- Schedule Meeting

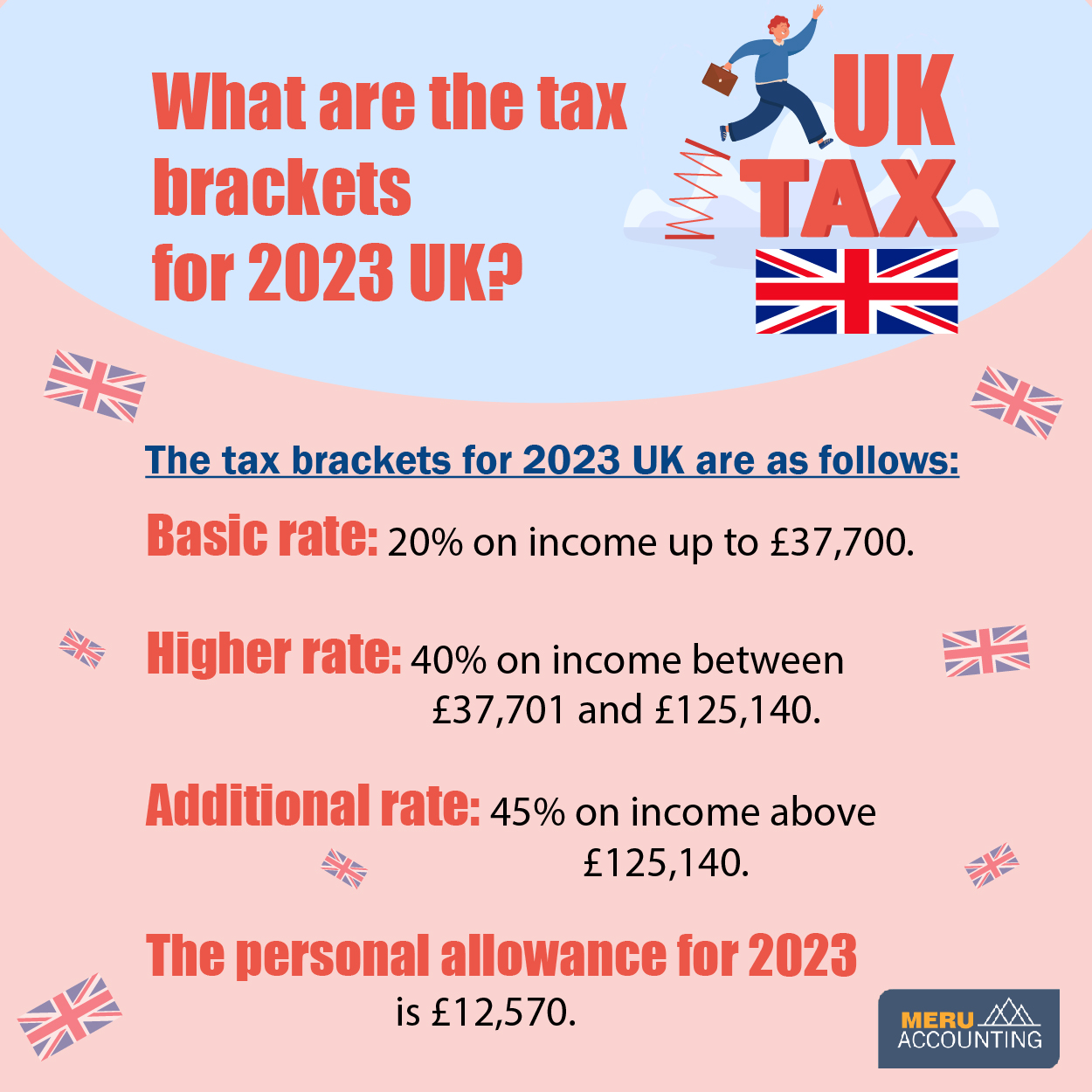

What are the tax brackets for 2023 UK?

Tax brackets 2023 UK: What you need to know!

The UK tax system is based on a progressive system, which means that the amount of tax you pay depends on your income. There are three income tax slab / brackets in the UK for 2023:

- Basic rate: 20% on income up to £37,700.

- Higher rate: 40% on income between £37,701 and £125,140.

- Additional rate: 45% on income above £125,140.

In addition to these income tax brackets, there is also a personal allowance, which is the amount of income you can earn before you start paying income tax. For 2023, the personal allowance is £12,570.

This means that if you earn less than £12,570 in a year, you will not pay any income tax. If you earn between £12,570 and £37,700, you will pay 20% tax on the amount of your income that is above £12,570. And if you earn more than £37,700, you will pay 40% tax on the amount of your income that is above £37,700.

For example, if you earn £50,000 in a year, you will pay £7,486 in income tax. This is calculated as follows:

£12,570 x 0% = £0 (your personal allowance)

£37,430 x 20% = £7,486 (your basic rate tax liability)

Income tax slabs:

The income tax brackets are also referred to as income tax slabs. This is because each slab represents a different rate of income tax. For example, the basic rate slab is the income tax slab that applies to income up to £37,700.

The income tax slabs are important because they determine how much tax you will pay. If you earn more than the upper limit of a particular slab, you will pay the higher rate of tax on all of your income that falls within that slab.

For example, if you earn £45,000 in a year, you will pay 20% tax on the first £37,700 of your income and 40% tax on the remaining £7,300.

However it is important to note that the above tax brackets are subject to change, so it is important to check the latest figures before you file your tax return.

Understanding tax brackets 2023

Tax brackets can be a bit confusing, but they are important to understand if you want to know how much tax you will pay. By understanding the different income tax brackets and the personal allowance, you can calculate your own income tax liability and make sure that you are paying the correct amount of tax.

If you have any questions about tax brackets, you should consult with a tax advisor. They will be able to help you understand your individual circumstances and ensure that you are paying the correct amount of tax.

Meru Accounting is a leading tax and accounting firm in the UK. We have a team of experienced tax advisors who can help you understand the tax brackets for 2023 UK and ensure that you are paying the correct amount of tax. Meru Accounting can also help you with your tax return preparation and filing. We will work with you to gather all of the necessary information and ensure that your return is filed correctly and on time.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 (0) 203 868 2860

- [email protected]

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2025 Meru Accounting. All Rights Reserved.

Privacy Policy

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 73 6051 0348

- Email: [email protected]

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds