- Schedule Meeting

Is tax planning a legal way of tax saving?

Whether it is for an individual or business owner, it is important to deal with taxes with proper regulations. Tax planning is legal practice in the UK that must be done within the boundaries of tax regulations and laws. This helps to reduce the taxes by making the personal or business transactions through different ways. It is important to understand that there is a difference between tax evasion and tax planning.

In tax evasion, the tax evasion is done deliberately and unlawfully by hiding or misrepresenting the assets, income, or transactions. Whereas, in tax planning, there is proper structuring of the financial affairs to minimize tax liability. Many of them in the UK do not have in-depth knowledge of the HMRC regulations. So, many of them are looking for professional tax planning services in the UK who can deal properly with tax compliance.

What are the main types of taxes in the UK?

The main types of taxes in the UK are listed below:

1. Income tax

Depending on the income, the tax levied ranges between 0% and 45%. This taxes is payable on dividends, savings, and interest.

2. Capital gains tax

If the annual threshold on the investment gains is more than £6,000 then taxes levied is between 10% and 28%.

3. Inheritance tax

While living this world, if your estate exceeds £325,000 then 40% of the taxes are levied.

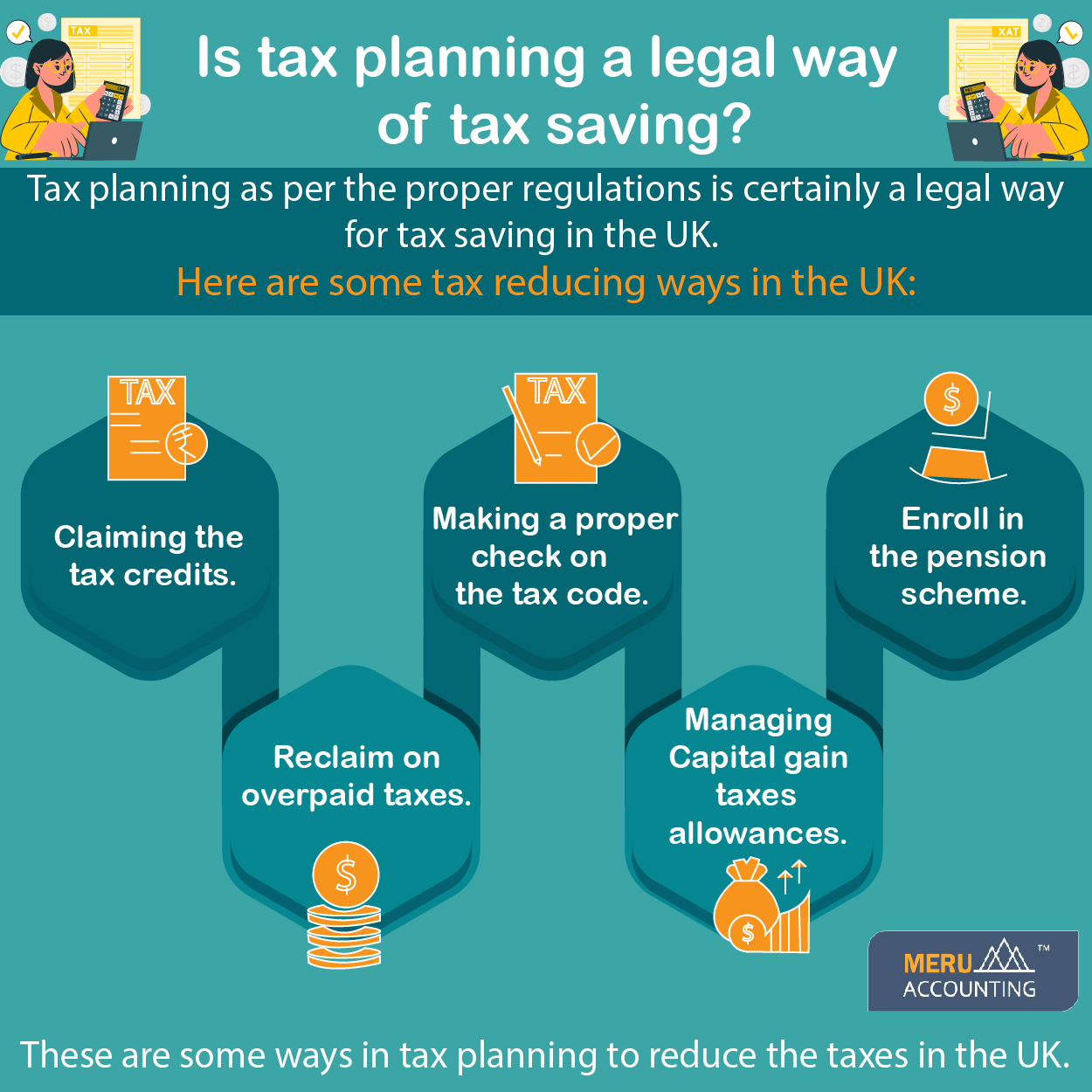

What are the ways to reduce income taxes in the UK?

Although you cannot avoid the taxes, tax planning services providers will surely guide you to reduce the taxes.

Here are few ways to reduce the taxes in the UK:

Claim the tax credits

Tax credit options provided under HMRC provide extra income for a few categories. Child tax credit and working tax credit are the two main categories of the tax credits.

Have a check on the tax code

Tax code indicates the taxes collected from you from the HMRC that is found on the payslip. While changing your job, it is important to check that you have the same code else some extra taxes may be collected from you.

Pay for the pension scheme

Before payment of any of the taxes charges, pay for the pension scheme of the government. You will get tax relief from the government while giving a free bonus for saving for retirement.

Reclaiming on overpaid taxes

If you have been taxed extra than you actually have to pay, then you can actually reclaim your actual taxes. Here, you need to fill the HMRC form R40 and you will receive all the overpaid taxes you have done.

Capital gains tax (CGT) allowance

The profits you gain from some types of investments like art selling, second home, antiques, shares, etc. will fall under capital gains. Here, if your capital gains are less than £6,000 then you are not tax liable and if it goes above then you are liable to pay taxes.

These are some ways you can do tax planning to reduce the taxes paid. Certainly this planning must be done with compliance with HMRC guidelines.

If you are finding it difficult to do proper tax planning in the UK then you can outsource this task to the experts. Meru Accounting are professional tax planning services providers in the UK. They have experts who have good knowledge on HMRC guidelines to help you reduce taxes. Meru Accounting is a proficient accounting service providing company around the world.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 (0) 203 868 2860

- [email protected]

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2025 Meru Accounting. All Rights Reserved.

Privacy Policy

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 73 6051 0348

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds