Why Consider CPA Consulting Services for Your Business Needs?

Financial management is a critical component of success in today’s complex corporate world. However, good financial management takes more than just fundamental understanding. This is where Certified Public Accountants (CPAs) come in, providing specialized consulting services customized to the specific needs of firms.

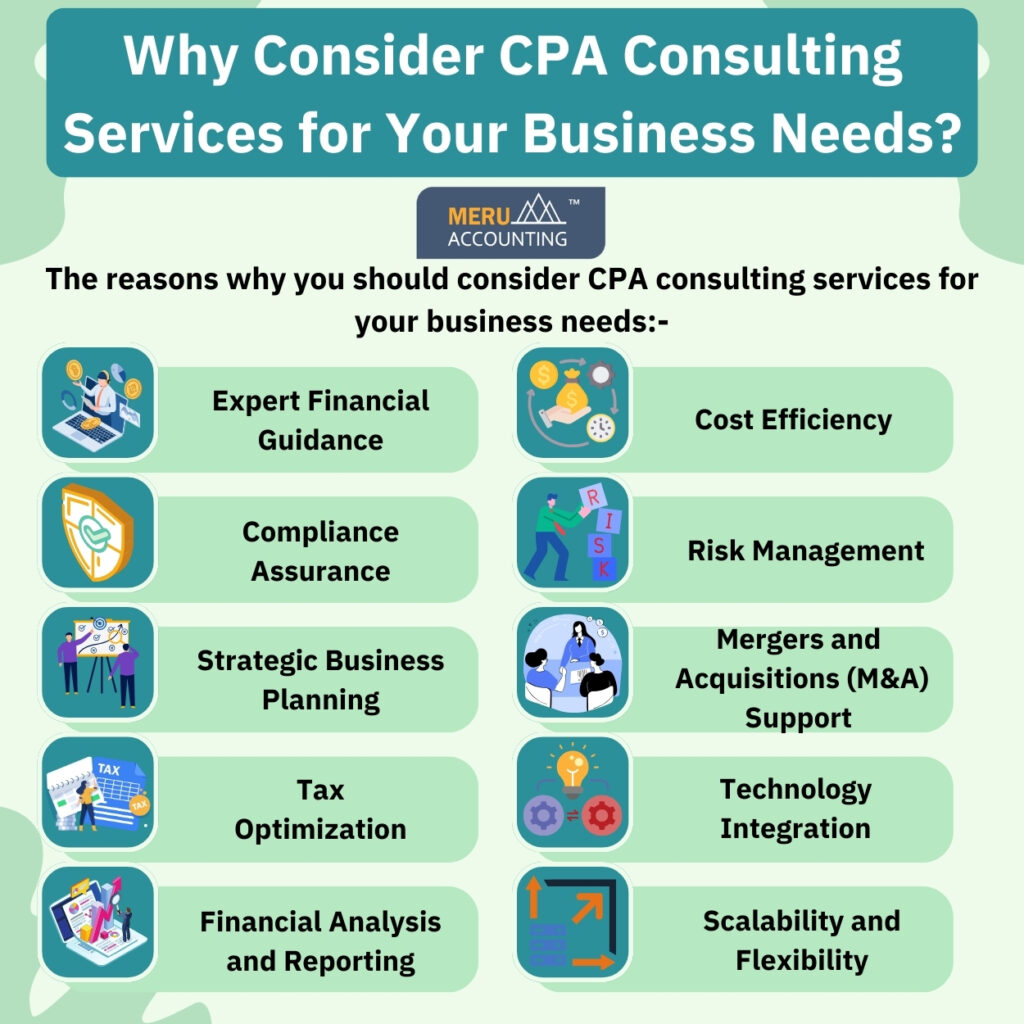

Let’s look at why hiring CPA consulting services is critical for business growth:

Expert Financial Guidance:

CPA consultants have substantial knowledge and experience in a variety of financial domains. The CPA consulting services provide expert advice on taxation, auditing, financial planning, and other topics, allowing organizations to confidently traverse complex financial environments.

Compliance Assurance:

Keeping up with constantly changing regulations and compliance standards can be difficult for organizations. The CPA consulting services ensure that your company complies with tax laws, accounting standards, and industry regulations, reducing the possibility of penalties and legal complications.

Strategic Business Planning:

Beyond figure crunching, CPA experts may help you establish strategic business plans that are aligned with your goals. They provide insights into budgeting, forecasting, risk management, and other crucial areas, allowing you to make better decisions for long-term success.

Tax Optimization:

Taxes have a big impact on a company’s bottom line. CPA experts develop tax optimization techniques to reduce tax bills while remaining compliant with applicable tax legislation. Businesses can optimize their tax savings by using deductions, credits, and exemptions.

Financial Analysis and Reporting:

Accurate financial analysis is vital for evaluating your company’s performance and making sound decisions. The CPA consulting services providers examine financial data, create detailed reports, and offer recommendations to increase efficiency and profitability.

Cost Efficiency:

Hiring an in-house finance team may be expensive for organizations, particularly small ones. Outsourcing CPA consulting services is a cost-effective option. Businesses can save money on overhead expenses while still receiving excellent financial guidance by utilizing their knowledge as needed.

Risk Management:

Identifying and minimizing financial risks is critical to long-term profitability. CPA consultants undertake detailed risk assessments, develop mitigation plans, and establish internal controls to protect assets and reputation.

Mergers and Acquisitions (M&A) Support:

M&A are difficult activities that require thorough planning and execution. The CPA consulting services experts give crucial assistance throughout the process, from financial due diligence to post-merger integration, guaranteeing smooth transitions and maximum value.

Technology Integration:

In today’s digital age, adopting technology is critical to staying competitive. CPA consultants assist firms in leveraging the capabilities of financial software and automation solutions, reducing operations and increasing productivity.

Scalability and Flexibility:

Your financial requirements will evolve in accordance with your business. The CPA consulting services are versatile and flexible, adapting to your changing needs without the difficulties of hiring and training additional employees.

Meru Accounting is an outsourcing CPA firm that has a team of certified bookkeepers and provides a wide range of accounting services to help you develop and expand your business with skilled bookkeepers and accountants.

FAQs

1. What services do CPA consulting firms offer?

CPA experts help with tax work, audits, money reports, and plans. They give tips that help firms make smart money moves.

2. How can a CPA consultant help reduce taxes?

CPA experts find legal ways to cut taxes. They use credits, write-offs, and rules so your firm saves cash while staying legal.

3. Can CPA consultants support business growth?

Yes. They guide budgets, plans, and risk checks. This helps firms grow, make more profit, and plan for the long term.

4. How do CPA services improve financial reporting?

CPA experts check numbers and make clear reports. These reports help owners see how the firm is doing and find ways to save or earn more.

5. Are CPA services cost-effective for small businesses?

Yes. Using CPA help cuts costs on staff and office work. You get experts without paying full-time salaries or perks.

6. How can CPA consultants help with mergers or acquisitions?

They help with plans, checks, and smooth moves. Their tips make sure mergers or buys go well and help the firm grow.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 203 868 2860

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2026 Meru Accounting. All Rights Reserved.

Privacy Policy

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds