How will Zoho Books accounting software help Accountants?

Accountants seeking to provide efficient and accurate financial services must definitely use Zoho Books accounting software. It is an accounting software solution that has emerged as a valuable tool for accountants, offering a range of features designed to streamline tasks and enhance overall productivity.

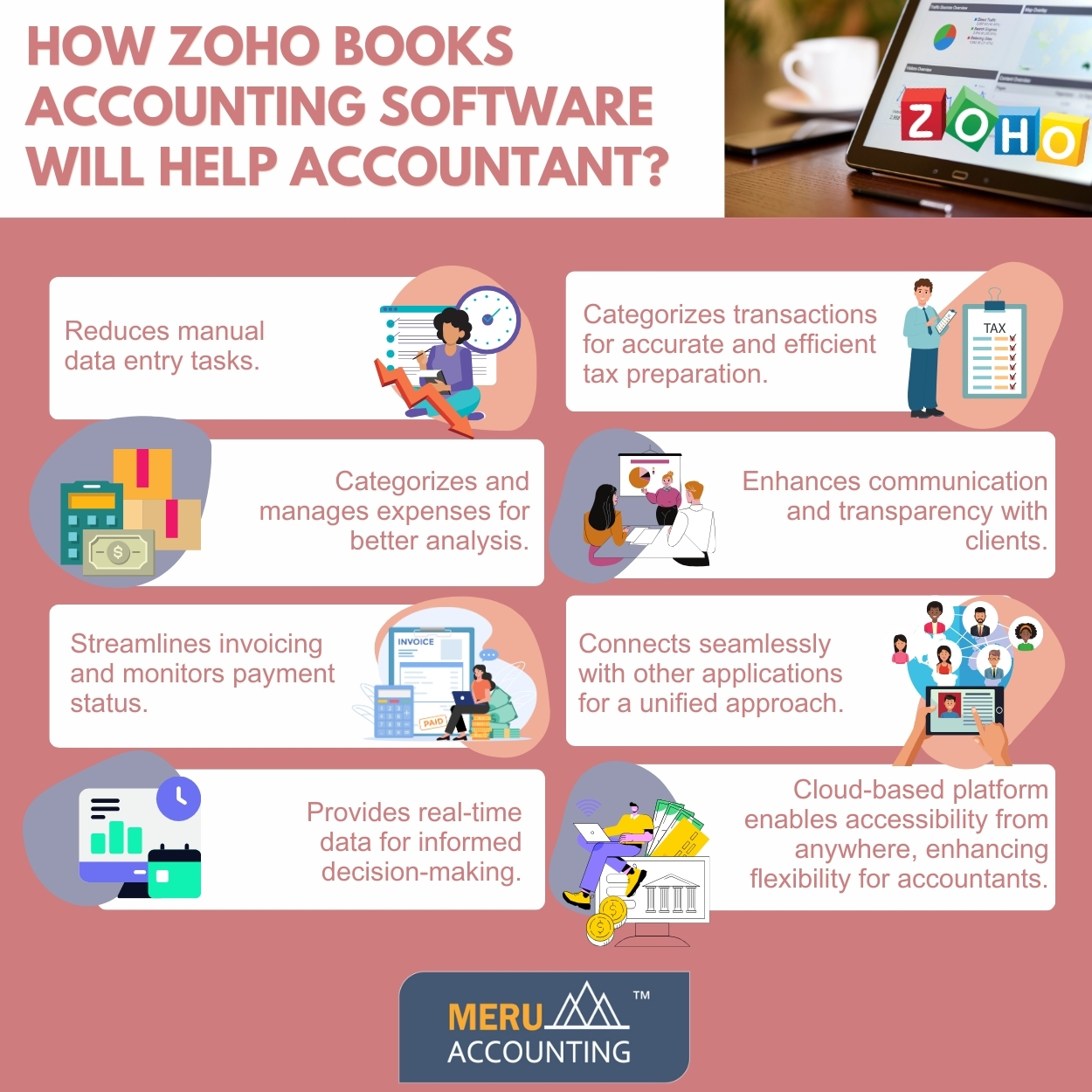

Features of Zoho Books Accounting software that can help Accountants:

Automated Bookkeeping

Zoho Books accounting software simplifies the bookkeeping process by automating data entry tasks. With features like bank reconciliation, the software automatically matches transactions from bank feeds, minimizing manual data input. This not only reduces the risk of errors but also saves accountants valuable time.

Expense Tracking and Management

Accountants can effortlessly track and manage expenses using Zoho Books accounting software. The software allows for the categorization of expenses, making it easier to monitor and analyze spending patterns. This feature is particularly beneficial for budgeting purposes and ensures that accountants have a comprehensive overview of financial transactions.

Invoicing and Billing Efficiency

By using Zoho Books, accountants can facilitate seamless invoicing and billing processes. Accountants can generate professional invoices, customize them to suit specific client needs, and send them directly from the platform. Zoho software also tracks payment status, enabling accountants to monitor cash flow and follow up on outstanding payments efficiently.

Financial Reporting and Analysis

By using Zoho Books accountants can provide robust reporting tools that empower accountants to generate a variety of financial reports. From profit and loss statements to balance sheets and cash flow analyses, accountants can access real-time data to make informed decisions and offer valuable insights to clients. This enhances their ability to provide strategic financial advice.

Tax Compliance and Reporting

Meeting tax obligations is simplified with Zoho Books. The software aids accountants in categorizing transactions according to relevant tax codes, ensuring accurate and efficient tax preparation. This not only reduces the risk of errors but also facilitates compliance with ever-evolving tax regulations.

Collaborative Features

Zoho Books offers collaborative features that enhance communication between accountants and their clients. Shared access to financial data promotes transparency and enables real-time collaboration. Accountants can seamlessly work with clients, share reports, and address financial queries without the need for constant back-and-forth communication.

Integration Capabilities

Zoho Books integrates seamlessly with other Zoho applications and a variety of third-party tools. This integration simplifies workflow processes by allowing accountants to connect various business applications, ensuring a unified and cohesive approach to financial management. This connectivity enhances overall efficiency.

Mobility and Accessibility

With a cloud-based platform, Zoho Books provides accountants with the flexibility to access financial data from anywhere with an internet connection. This mobility is crucial for accountants who may need to work remotely or collaborate with clients on the go. The ability to manage finances from various locations enhances overall accessibility.

Conclusion:

Zoho Books stands out as a comprehensive accounting software solution that caters to the diverse needs of accountants. From automating routine tasks to providing sophisticated financial reporting tools, Meru Accounting believes that the software streamlines operations and enhances overall efficiency.

FAQs

- Why should accountants use Zoho Books over manual records?

Manual records take more time and lead to more errors. Zoho Books cuts down on tasks by automatching data, tracking costs, and giving fast reports. - How does Zoho Books make invoicing easier for accountants?

Zoho Books lets accountants draft and send pro-style bills with ease. They can track who paid, send alerts for late pay, and keep a clear cash flow. This makes billing smooth and stress-free. - Can Zoho Books help with tax filing?

Yes, Zoho Books tags each deal with the right tax code. This means fewer errors at tax time and less stress when rules change. Accountants can file with more ease and less risk. - What types of reports can accountants build with Zoho Books?

Accountants can build profit and loss sheets, balance sheets, and cash flow statements. These reports give live data that helps in smart plans and deep client advice. - How does Zoho Books support client teamwork?

Zoho Books gives shared access so both sides can see data in real time. This means fewer calls and emails. It builds trust and keeps work clear and quick. - Is Zoho Books useful for both small and large firms?

Yes, it works for both. Small firms gain from simple use and less manual work. Larger firms gain from strong reports, tax tools, and smooth client links.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 203 868 2860

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2026 Meru Accounting. All Rights Reserved.

Privacy Policy

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds