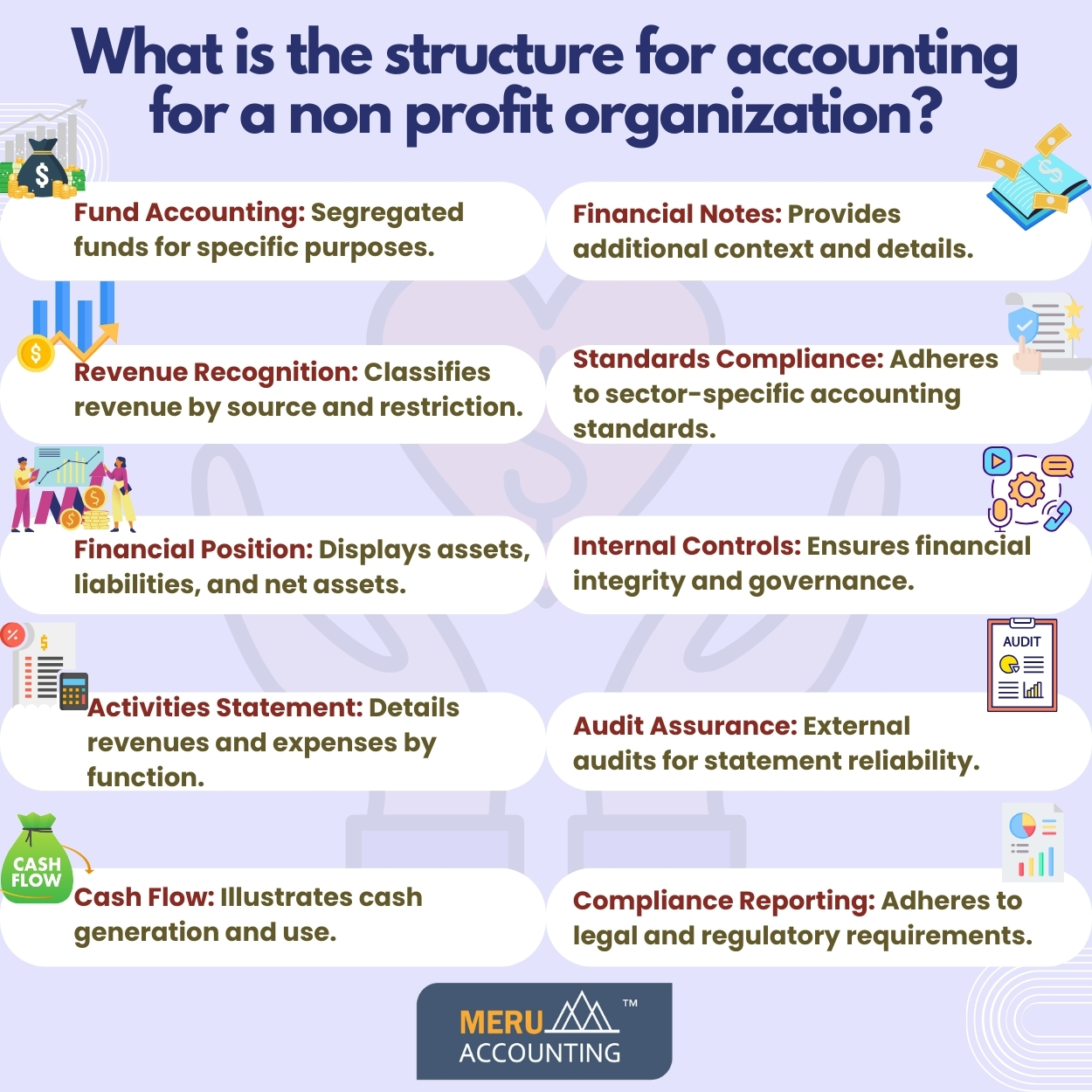

What is the structure for accounting for a non profit organization?

Nonprofit accounting for a nonprofit organization follows a specific format designed to meet the unique needs and objectives of these entities. Nonprofits operate with the primary goal of serving a social or community purpose rather than generating profits for shareholders. The nonprofit accounting framework for nonprofits is centered around transparency, accountability, and demonstrating stewardship of resources. Here’s a comprehensive overview of the format for non profit bookkeeping for a nonprofit organization

Fund Nonprofit accounting

Nonprofits typically use fund nonprofit accounting to track resources dedicated to specific purposes. Each fund represents a separate nonprofit accounting entity with its own set of accounts. Common funds include the general fund, restricted funds, and endowment funds. This segregation helps ensure that resources are used in accordance with donor restrictions.

Revenue Recognition

Nonprofits generate revenue through various sources, such as donations, grants, program fees, and fundraising events. Revenue recognition is based on the type of funding received. Contributions are often classified as unrestricted, temporarily restricted, or permanently restricted based on donor restrictions.

Statement of Financial Position

This statement, also known as the balance sheet, provides a snapshot of the organization’s financial position at a specific point in time. Assets, liabilities, and net assets are categorized, with a clear distinction between restricted and unrestricted net assets.

Statement of Activities

Similar to the income statement in for-profit organizations, the statement of activities outlines the organization’s revenues and expenses over a specific period. Revenues are categorized by source, and expenses are presented by function (e.g., program services, administration, fundraising).

Cash Flow Statement

While not always required, some nonprofits prepare a cash flow statement to illustrate how cash is generated and used during a specific period. This statement provides insights into the organization’s liquidity and ability to meet its short-term obligations.

Notes to the Financial Statements

Nonprofit financial statements are accompanied by detailed notes that provide additional information about nonprofit accounting policies, significant events, and any potential future obligations. These notes enhance the transparency of the financial reporting.

Compliance with Nonprofit accounting Standards

Nonprofits must adhere to non profit bookkeeping standards specific to their sector. In the United States, many follow the Financial Nonprofit accounting Standards Board (FASB) guidelines, particularly the Nonprofit accounting Standards Codification (ASC) 958 for Not-for-Profit Entities.

Internal Controls and Governance

Nonprofits emphasize strong internal controls to safeguard assets and ensure accurate financial reporting. Governance structures, including boards of directors, play a crucial role in overseeing financial management and decision-making.

Audit and Assurance

Many nonprofits undergo external audits to provide stakeholders with assurance about the accuracy and reliability of their financial statements. Audits are often conducted by independent certified public accountants (CPA).

Compliance Reporting

Nonprofits are often subject to various regulatory and compliance requirements, depending on their activities and the jurisdictions in which they operate. Compliance reporting ensures adherence to legal and regulatory obligations.

With help from Meru Accounting there will be emphasis on transparency, accountability, and proper stewardship of resources ensures that nonprofits can fulfill their missions while maintaining the trust of their stakeholders.

FAQs

- What is the main goal of nonprofit accounting?

Nonprofit accounting aims to track funds and show how the group uses them. It helps the group stay clear and fair with donors. - How do funds work in nonprofit bookkeeping?

Funds keep money for a set goal. Each fund has its accounts. This helps the group use money as donors want. - How is revenue tracked in a nonprofit?

Groups track revenue by type. Gifts, grants, and fees are logged by rules. Some funds can only be used for set projects. - What does a statement of financial position show?

It shows what the group owns and owes at one time. It lists assets, debts, and net funds. Restricted and free funds are shown clearly. - Why is a statement of activities important?

It shows money in and out for a period. Income is split by source, and costs are shown by work type, such as programs or admin. - Do nonprofits need a cash flow report?

Not all do, but a cash flow report shows how cash moves. It helps the group see if it can meet short-term bills. - How do nonprofits stay compliant with rules?

Groups follow set standards, such as FASB rules in the US. They track funds, report clearly, and meet all law needs. - Why are audits needed for nonprofits?

Audits check that reports are true. Independent CPAs review records so donors and boards can trust the numbers.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 203 868 2860

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2026 Meru Accounting. All Rights Reserved.

Privacy Policy

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds