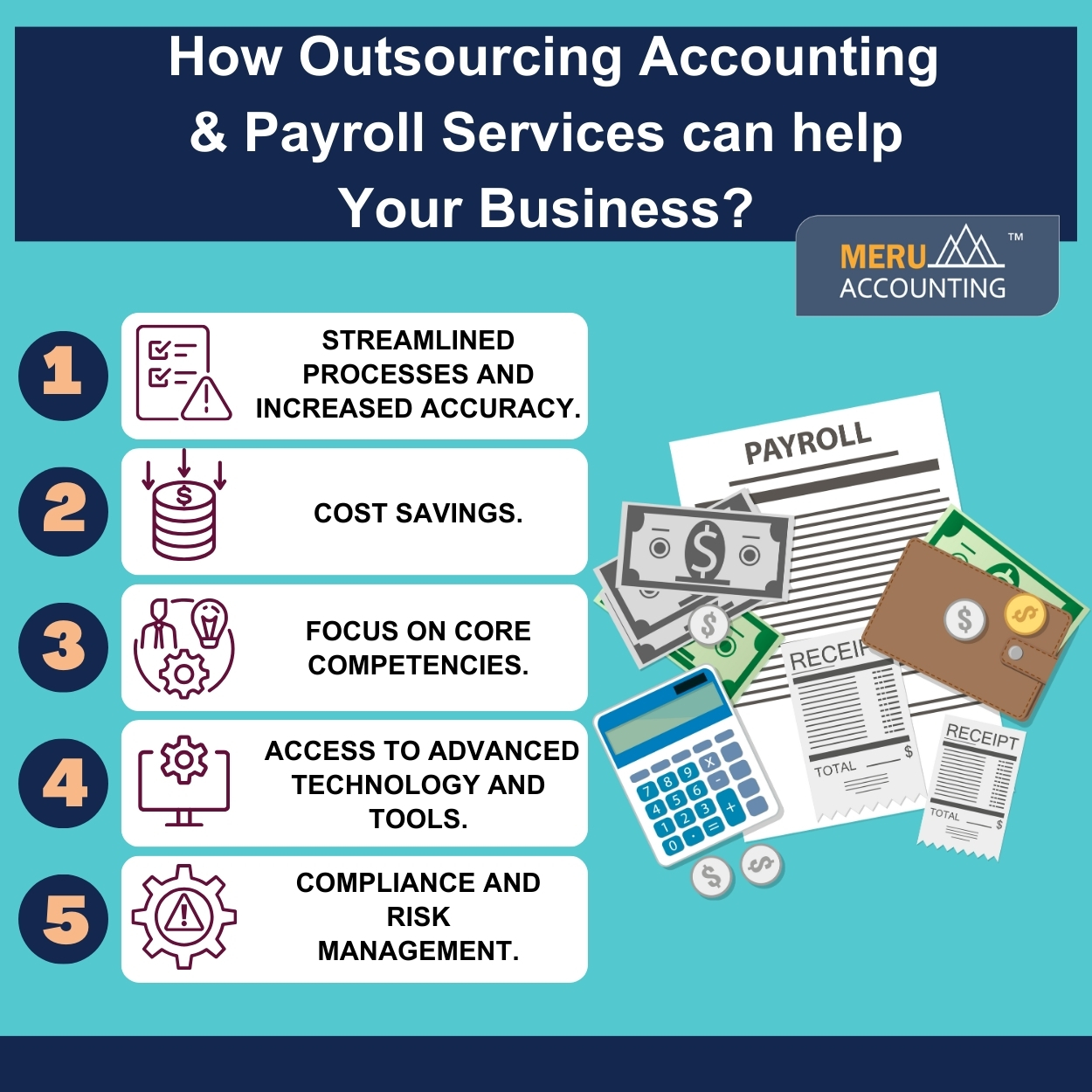

How Outsourcing Accounting & Payroll Services can help Your Business?

Accounting and payroll services are integral to the smooth functioning of any business. However, the intricate nature of payroll accounting services and the time they consume can divert valuable resources from core business operations.

This is where outsourcing accounting & payroll services can prove to be a game-changer for your business.

By leveraging specialized providers who excel in handling accounting & payroll tasks, businesses can streamline their financial processes, ensure accuracy in payroll calculations, enhance cost savings, stay compliant, and manage risks by having access to advanced technology and tools and allocate resources effectively to focus on core competencies and strategic growth.

1. Streamlined Processes and Increased Accuracy:

Outsourcing accounting & payroll services to a specialized provider can help streamline your financial processes, resulting in increased accuracy and efficiency.

These service providers work with experts who are skilled at handling challenging accounting duties.

The accuracy and compliance of your financial statements and payroll computations are guaranteed by their in-depth understanding of tax laws, regulations, and industry best practices.

2. Cost Savings:

Maintaining an in-house accounting and payroll department can be expensive, involving costs associated with recruitment, training, salaries, and benefits.

However, outsourcing these services enables you to benefit from expert knowledge without paying these extra expenses.

It is a cost-effective option for companies of all sizes because you only pay for the services you use.

3. Focus on Core Competencies:

By outsourcing accounting & payroll services, you free up valuable time and resources, enabling your team to focus on core competencies and strategic initiatives.

Rather than being burdened with administrative tasks, your employees can dedicate their energy to revenue-generating activities, innovation, and customer satisfaction.

This can lead to increased productivity and overall business growth.

4. Access to Advanced Technology and Tools:

Accounting & payroll service providers have access to the latest technology and software that streamline processes, automate repetitive tasks, and enhance accuracy.

Your business can obtain these capabilities through outsourcing without making significant financial commitments.

Real-time reporting and analytics are also made possible by these cutting-edge technologies, giving you insightful information about your financial situation and empowering you to make wise decisions.

5. Compliance and Risk Management:

Staying compliant with ever-changing tax laws and regulations is a significant challenge for businesses.

By outsourcing your accounting services, you can rely on experts who stay up-to-date with these regulations.

They ensure that your business remains compliant, reducing the risk of penalties, fines, and legal issues.

Outsourcing also provides an extra layer of security by implementing robust data protection measures to safeguard sensitive financial information.

How Meru Accounting Can Help?

By attending to their client’s financial requirements, Meru Accounting, a top provider of accounting & payroll services, aims to support the success of businesses.

Meru Accounting‘s team of highly qualified experts guarantees precise financial reporting, prompt payroll processing, and adherence to compliance standards.

We make use of state-of-the-art tools and technology to deliver customized solutions and real-time insights that are suited to your business’s demands.

Outsourcing accounting & payroll tasks is a wise decision that you can make right now to alter your business.

FAQs

- How can outsourcing save my firm money?

Outsourcing cuts the need for in-house hires, staff pay, and tools. You pay only for the work you use, which makes it cost-smart for both small and large firms. - Will my data stay safe with an outside service?

Yes, Good firms use strict data rules, safe cloud tools, and secure log-ins. They also track risks and keep your records safe from loss or misuse. - Can small firms gain from outsourced payroll?

Yes. Small firms often lack the time or skill for tax and pay tasks. With experts, they gain speed, clear books, and no need to stress about rules or fines. - How does outsourcing help with tax law changes?

Rules on tax and pay change a lot. Expert teams stay up to date and keep your firm in line with the law. This helps you avoid fees or legal risk. - Do I lose control if I outsource my accounts?

No. You still view and track all reports. The service just does the hard work, while you stay in charge of important calls and plans. - What tech do service firms use for payroll?

Most use cloud tools that check pay, file taxes, and give real-time reports. This tech cuts errors, speeds up work, and gives you clear insight into your books. - How does it help staff focus on core work?

By moving tasks like pay and books out, your team gains time for sales, growth, and client care. This boosts staff drive and firm growth.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 203 868 2860

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2026 Meru Accounting. All Rights Reserved.

Privacy Policy

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds