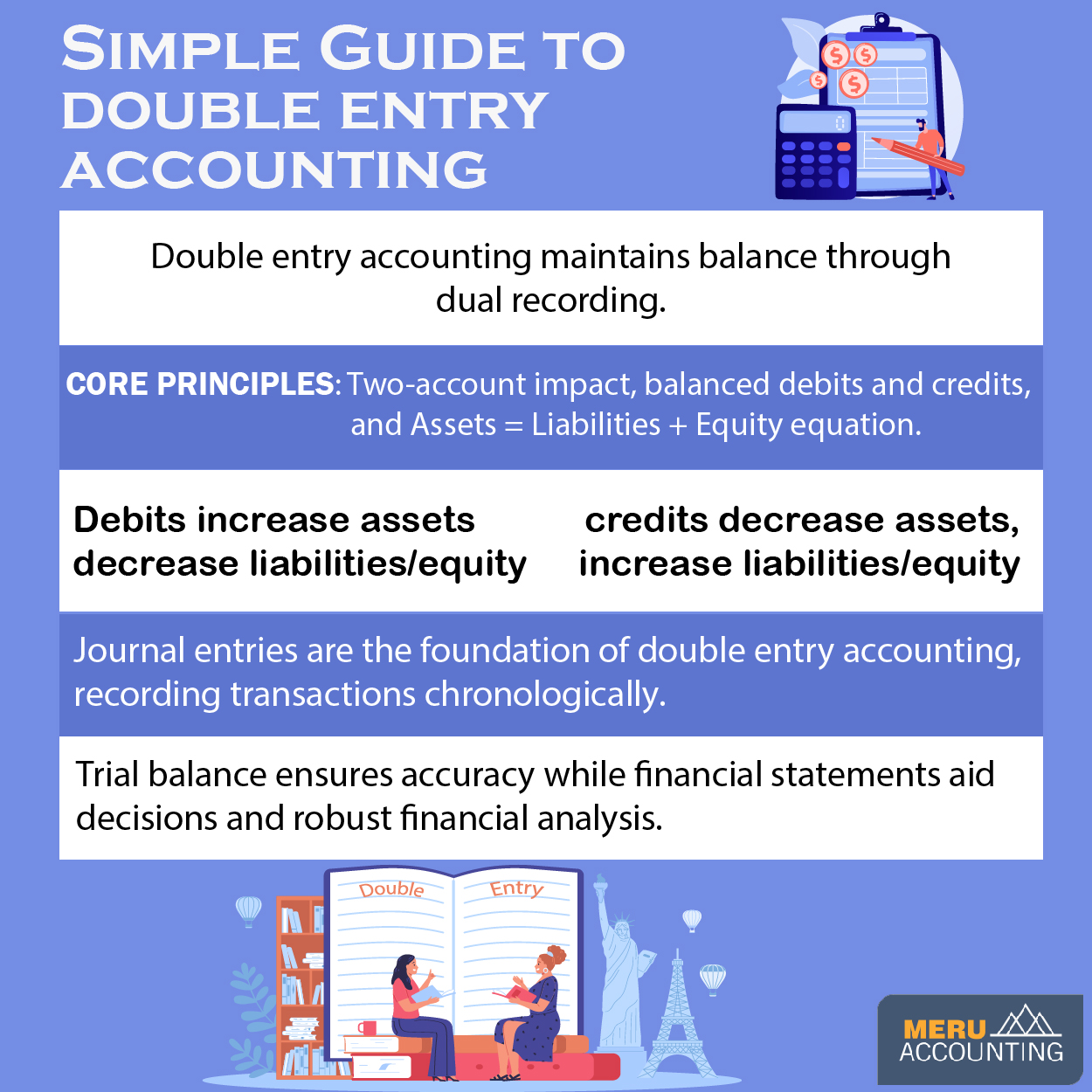

Simple Guide To Double Entry Accounting.

Double entry accounting is a bookkeeping system in which every financial transaction is recorded twice, once as a debit and once as a credit. This ensures that the total debits always equal the total credits, and that the accounting equation (Assets = Liabilities + Equity) is always in balance.

Double entry bookkeeping is the standard accounting method used by businesses of all sizes, and it is required by law for public companies. It is also a valuable tool for small businesses and individuals to track their finances and make sound financial decisions.

How Double Entry Accounting Works?

Double entry accounting is based on the following three principles:

- Every financial transaction has at least two effects.

- The aggregate of debits must consistently match the sum of credits.

- The accounting equation must perpetually maintain equilibrium.

To record a financial transaction using double entry accounting, you must first identify the two accounts that are affected by the transaction. Then, you must decide whether the transaction is a debit or a credit to each account.

Debits and Credits

A debit is an increase to an asset account or a decrease to a liability or equity account. A credit is an increase to a liability or equity account or a decrease to an asset account. Here is a table that summarizes the effects of debits and credits on the different types of accounts:

| Account Type | Debit | Credit |

| Assets | Increase | Decrease |

| Liabilities | Decrease | Increase |

| Equity | Decrease | Increase |

The Journal Entry

Double entry bookkeeping and accounting relies heavily on journal entries. Each transaction is recorded in the journal with a date, a brief description, and the debit and credit amounts. These entries serve as the foundation for all subsequent financial records.

The Trial Balance

To ensure the accuracy of the books, accountants prepare a trial balance periodically. This report lists all accounts with their respective debit and credit balances. If the double entry bookkeeping system has been applied correctly, the total debits should equal the total credits, leading to a balanced trial balance.

Financial Statements

The magic of double entry accounting truly shines when it comes to generating financial statements. Using the data from the trial balance, companies can create key financial reports such as the income statement, balance sheet, and cash flow statement. These statements provide a clear picture of the organization’s profitability, financial position, and cash flow, helping stakeholders make informed decisions.

The Power of Analysis

One of the most significant advantages of double entry accounting is its ability to facilitate financial analysis. With accurate and comprehensive records, businesses can perform in-depth analysis to assess performance, and make strategic decisions. This method of bookkeeping is invaluable in planning for the future and ensuring the financial stability of a company.

Why choose Meru Accounting?

By outsourcing your double entry bookkeeping and accounting needs to Meru Accounting, you can free up your time and resources to focus on your business. You can also be confident that your financial records are accurate and reliable, and that you comply with all applicable laws and regulations. Our team of experienced accountants is knowledgeable about the latest accounting standards and practices, and can help you to ensure that your accounting system is compliant with all applicable laws and regulations.

FAQs

- What is the main aim of double entry accounting?

The main goal is to keep books in balance. Each deal has two sides, and by logging both, the books stay fair and clear. - Why do all firms use double entry?

Firms use this method since it gives a full view of money flow. It shows gains, debts, and cash in a way that helps both small firms and big firms track funds well.

- How do debits and credits apply in this system?

A debit adds to assets but cuts from debts or equity. A credit adds to debts or equity but cuts from assets. Each deal needs one debit and one credit.

- What does a journal entry mean in double entry system?

A journal entry is the first note of a deal. It shows the date, a short note, and the debit and credit sums. This step builds the base for all other records.

- Why is a trial balance important in making financial statements?

A trial balance checks if debits and credits match. If both sides match, the books are balanced. If not, there may be a slip that needs a fix.

- How does double entry help in making reports?

This system lets you prepare cash flow, income report, and balance sheet. These show how strong or weak a firm’s funds are.

- Can double entry help in long-term plans?

Yes. With clean and fair data, a firm can check trends, cut risk, and plan for growth. It turns raw deals into clear insight for smart moves.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 203 868 2860

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2026 Meru Accounting. All Rights Reserved.

Privacy Policy

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds