How Finance & Accounting Professionals Drive Organizational Decisions

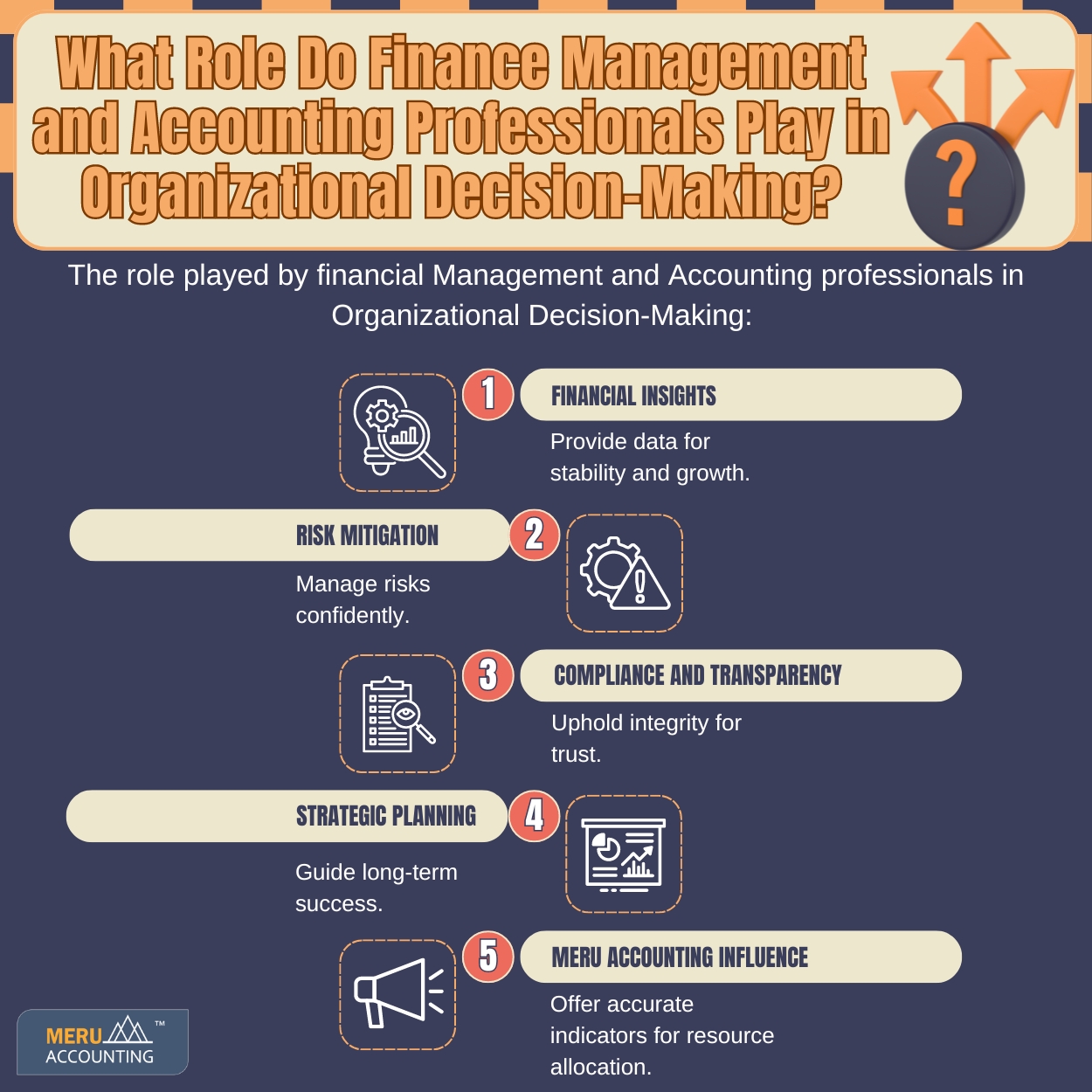

The dynamic nature of business calls upon the professional insight of finance management and accounting professionals and this is why the latter become an essential part of the business world. These experts are the essential pillars of organizational decision-making processes. They do so by applying their expertise in ways that will ensure the financial stability of the company, and manage the risk thereby providing strategic growth of the organization.

Providing Financial Insights:

Accounting professionals and finance management experts play a fundamental role in providing management of an organization, with reliable and timely financial data for better decision-making. The process of financial reporting and analysis that is accurate, in-depth, and expansive offers a comprehensive view of the performance of the organization’s finances, thereby allowing stakeholders to make smart decisions regarding the use of resources and the implementation of strategic initiatives.

Mitigating Risks:

Moreover, finance management and accounting personnel play a big role in risk management. Through conducting risk assessments, financial threat identification, and, finally, the application of robust internal control systems, our accounting team shall endeavor to shield the organization from any unprovoked risks. The knowledge they possess for gauging the stability of the markets as well as evaluating the feasibility of new ventures gives the decision makers the confidence to make sound decisions in the midst of uncertainties.

Ensuring Compliance and Transparency:

All finance and accounting professionals should also make sure they follow the rules set by the regulators and financial standards. This is the basis of their ability to stay updated on the ever-changing regulations and accounting principles. They build a reputation for holding integrity and accountability in their financial practices, thus earning the trust of investors and other stakeholders. Their commitment to maintaining transparency builds a good reputation as well as raises the level of credibility.

Strategic Planning:

The finance and accounting professionals not only do operational work but also contribute to the development of long-term strategic plans. By applying financial models, scenario analyses, and investment appraisals to senior management, they clarify strategic objectives and assess options. The analytical thinking of finance experts, about mergers or capital, impacts the organization’s direction and future.

Conclusion:

Meru Accounting is distinguished for its financial management and accounting services and has a great influence on organizations in their decision-making processes. Through our expertise in financial reporting, analysis, and compliance, we give up-to-the-minute and accurate financial health indicators of the organization. The accuracy and details of the presented information guarantee that stakeholders have an overview of the financial performance, allowing them to make decisions regarding the allocation of resources, mitigation of risks, and planning of strategy.

Furthermore, the company’s focus on ensuring that its financial practices are above board and transparent inspires trust in investors and creditors, which, in turn, increases the organization’s brand image and credibility. Through our strategic guidance and tailored solutions, Meru Accounting helps organizations to cope with difficulties and at the same time exploit available opportunities for their sustained growth.

FAQs

- What do finance professionals do in a firm?

They watch cash, costs, and gains. They give leaders clear facts to make smart moves. Their work helps the firm grow and cut losses. - How do accountants help decision-making?

They make sure all data is right and easy to read. They show where cash goes, which helps in plans, goals, and budgets. - How can finance teams cut risk for a firm?

They find weak spots in cash or the market. They add checks to block loss. This lets leaders act with trust in hard times. - Why is clear work key in finance and accounts?

Open reports help staff and backers trust the firm. When the facts are right, the firm builds a strong name and avoids fines. - How do finance pros plan for growth?

They test plans with charts and sums. They check if new work, deals, or buys will pay off. This guides leaders to shape the firm’s path. - How do accountants keep the firm in line with rules?

They track updates in tax, cash, and reporting rules. They make sure each report meets the law, which keeps the firm safe. - Can finance teams steer firm plans?

Yes. They do more than track cash; they give facts on trends, gains, and risk. Their help shapes moves on growth, cost cuts, or new work. - What tools do finance and accounting pros use to help make choices?

They use charts and sums to show facts in clear ways. They test each plan and make reports to show the effect of each choice.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 203 868 2860

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2025 Meru Accounting. All Rights Reserved.

Privacy Policy

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 73 6051 0348

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds