily.

In the fiercely competitive and tightly regulated world of gems and jewelry export in the UK, accounting and bookkeeping practices are indispensable. These financial services offer transparency, compliance, and efficiency, essential for business success and growth. Accurate financial records empower Gems & jewelry exporters to monitor expenses, analyze sales revenue, and make informed decisions to optimize operations.

Furthermore, precise records ensure adherence to ever-changing regulations and tax obligations, safeguarding against penalties. Meru Accounting, with its specialized expertise in this unique industry, provides tailored solutions, from transaction recording to financial statement preparation. By entrusting their financial management to Meru Accounting, Gems & jewelry exporters can focus on their core business, confident that their financial operations will shine as brightly as their precious gems.

How to find the best accounting and bookkeeping service for the Gems and Jewelry Industry in the UK?

When it comes to finding the best accounting and bookkeeping service for the Gems and Jewelry Industry in the UK, there are a few key factors to consider:

- Experience: You'll have to look for a service that has experience working specifically with businesses in this industry. Gems and jewelry have unique financial considerations, so it's important to work with professionals who understand these intricacies. Meru Accounting offers specialized accounting and bookkeeping services for Gems and Jewelry businesses in the UK.

- Reliability: You need an accounting and bookkeeping service that can provide accurate and timely financial information when you need it most. This will help you make informed business decisions and stay on top of your finances. Meru Accounting ensures reliable accounting and bookkeeping services to all its customers.

- Technology: In today's digital age, it's essential to choose a service that utilizes modern accounting software and tools. This will not only streamline your financial processes but also ensure accuracy and efficiency. Meru Accounting uses the latest cloud-based technologies to ensure the best accounting and bookkeeping services.

- Customer support: Consider the level of support provided by the service provider. Do they offer ongoing assistance or consultations? Can they answer any questions or concerns you may have regarding your accounts? Meru Accounting is ready to hear from its customers whenever they have any concerns or face difficulties.

- Cost-effectiveness: While quality should be a priority, it's always beneficial to find an accounting and bookkeeping service that offers competitive pricing without compromising on expertise. You can save a lot of money by choosing the pay-per-hour accounting and bookkeeping services of Meru Accounting.

Meru Accounting's Accounting and Bookkeeping services for the Gems and Jewelry Industry in the UK

Meru Accounting understands the unique challenges and requirements of the Gems and Jewelry industry in the UK. With our specialized accounting and bookkeeping services, we are dedicated to supporting businesses in this sector. Our team of experienced accountants has a deep understanding of gems and jewelry market dynamics. We stay updated with the latest regulations, tax laws, and industry trends specific to this niche. This enables us to provide tailored financial solutions that meet your business needs.

We offer comprehensive bookkeeping services that ensure accurate tracking of your income, expenses, inventory management, and cash flow. Our experts will handle all aspects of your financial records so that you can focus on growing your business. In addition to day-to-day bookkeeping tasks, we also assist with monthly or quarterly financial statement preparation. These reports provide valuable insights into your company’s performance and help you make informed decisions for future growth.

Moreover, our team is well-versed in handling VAT returns for gemstone traders and jewelers. We can guide you through complex VAT rules specific to the Gems and Jewelry industry in the UK, ensuring compliance while minimizing tax liabilities. By choosing Meru Accounting as your accounting partner for gems and jewelry businesses in the UK, you gain access to a reliable team that prioritizes accuracy, confidentiality, and efficiency. We use advanced cloud-based software solutions that streamline processes while maintaining data security.

Conclusion

In today’s competitive business landscape, accounting and bookkeeping play a vital role in the success of any industry, including the gems and jewelry sector in the UK. With its unique financial requirements and complexities, businesses in this industry must partner with reliable and experienced accounting professionals. Finding the right accounting and bookkeeping service can make all the difference in managing your finances effectively. From tracking sales and expenses to maintaining accurate records of inventory, a specialized accounting service like Meru Accounting can provide comprehensive solutions tailored specifically for the gems and jewelry industry.

Meru Accounting understands the specific challenges faced by businesses in this sector. Their team of skilled accountants brings expertise not only in general financial management but also knowledge of gemstone valuation, diamond grading systems, gold pricing trends, import/export regulations, VAT compliance, and more. By partnering with Meru Accounting’s dedicated professionals who are well-versed in both traditional practices and modern software solutions like QuickBooks or Xero, you can ensure that your financial operations are streamlined while adhering to regulatory requirements.

When it comes to running a successful gems and jewelry business in the UK market, accounting should never be overlooked. It is an essential aspect that helps maintain financial stability while providing valuable insights into business performance. Partner with Meru Accounting today for professional accounting support customized to your unique needs.

CONTACT US FOR ANY QUESTIONS

Hiring Virtual Accountant With Meru Accounting

Meru Accounting provides world-class services that cater to all the needs of cloud accounting and bookkeeping of your business.

We work on the best accounting software like Xero and Quickbooks, as well as add-ons that will make sure all your work is up-to-date.

Help you with switching from your traditional software to Xero and Quickbooks.

We also manage VAT, CIS, CT 600 Tax return, Companies house Tax return, Confirmation Statement, Payroll RTI return submissions which gives your onstop solution for all.

When you choose to outsource your accounting work with us, it benefits you in the following ways:

- 1. Cost-saving

- 2. Access to skilled and experienced professionals

- 3. Better management of books of accounts

- 4. Decreased chances of errors

- 5. Improve business efficiency

- 6. De-burdens in-office employee’s dependency

- 7. Better turnaround time

We work on virtual technologies like Team Viewer, Virtual Private Network (VPN) to share and access data from your system.

You have to share your accounting software login details.

Through that, we complete all of your work and update it on the cloud, so you can have access to your data from anywhere and at any time.

Software is not a barrier for us. Due to our strong and professional accounting knowledge, we can prepare your books in almost any of the accounting software.

Our experts are always all ears to listen to your queries regarding bookkeeping and accounting or our services. You can contact us anytime by visiting: Contact Us page.

We provide our bookkeeping services at the rate of US $10 per hour. So, you only need to pay for the amount of time actual work is done.

We take certain preventive measures to secure your data, like:

- Cyberoam Firewall to prevent any kind of foreign threat.

- Dual-step authentication

- Implement anti-virus

- Limit user access so that login details are with a few people.

Meru Accounting work on some of the best accounting software’s like:

- Xero

- Quickbooks

- Netsuite

- Saasu

- Wave

- Odoo

Along with that, we also work with many add-ons like Workflow Max, Receipt Bank, Slack, TradeGecko etc., to extend your software’s capacity and improved work experience.

To book for trial, call us on our numbers or Please fill out the form here.

Our Work Information

We have combined team of Professionals. Seniors are generally Certified Chartered Accountants. Junior Bookkeepers are having Qualifications like Bachelors of Commerce, Masters of Commerce, Masters in Business Administration in the subject of Accounts and Finance, Intermediate level Qualification of Chartered Accountancy, etc.

For information visit our work methodology page.

We prepare a checklist of information required for bookkeeping and send you at timely intervals so as to ensure that we can do bookkeeping faster.

We can provide to you once we move ahead in our interview.

We serve clients on MYOB and have expertise working in Essentials, Account Rights Plus, etc.

Yes, We are presently processing Payroll for Number of clients in US , UK and Australia and take care of complete payroll activities.

Goods and Service tax (GST) is levied on sales of all the goods and services in Australia. GST is generally chargeable at 10% of value of sales.

Business Activity Statement is a predefined form to be submitted to the Australian Tax office by all the business persons in order to report on their all the tax obligations during the period covered.

BAS is generally required to be filed quarterly by various businesses.

Individual Business Owners

Yes, Owner of the business can prepare sign and lodge the tax return on his own. Its not mandatory that the Tax return needs to be signed by an EA or CPA.

No , its not mandatory that it should be prepared by only CPA or EA. It can be prepared by anyone who has PTIN.

We have Enrolled Agent who has the Authority to sign the documents for our clients after completing the through professional check.

Meru Accounting has its operational centre in India and hence the prices are quite less as compared to US based CPA’s and Enrolled Agents.

Meru Accounting has a team of Tax experts. Each Tax expert prepares around 300-400 Tax returns every year for various CPA’s in United States and Individual Businesses like yours. Due to this vast Experience and Robust Quality Check processes in place we can ensure you about correct Tax planning for your firm.