What Are The Steps In Payroll Management?

Effective payroll management is crucial for any organization to calculate and distribute employee salaries, taxes, and benefits while ensuring precision, compliance, and timeliness. It plays a vital role in meeting legal requirements and ensuring accurate payment to employees.

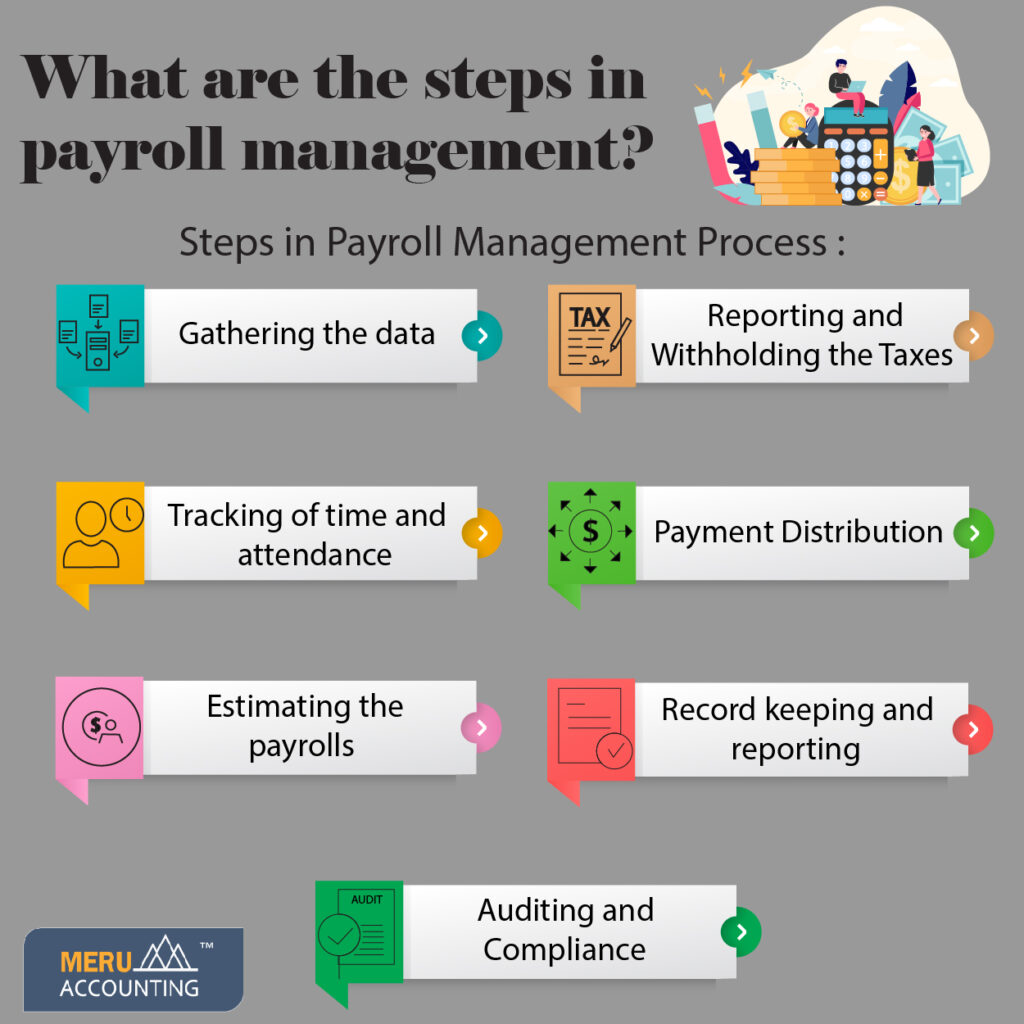

Steps To The Effective Payroll Management Process :

1. Data Gathering

Accurate and current employee data collection is the first stage in payroll management. This includes details about the names, residences, tax deductions, and benefits of the employees. Numerous methods, including a time monitoring program, HR databases, and employee onboarding forms, can be used to collect data. The collection of accurate data is essential since it serves as the basis for all subsequent payroll calculations.

2. Tracking Of Time And Attendance

For correct payroll computation, keeping track of employee attendance, working hours, and leaves is crucial. Keeping track of employee hours worked, overtime, time-off requests, and any applicable shift differentials, time and attendance systems, or time-tracking software assists in automating this process. By incorporating this data into the payroll system, wages may be calculated more quickly and correctly based on employees’ real working hours.

3. Payroll Estimates

Payroll computations begin with gathering employee information and time sheets, followed by applying wage rates, and accounting for overtime, deductions, taxes, and benefits. Payroll management software automates these complex calculations, reducing errors and saving time. Compliance with employment rules, tax legislation, and benefit policies is crucial for accurate and lawful payroll processing.

4. Withholding And Reporting Of Taxes

Accurately computing and withholding different taxes, such as income tax, Social Security contributions, and Medicare, are part of payroll management. Organisations are required to abide by federal, state, and local tax laws and make sure that tax deposits and filings are done on schedule. Payroll administration also includes the creation and distribution of employee tax statements, such as Form W-2 in the US.

5. Payment Distribution

Payroll deductions and calculations are finished, and now it’s time to distribute employee compensation. This stage entails selecting the right payment mechanism, such as electronic payment systems, direct deposit, or paper checks. Automating payment disbursement with payroll management systems ensures that employee wages are delivered securely and on schedule.

6. Reporting And Recordkeeping

It is crucial to have correct payroll records for compliance, auditing, and reference needs. Employers are required to maintain records of payroll calculations, tax deductions, benefits, and other pertinent paperwork. Regular reporting, such payroll summaries and financial statements, offers insightful information on labour costs and facilitates financial planning and analysis.

7. Auditing And Compliance

Compliance with several legal and regulatory obligations is a part of payroll administration. Compliance entails precise tax calculations, personnel classification, compliance with overtime rules, and benefits administration. Regular audits assist in finding any inconsistencies, mistakes, or potential compliance issues, allowing for prompt fixes and reducing risks.

Conclusion

Payroll management requires meticulous attention to detail and adherence to diverse procedures to ensure accurate and timely employee payments while complying with legal regulations. Automation and payroll management software streamline processes, reduce errors, and allow organizations to focus on their core operations. Meru Accounting offers a comprehensive solution to all your accounting needs.

FAQs

- Why is payroll management so important for a business?

Payroll management ensures staff get paid on time and in full. It also helps firms stay in line with tax laws, which lowers risks and builds staff trust. - What role does data gathering play in payroll?

Data gathering sets the base for all pay tasks. With correct staff details, firms can avoid errors in tax, pay, and benefits. - How does time and leave tracking affect payroll?

Time and leave logs guide pay rates, shifts, and extra hours. Track tools help cut errors and save time. - Can payroll apps help cut pay errors?

Yes. Apps check hours, tax, and perks on their own. This makes paying fast, clear, and less prone to big slips. - How do firms stay compliant with tax laws in payroll?

Firms must hold back the right tax, file on time, and keep tax forms like W-2s. Good payroll systems help firms meet tax law needs. - What are the best ways to pay staff in payroll?

Most firms use direct deposit or e-pay since they are fast and safe. Paper checks still work, but digital pay is smoother. - Why should firms audit their payroll process?

Audits help find gaps or rule breaks. By doing checks often, firms fix issues early and prove that their pay flow is fair and legal.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 203 868 2860

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2026 Meru Accounting. All Rights Reserved.

Privacy Policy

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds