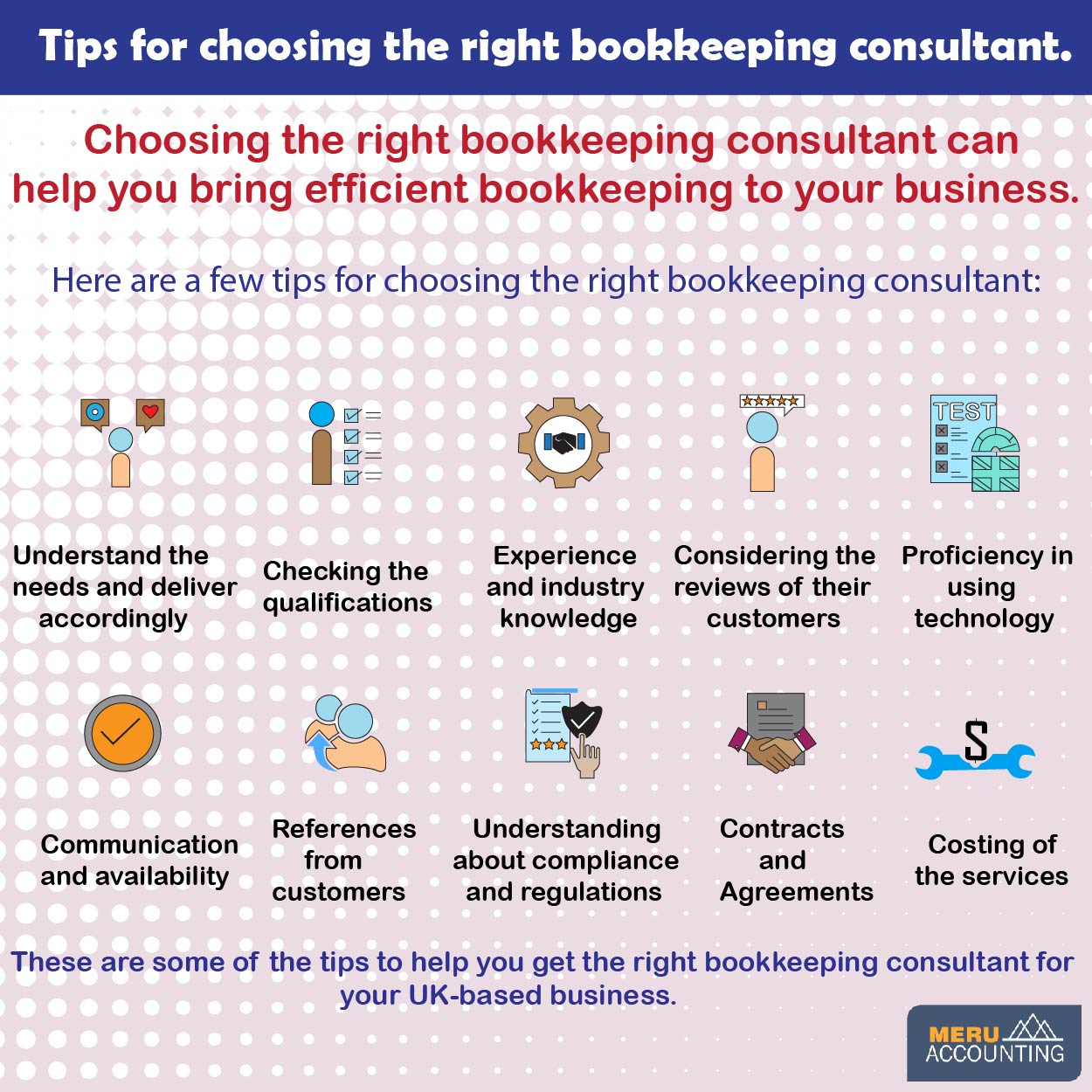

Tips for choosing the right bookkeeping consultant.

If you are planning to get the proper bookkeeping service for your business then you must ensure you choose the right consultant. It is not possible for all businesses in the UK to hire an in-house team of bookkeepers.

Most of the small and medium-sized businesses experience these problems. So, outsourcing the bookkeeping consulting services to the experts will be very influential to get the quality service. This can relieve them from the complicated bookkeeping task.

However, you need to get the right bookkeeping firm to get the desired services. The guide given below will be helpful for you to get the proper bookkeeping service.

How to choose the right bookkeeping consulting services for your business?

Choosing the right bookkeeping consultant is really a challenging task for a business.

Here are some tips for choosing the right bookkeeping firm for UK-based businesses:

1. Determine Your Needs

Before you start searching for a bookkeeping consultant, clarify your specific needs. They must know basic data entry, payroll management, tax preparation, and more comprehensive financial analysis.

2. Check Qualifications

Bookkeeping consultants must have proper certifications and qualifications. In the UK, qualified bookkeepers may hold certifications from organizations like the Institute of Certified Bookkeepers (ICB) or the Association of Accounting Technicians (AAT).

3. Experience and Industry Knowledge

Consider candidates who have experience working with businesses similar to yours in terms of size and industry. Industry-specific knowledge can be very beneficial.

4. Check the Reviews

Look for online reviews and testimonials of the consultant. Websites like Trustpilot, Google Reviews, or industry-specific forums can provide insight into a consultant’s reputation.

5. Technology Proficiency

In today’s digital age, it’s important that your consultant is comfortable with bookkeeping software and tools, such as QuickBooks, FreshBooks, Xero, or other accounting software you use.

6. Availability and Communication

Ensure the consultant can accommodate your schedule and is responsive to your inquiries. Effective communication is essential for a successful coordination in the bookkeeping task that can speed-up the work.

7. References

Ask for references from past or current clients about bookkeeping firm. Speaking with these references can provide insights into the consultant’s performance and reliability.

8. Compliance and Regulations

In the UK, bookkeepers should be familiar with the latest tax regulations and compliance requirements. Ensure that the consultant is up to date with these changes to do bookkeeping activities accordingly.

9. Contracts and Agreements

Once you’ve selected a consultant, make sure to have a written contract in place that outlines the scope of work, responsibilities, fees, and any other relevant terms.

10. Costing of the services

One of the important aspects of choosing a bookkeeping consultant is knowing their costs for service. The cost of services must be affordable comparatively to give quality service.

These are some important tips to get quality bookkeeping consulting services for your UK-based business. These consultants will bring better efficiency to your bookkeeping task that can further improve the financial health of your business.

If you are not able to get a proper in-house team to bring efficient bookkeeping then you can outsource this task to the bookkeeping firm. Meru Accounting provides outsourced bookkeeping consulting services for businesses in the UK. Their expert consultant has deep knowledge about compliance in the UK and expertise in bringing efficiency to bookkeeping. Meru Accounting is a trusting accounting service providers firm around the world.

FAQs

- Why should a small firm hire a bookkeeping consultant?

A small firm may not need or fund a full team for books. A consultant can step in to track records, cut stress, and help save time and cost. - What skills should I look for in a bookkeeper?

Look for skills like data entry, payroll, and tax prep. Good bookkeepers must also know how to use tools like Xero, QuickBooks, or FreshBooks. - Do I need a certified bookkeeper in the UK?

Yes, it helps a lot. A bookkeeper with ICB or AAT status shows they have the right skills and meet high UK norms. - How does industry know-how help in bookkeeping?

Each field has its own rules. A bookkeeper who knows your trade can spot risks fast and give tips that fit your firm best. - How do reviews help me pick a bookkeeper?

Online reviews show what past clients say. They can show if the bookkeeper is fair, on time, and good to work with. - What role does tech play in bookkeeping today?

Bookkeeping now runs on apps and cloud tools. A skilled bookkeeper must use these tools to give fast, clear, and safe reports. - How do I know if the cost of a bookkeeper is fair?

Compare the fees of more than one firm. Low fees may sound good, but the right mix of fair price and strong skill is what helps most.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 203 868 2860

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2026 Meru Accounting. All Rights Reserved.

Privacy Policy

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds