- Schedule Meeting

How UK Small Businesses Can Maximize Xero Accounting

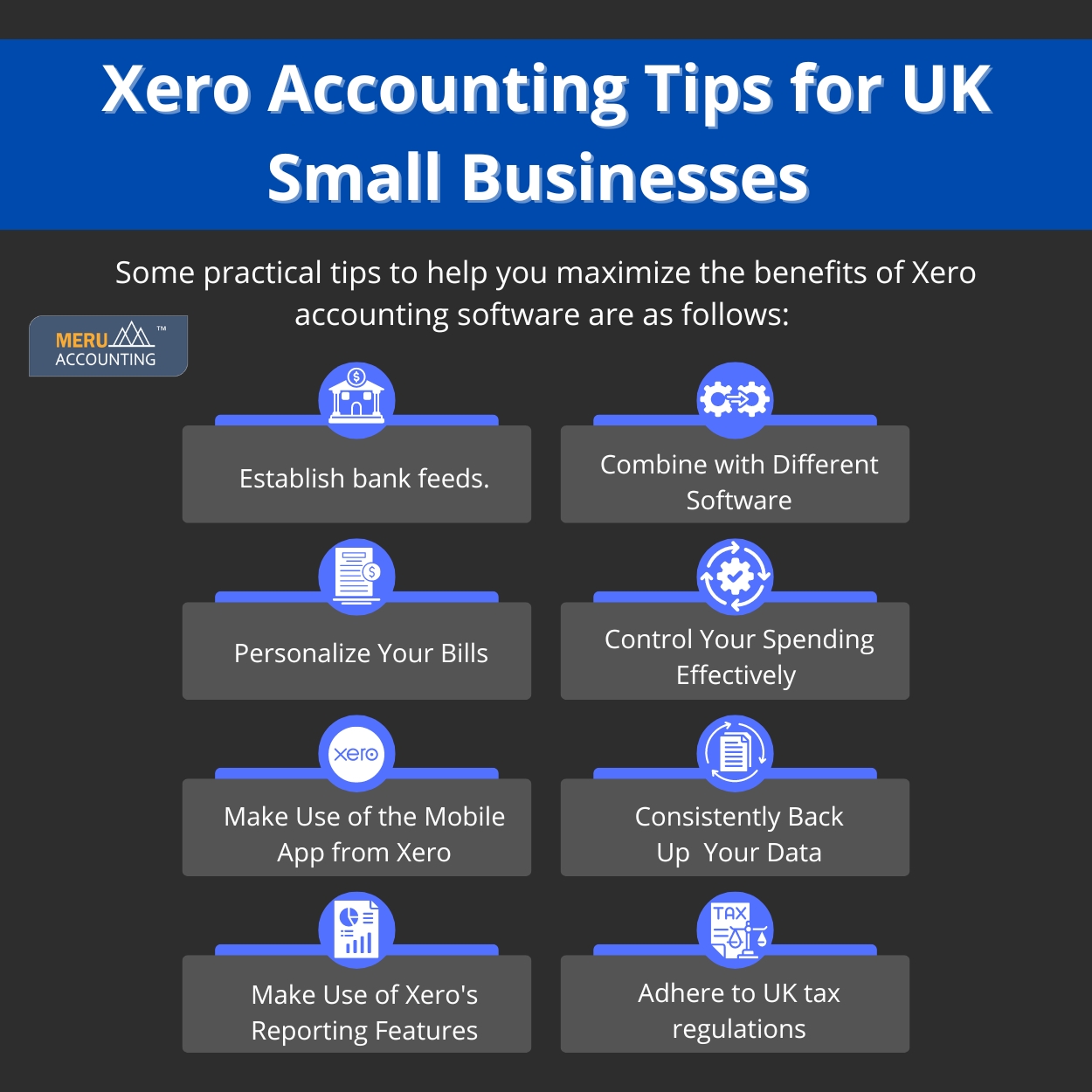

Small businesses in the UK may find it difficult to manage their finances. Xero Accounting provides a reliable way to improve and streamline bookkeeping duties. We’ll provide crucial Xero accounting advice in this blog specifically for small businesses in the UK so you can get the most out of this effective technology. Xero offers capabilities to help you automate repetitive chores, manage VAT returns, integrate with other business systems, and optimize your accounting procedures.

We’ll go over helpful tips for configuring reports, setting up your accounts, and utilizing Xero’s real-time insights to make wise financial decisions. These points will help you maximize your current setup or get started with Xero, as they will increase productivity, guarantee compliance, and enhance your financial management in general.

Xero accounting for UK businesses offers a robust platform that simplifies accounting tasks and ensures accuracy. In this blog, we’ll explore practical tips to help you maximize the benefits of Xero accounting software.

1. Establish bank feeds

Put Transactions in Automation:

The capability to link your bank accounts to Xero directly is among the most potent aspects of Xero accounting for UK businesses. By streamlining the import and reconciliation process, this automation will save you time and minimize errors.

Frequent Settlement:

To make sure your records are current, reconcile your bank transactions on a regular basis. This process helps in the timely detection of disparities and the protection of accurate financial data.

2. Personalize Your Bills

Professional Look:

You may display a polished image to your clients by customizing your invoices in Xero. To make your bills look professional and understandable, choose your favorite template, add your company logo, and include any essential information.

Automated Notifications:

Create automated reminders for bills that are past due. This function guarantees that you get paid on time without the need for manual follow-ups.

3. Make Use of the Mobile App from Xero

Manage On-the-Go:

You can handle your finances while on the go with the Xero mobile app. With your smartphone, you can send invoices, reconcile transactions, and keep an eye on your cash flow. All of these can help you remain on top of your business’s finances no matter where you are or when.

Updates in Real Time:

With the app’s real-time updates, you can be sure you always have access to the most recent financial data.

4. Make Use of Xero’s Reporting Features

Produce Accounts Receivable Reports:

A variety of financial reports are available in Xero accounting software, which can assist you in understanding the operation of your company. To make wise business decisions, create and evaluate cash flow, balance sheet, and profit and loss statements on a regular basis.

Personal Reports:

Make personalized reports that meet your needs. This function enables you to track key performance indicators and analyze trends relevant to your business.

5. Combine with Different Software

Simplify Your Processes:

Xero easily interfaces with a wide range of third-party programs, including CRM software, inventory management tools, and payroll systems. Your company’s operations can be more efficiently run by utilizing these integrations.

Save Time:

By eliminating the need for manual data entry, integration lowers the possibility of errors while also saving time.

6. Control Your Spending Effectively

Monitor and Categorize:

Track and organize your business spending using Xero. You can find places where you can make savings and gain insight into where your money is going by engaging in this exercise.

Management of Receipts:

Digital copies of your receipts can be stored and arranged using Xero’s receipt management tool. This lessens paper usage and guarantees you are equipped with all the paperwork you need for taxation.

7. Consistently Back Up Your Data

Cloud Backup:

Your financial data may be reliably and securely stored in the cloud with Xero’s automated data backup feature. Maintaining regular backups makes sure you can restore your data in the event of an unexpected circumstance.

Export Information:

Export your data from Xero on a regular basis as an extra precaution. This gives an extra layer of comfort and protection.

8. Adhere to UK tax regulations

VAT Refunds:

The preparation and submission of VAT returns are made easier with Xero. The integrated capabilities of the program guarantee that your VAT computations are precise and adhere to HMRC regulations.

Tax Due Dates:

To make sure you never forget a crucial date, set up Xero to notify you when taxes are due. Staying compliant with tax laws is necessary to avoid penalties and stand with HMRC.

Conclusion

Mastering Xero accounting for UK businesses can significantly enhance your financial management processes. You may ensure compliance with UK tax rules, acquire important insights, and streamline your accounting processes by employing these strategies. At Meru Accounting, we offer complete accounting solutions that are designed to meet small business requirements.

Our proficiency with Xero accounting software guarantees the accuracy, timeliness, and compliance of your financial records with industry norms. Get in touch with us right now to find out how we can assist you in maximizing Xero accounting’s advantages for your company.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 (0) 203 868 2860

- [email protected]

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2025 Meru Accounting. All Rights Reserved.

Privacy Policy

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 73 6051 0348

- Email: [email protected]

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds