What problems face dental practice owners with bookkeeping?

Bookkeeping is the lifeblood of any dental practice. It can be one of the most overlooked and underestimated aspects of operating a dental business, yet it’s essential for success. Unfortunately, many dental practice owners don’t understand the basics of bookkeeping or how to optimize their practices for effective bookkeeping practices. Bookkeeping For Dentists and Accounting For Dentists is indeed a cumbersome task. As a result, they may find themselves in financial turmoil, not understanding how to fix mistakes that have been made in their accounting system or where their finances stand.

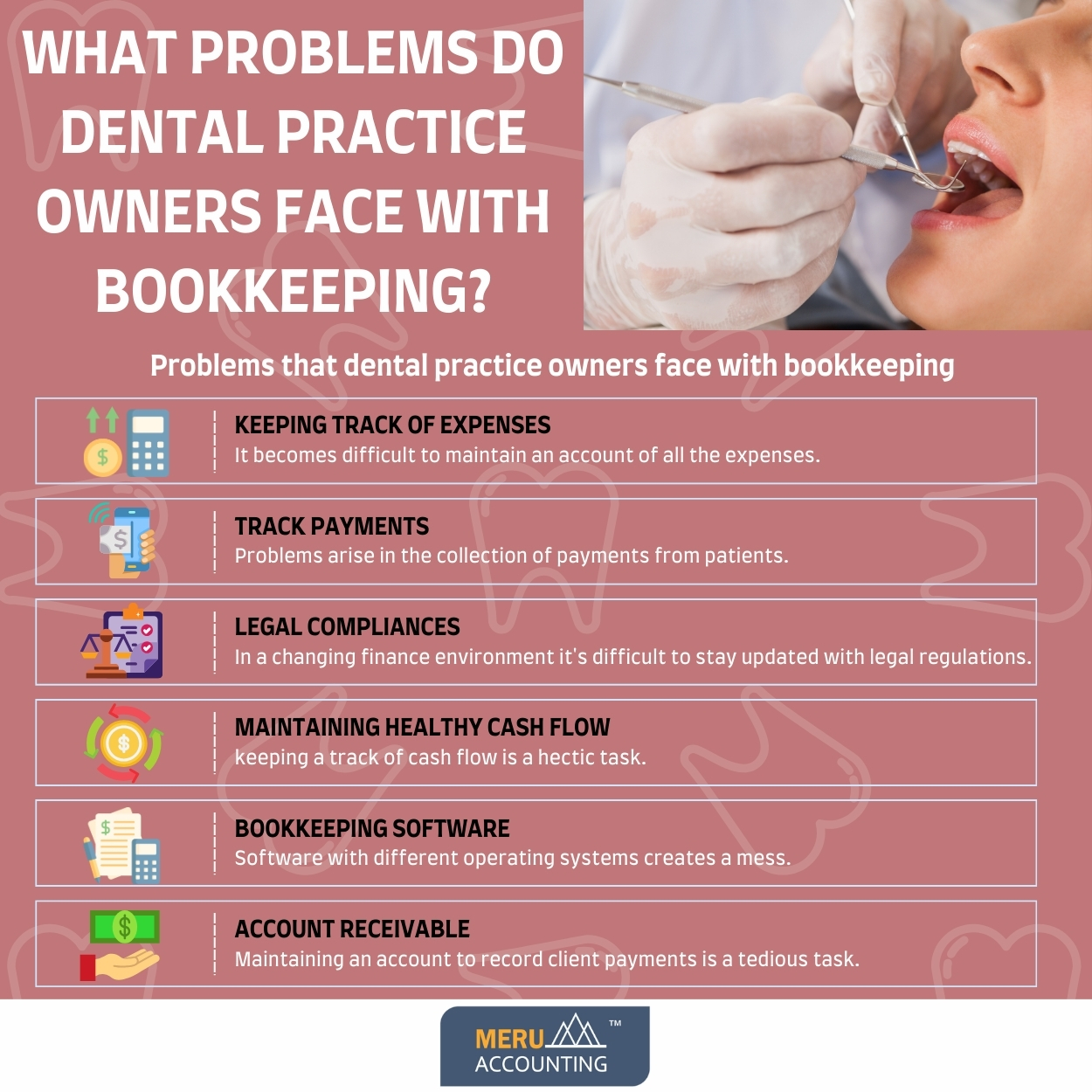

In this article, we’ll discuss what problems dental practice owners face with bookkeeping.

1. Keeping track of expenses:

Dental practices have a lot of expenses, from supplies to wages. Bookkeeping For Dentists is not an easy task. There are a high volume of transactions in the day-to-day business, including patient payments, insurance claims, and vendor payments, which can make it difficult to keep track of everything.

2. Tracking payments:

Another issue is managing the financial records. Recording every transaction, keeping track of employees’ payroll, vendor payments, and patient payments can be overwhelming and time-consuming. This can lead to errors, discrepancies, and ultimately, financial losses.

3. Compliance with statutory regulation:

Another problem that dental practice owners face with bookkeeping is staying current with the latest accounting regulations. Dental practices are subject to a variety of regulations, and Accounting For Dentists becomes very stressful because of complicated tax implications, which can make it difficult to stay compliant. Additionally, accounting regulations are constantly changing, which can make it difficult for dental practice owners to keep up.

4. Maintaining healthy cash flow:

Dental practice owners also face the challenge of managing their cash flow. Dental practices often have a high volume of patient billing and insurance claims, which can make it difficult to predict when cash will come in. This can make it difficult to pay bills and make other financial decisions.

5. Bookkeeping software:

There are several bookkeeping software programs available and it can be hard to choose the right one for your dental practice. Operating different software may become a strenuous task that a dentist practice owner might face which can make Bookkeeping For Dentists even more difficult.

6. Accounts receivable:

Dental practices often have to wait for clients to pay their bills, which can lead to a significant amount of accounts receivable. This can be a challenge for dental practice owners who are not familiar with how to properly manage these accounts.

One solution to these problems is to outsource bookkeeping and accounting tasks to us. Meru Accounting can help you by providing a comprehensive bookkeeping solution tailored to your needs and help you to get real-time insights into your business’s financial health. From developing an effective budgeting system to tracking expenses and creating accurate financial records, we’ll provide tips on streamlining your bookkeeping process so you can focus on providing quality patient care.

We can also help the practice owner to stay on top of all the different tax laws and regulations and can provide valuable advice and guidance on how to manage the practice’s finances. Outsourcing to our qualified CAs and CPAs helps you to streamline the bookkeeping and accounting processes.

FAQs

- Why do dentists struggle with daily bookkeeping?

Dentists focus on patient care, so they often have little time for detailed financial tasks. Daily entries, receipts, and claims pile up fast, which makes it hard to keep books in order. - How can poor record-keeping hurt a dental practice?

If records are not up to date, the owner may miss key signs of cash flow gaps, tax errors, or unpaid bills. This can slow growth and cause stress during audits or tax season. - Do dental practices need special accounting tools?

Yes, standard software may not meet the unique needs of a dental office. Tools built for medical or dental use can track patient claims, vendor bills, and payroll with ease.

- How often should a dentist review their financial data?

It’s best to review books each week and do a full check each month. This helps catch errors early and gives a clear view of profits, costs, and patient payments. - What role does cash flow play in dental success?

Cash flow shows if a practice can pay bills on time. Even with high income, late claims or slow client pay can cause strain. Strong cash flow helps the practice run smoothly. - Why is compliance a big concern for dental owners?

Tax laws and health care rules change often. Missing updates can bring fines or legal risk. Keeping books accurate helps the office stay safe and compliant. - How do unpaid patient bills affect the practice?

Late or unpaid bills increase accounts receivable. If not tracked, it ties up cash that could be used for payroll, supplies, or growth. Good follow-up reduces this risk. - Can outsourcing bookkeeping help dental offices?

Yes, outsourcing saves time and cuts errors. A skilled team can handle payroll, claims, and tax rules while the dentist focuses on patient care.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 203 868 2860

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2026 Meru Accounting. All Rights Reserved.

Privacy Policy

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds