- Schedule Meeting

Journal vs. Ledger: A Crucial Accounting Distinction

Accounting involves several procedures that help keep track of financial transactions and is a crucial component of any business. Journalizing and ledgering are two of the most crucial accounting procedures. Despite their apparent similarity, these two procedures have different functions and are applied at various points throughout the accounting cycle. The Difference between Journal and Ledger will be covered in these points:-

Journal

A business’s financial transactions are recorded chronologically in a Journal. Every transaction that takes place is noted in the journal in the order that it occurred. A business’s financial transactions should be completely and in-depthly documented in the journal.

The debit column and the credit column are the two standard columns used in Journal entry formats. When money is received or removed from an account, it is represented in the debit column; when it is paid into an account, it is represented in the credit column. The journal also includes a brief description of each transaction to go with the entry.

Usually, when a transaction occurs but is not yet reflected in the Ledger, a Journal entry is made. Before these transactions are added to the Ledger, the Journal gives you a way to keep track of them.

Ledger

All of a company’s financial transactions are permanently recorded in a Ledger. Each account has its own page or set of pages in the ledger, which is arranged according to accounts. The purpose of the ledger is to provide a summary of all transactions for each account that have been noted in the Journal.

The debit column and the credit column make up the format of a Ledger entry, respectively. All of the account’s debits are listed in the debit column, and all of its credits are listed in the credit column. The total debits from the total credits are subtracted to determine each account’s balance.

Following the transaction’s entry in the Journal, Ledger entries are typically made. The Ledger offers a way to compile and arrange each account’s transactions that have been noted in the Journal.

Difference Between Journal and Ledger:-

The main Difference Between Journal and Ledger are as follows:

1. Purpose

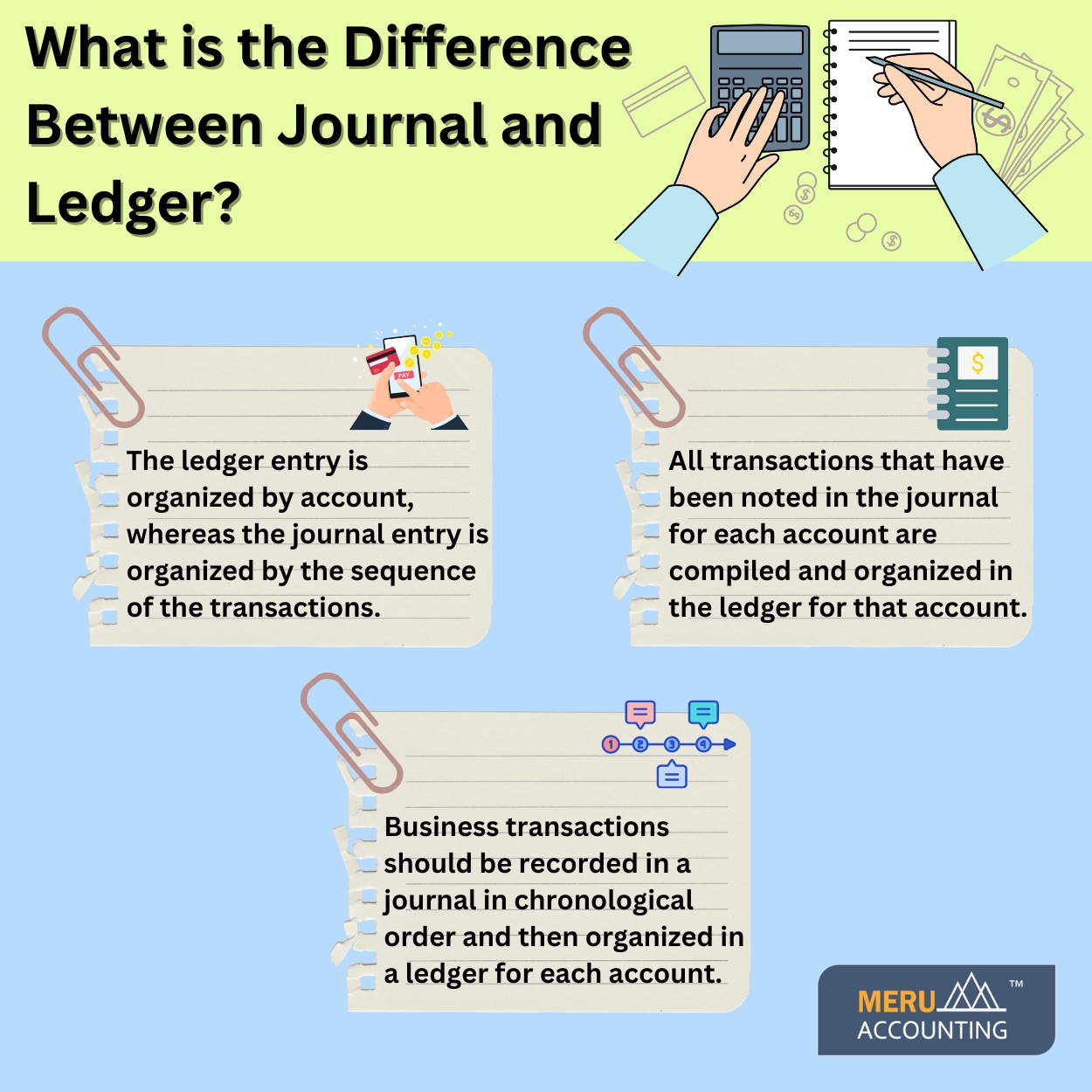

A business’s financial transactions should be recorded in a Journal in chronological order. All transactions that have been noted in the Journal for each account are compiled and organized in the Ledger for that account.

2. Format

The debit column and the credit column are the two standard columns used in Journal entry format. The debit column and the credit column are the other two columns used in the format of a Ledger entry. The Ledger entry, however, is organized by account, whereas the Journal entry is organized by the sequence of the transactions.

3. Timing

When a transaction takes place but hasn’t yet been added to the Ledger, a Journal entry is made. Following the transaction’s entry in the Journal, a Ledger entry is created.

4. Scope

The Journal offers a thorough and detailed record of every financial transaction a business has ever made. The Ledger gives a summary of all transactions for each account that have been noted in the Journal.

For comprehensive outsourced bookkeeping and accounting solutions in the US, UK, Australia, New Zealand, Hong Kong, Canada, and Europe, small and medium-sized enterprises can turn to Mere Accounting, a CPA firm.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 73 6051 0348

- Email: [email protected]

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2025 Meru Accounting. All Rights Reserved.

Privacy Policy

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 73 6051 0348

- Email: [email protected]

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds