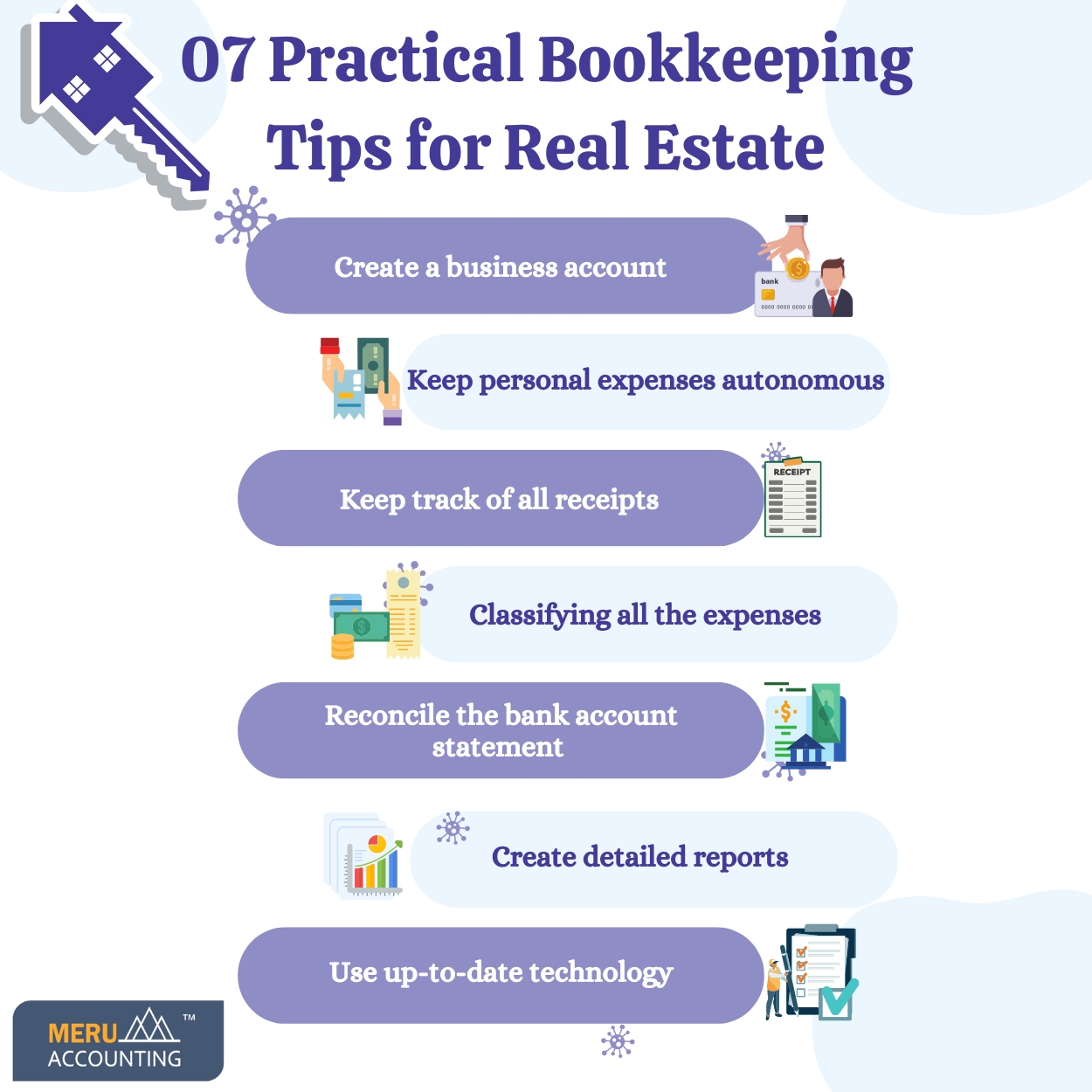

7 Practical Bookkeeping Tips for Real Estate

Bookkeeping For Real Estate is the process of keeping an accurate record of all the money that enters and exits one’s business. It is an important task for any real estate business. A well-organized, timely, and simple Real Estate Bookkeeping serves numerous practical purposes. It aids in the tracking of key performance indicators such as cash flow, profits and losses, and net worth. Below are some Bookkeeping Tips For Real Estate.

01. Create a Business Account

Many new investors are unsure whether they need a different bank account for real estate. A business account for real estate is required for a variety of reasons. It will save both time and money. It will aid in the protection of one’s assets. It reduces risks and helps make bookkeeping simpler and more accurate.

02. Keep Personal Expenses Autonomous

An essential principle of Real Estate Bookkeeping is to keep personal expenses separate from business expenses. This separation serves a practical purpose, but it also helps save legal trouble during tax season. Keeping business and personal accounts autonomous provides security. It also enables one to claim all possible deductions, lowering one’s tax burden and thereby saving money.

03. Keep Track of All Receipts

Keeping track of all of the receipts will help one stay financially organized and ensure that one deducts the correct amount from one’s income during tax season. This is simpler than it appears because one is not required to maintain hard copies. it is recommended to use receipt photos or scans because they are much simpler to deal with. This will make tracking one’s expenses easier and will aid one in doing taxes.

04. Classifying all The Expenses

The purpose of documenting the income and itemizing expenses for real estate is to determine one’s taxable income. Taxable income is directly proportionate to the tax one pays which means, the lower one’s taxable income, the less the tax one has to pay. Expense classification should be fairly simple, especially if one keeps all of one’s receipts.

05. Reconcile the Bank Account Statement

One of the most crucial tips for Bookkeeping For Real Estate is to reconcile one’s accounts each month. Reconciling one’s accounts is the method of double-checking that the documented transactions match the actual transactions. reconciliation is a fundamental practice of bookkeeping Because ongoing accuracy is very critical.

06. Create Detailed Reports

A profit and loss statement, which demonstrates all of the property’s income streams, expenditure, and cash flow, is the most popular report in Real Estate Bookkeeping. These statements, therefore, provide an accurate representation of how one’s company operates and how much profit it makes. Examining one’s financial statements will assist in making better decisions.

07. Use Up-to-date Technology

One of the crucial Bookkeeping Tips For Real Estate is to use the latest technology. The most recent technological tools make managing one’s finances and real estate investments easier than ever. They can save time while improving accuracy by automating tedious tasks like data entry.

By following these tips, one can ensure that their bookkeeping process runs smoothly. With Meru Accounting, ensure that your real estate business is on top by using all the practical bookkeeping tips.

FAQs

- Why should I open a business account for real estate?

A business account keeps real estate funds clear and apart from personal funds. This helps track cash with ease, lowers risk, and makes tax work simple. - How can I stop mix-ups between my personal and real estate costs?

You can stop mix-ups by using one card for real estate and a different card for your own buys. This way, you keep clean records and guard tax claims. - Do I need to save every small receipt in real estate deals?

Yes, each slip counts. Small costs add up fast. You can snap pics of slips and store them in apps. This makes tax preparation smooth and error-free. - What is the best way to track real estate income and spending?

Sort each cost into clear groups like rent, fix, or fees. This helps you see cash flow and cut taxes with the right claims. - How often should I check my real estate bank records?

Check your bank files each month. A match of your books and bank cuts the risk of fraud or loss. It also shows if your cash flow is on track. - Why are real estate reports like P&L so vital?

A profit and loss report shows your rent, sales, spend, and gains. It helps you plan, find weak spots, and grow your real estate firm with facts. - Can tech tools make real estate bookkeeping easier?

Yes, Cloud apps and new tools save time by auto-syncing data. They cut errors and give real-time views of your cash. - What key habit can help me stay on top of real estate books?

Stay firm with a set plan. Log all sales and spend on time, store slips, and check reports each month. Good habits build strong books.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 203 868 2860

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2025 Meru Accounting. All Rights Reserved.

Privacy Policy

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 73 6051 0348

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds