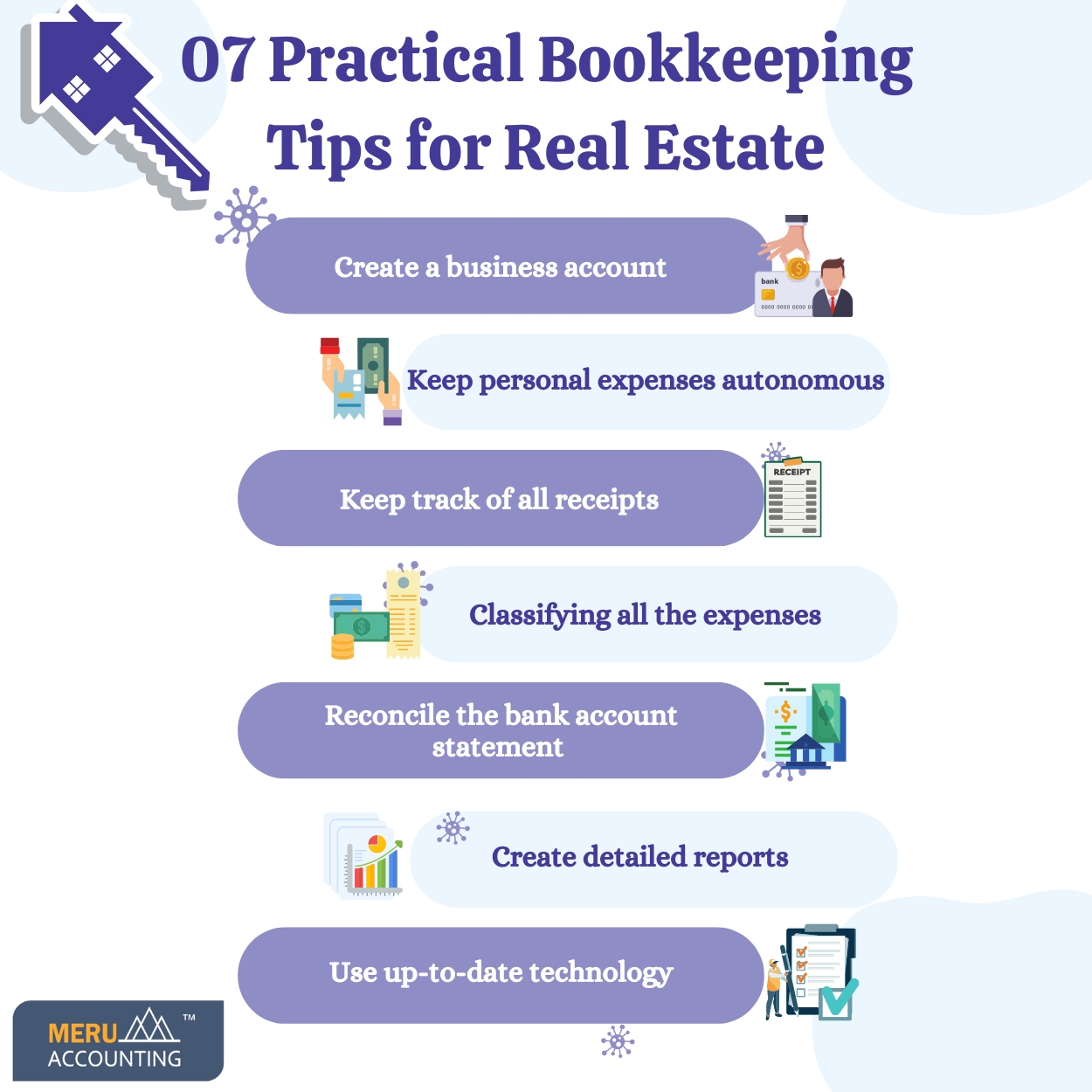

7 Practical Bookkeeping Tips for Real Estate

Bookkeeping For Real Estate is the process of keeping an accurate record of all the money that enters and exits one’s business. It is an important task for any real estate business. A well-organized, timely, and simple Real Estate Bookkeeping serves numerous practical purposes. It aids in the tracking of key performance indicators such as cash flow, profits and losses, and net worth. Below are some Bookkeeping Tips For Real Estate.

01. Create a Business Account

Many new investors are unsure whether they need a different bank account for real estate. A business account for real estate is required for a variety of reasons. It will save both time and money. It will aid in the protection of one’s assets. It reduces risks and helps make bookkeeping simpler and more accurate.

02. Keep Personal Expenses Autonomous

An essential principle of Real Estate Bookkeeping is to keep personal expenses separate from business expenses. This separation serves a practical purpose, but it also helps save legal trouble during tax season. Keeping business and personal accounts autonomous provides security. It also enables one to claim all possible deductions, lowering one’s tax burden and thereby saving money.

03. Keep Track of All Receipts

Keeping track of all of the receipts will help one stay financially organized and ensure that one deducts the correct amount from one’s income during tax season. This is simpler than it appears because one is not required to maintain hard copies. it is recommended to use receipt photos or scans because they are much simpler to deal with. This will make tracking one’s expenses easier and will aid one in doing taxes.

04. Classifying all The Expenses

The purpose of documenting the income and itemizing expenses for real estate is to determine one’s taxable income. Taxable income is directly proportionate to the tax one pays which means, the lower one’s taxable income, the less the tax one has to pay. Expense classification should be fairly simple, especially if one keeps all of one’s receipts.

05. Reconcile the Bank Account Statement

One of the most crucial tips for Bookkeeping For Real Estate is to reconcile one’s accounts each month. Reconciling one’s accounts is the method of double-checking that the documented transactions match the actual transactions. reconciliation is a fundamental practice of bookkeeping Because ongoing accuracy is very critical.

06. Create Detailed Reports

A profit and loss statement, which demonstrates all of the property’s income streams, expenditure, and cash flow, is the most popular report in Real Estate Bookkeeping. These statements, therefore, provide an accurate representation of how one’s company operates and how much profit it makes. Examining one’s financial statements will assist in making better decisions.

07. Use Up-to-date Technology

One of the crucial Bookkeeping Tips For Real Estate is to use the latest technology. The most recent technological tools make managing one’s finances and real estate investments easier than ever. They can save time while improving accuracy by automating tedious tasks like data entry.

By following these tips, one can ensure that their bookkeeping process runs smoothly. With Meru Accounting, ensure that your real estate business is on top by using all the practical bookkeeping tips.