Common Challenges in Backlog-Accounting and How to Overcome Them?

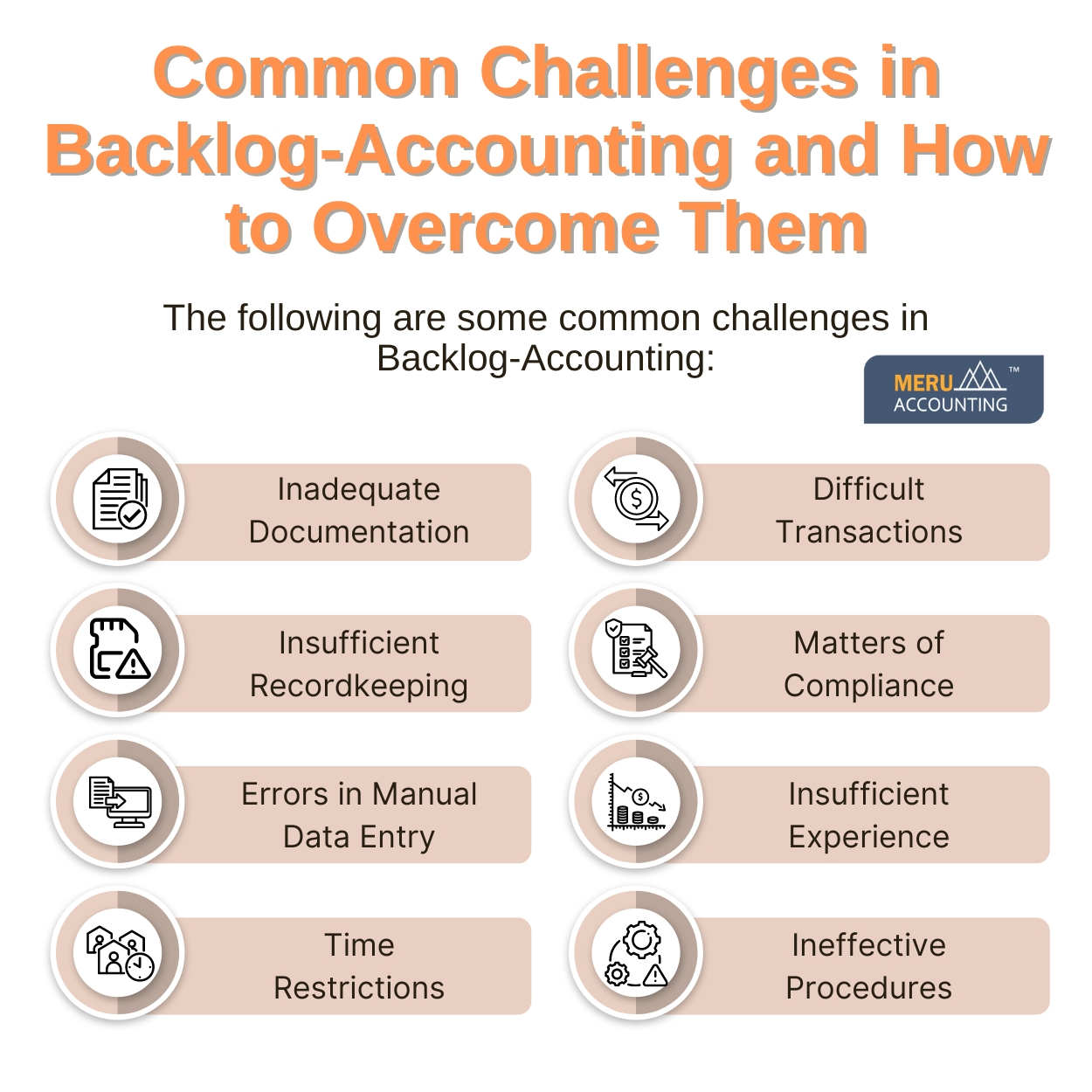

Businesses may find backlog accounting to be a formidable task that, if not handled correctly, can result in both operational and financial errors. We will examine the typical difficulties encountered in backlog accounting in this blog and offer solutions. A company’s ability to make decisions and maintain its financial stability can be seriously impacted by problems including obsolete financial data, inadequate records, and a higher chance of errors. We will also go over how crucial it is to keep up regular accounting procedures in order to avoid backlogs in the future.

A crucial component of financial management that guarantees accurate and current financial records for a business is backlog accounting. Nonetheless, many companies struggle to keep up with accurate and timely backlog accounting. Significant problems like financial misstatements, compliance hazards, and operational inefficiencies might result from these difficulties. This blog will examine frequent problems with backlog accounting services and offer appropriate solutions.

Inadequate Documentation

A prevalent obstacle in backlog accounting is irregular record-keeping. Accurately tracking transactions becomes challenging when financial records are not kept up to date on a regular basis. Financial statements may contain mistakes and omissions as a result of this discrepancy.

Solution:

Put in place a methodical record-keeping procedure. Make sure that every transaction is promptly and accurately recorded. To assist with maintaining consistent and well-organized financial records, make use of backlog accounting services.

Insufficient Recordkeeping

Incomplete or absent paperwork might provide serious challenges for backlog accounting. Account reconciliation and transaction verification can be difficult tasks in the absence of appropriate documentation.

Solution:

The answer is to set up a thorough documentation procedure. Make sure the proper paperwork is attached to every financial transaction. Financial document management and organization can be facilitated with the use of backlog accounting services.

Errors in Manual Data Entry

Errors can occur during manual data entry, which might result in inaccurate financial records. It may take some time to find and fix these mistakes.

Solution:

Whenever feasible, automate data entry procedures. To minimize errors and lower the danger of manual input, use accounting software. Frequently, Backlog-Accounting Services come with automated technologies that improve accuracy and speed up data entry.

Time Restrictions

Due to time restrictions, businesses frequently find it difficult to keep up with backlog accounting. It can be very difficult to catch up on accounting duties while managing daily operations.

Solution:

The solution is to set aside particular times for backlog accounting work. If you want to ensure that accounting activities are handled effectively without taxing your internal team, think about outsourcing to Backlog-Accounting Services.

Difficult Transactions

It can be difficult to appropriately record some events in the backlog, such as mergers, acquisitions, or significant investments, due to their complexity.

Solution:

For complicated transactions, get expert support. Experts at Backlog-Accounting Services are equipped to manage complex financial tasks and guarantee precise reporting and recording.

Matters of Compliance

Regulation non-compliance may arise from an inability to keep current financial records. Penalties and legal ramifications may result from this failure to comply.

Solution:

Remain aware of deadlines and regulatory requirements. To make sure you’re in compliance with all applicable laws and regulations and to stay out of trouble, use Backlog-Accounting Services.

Insufficient Experience

Many companies lack the knowledge and experience needed to manage backlog accounting effectively. Inadequate knowledge might result in mistakes and ineffective financial management.

Solution:

Invest in your accounting staff’s training or engage seasoned experts. Backlog-Accounting Services give you access to knowledgeable accountants who can effectively handle your backlog.

Ineffective Procedures

Ineffective bookkeeping procedures might hinder backlog accounting operations and lead to financial management bottlenecks.

Solution:

Simplify your accounting procedures. To increase productivity, apply best practices and make use of contemporary accounting software. Your accounting processes may have inefficiencies that you may find and get rid of with the aid of Backlog-Accounting Services.

Conclusion:

Meru Accounting specializes in offering full-service backlog accounting services. Our team of professionals can assist you in overcoming typical backlog-accounting obstacles by putting in place effective procedures, guaranteeing compliance, and keeping precise financial records. You may concentrate on your main business operations with Meru Accounting while we take care of your backlog of accounting tasks. Get in touch with us right now to find out how our services may help you maintain the direction of your company and simplify your financial administration.

FAQs

- What does backlog accounting mean for a business?

It means updating old or missed financial records so your books are accurate and current. It helps you see your real business health and meet legal rules.

- Why do firms face delays in backlog accounting?

Firms face delays from poor record-keeping, short time frames, or hard deals. These gaps can slow growth and cause errors in reports.

- Can backlog accounting mistakes hurt compliance?

Yes. Late or wrong records can lead to missed tax dates or rule breaks, which may result in fines or legal issues.

- How can I stop backlog accounting issues before they grow?

Keep records in order, set fixed times for updates, and use tools or staff with the right skills. This keeps tasks small and easy to manage.

- Should small firms use backlog accounting services?

Yes. They save time, cut errors, and give you access to pros who can handle hard or high-volume work fast.

- How does tech help reduce backlog accounting errors?

New software can scan, store, and sort data with speed. It cuts the risk of manual entry errors and keeps files in one safe place.

- What skills should my team have to manage backlog work?

They should know tax rules, use accounting software well, and follow a clear process to track and store data.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 203 868 2860

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2026 Meru Accounting. All Rights Reserved.

Privacy Policy

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds