What is the process for Construction Company bookkeeping?

Construction Company bookkeeping is the process of recording and tracking all financial transactions of a construction business. This includes income and expenses, as well as project-specific costs. Whether you’re a small contractor or a large construction firm, effective bookkeeping is essential for tracking expenses, managing budgets, and ensuring compliance with tax regulations.

In this article , we will delve into the process of Construction Company bookkeeping and matters incidental to bookkeeping for contractors.

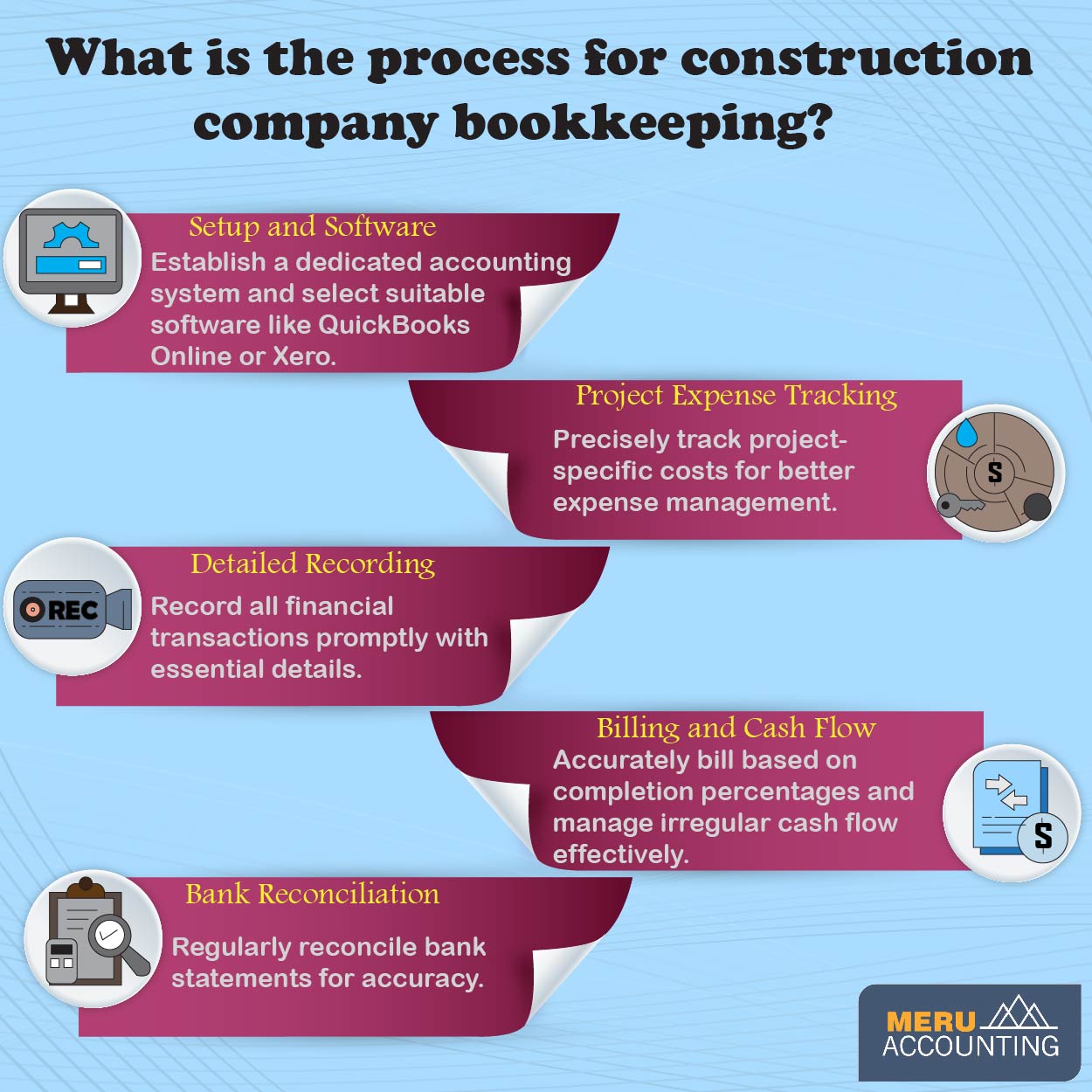

Road map for Construction Company bookkeeping:

1. Getting Started.

The first step in Construction Company bookkeeping is setting up a dedicated accounting system. This system should include all financial transactions related to your construction projects. It’s crucial to maintain separate accounts for each project to accurately monitor their profitability.

2. Choose bookkeeping software.

There are a number of different bookkeeping software programs available, so it is important to choose one that is right for your business needs. Some popular bookkeeping software programs for construction companies include QuickBooks Online and Xero.

3. Record all financial transactions.

This includes income, expenses and project-specific costs. Be sure to record all transactions in a timely manner and to include all relevant details, such as the date, amount, and description of the transaction.

4. Reconcile your bank statements.

This involves comparing your bank statements to your bookkeeping records to make sure that they match. This is an important step in ensuring that your bookkeeping records are accurate.

5. Generate financial reports.

Once you have recorded all financial transactions and reconciled your bank statements, you can generate financial reports. These reports can be used to track your business performance, make informed business decisions.

Important things to note when it comes to bookkeeping for contractors:

1. Tracking expenses :

Construction contractors face a number of unique bookkeeping challenges. One of the biggest challenges is tracking project-specific costs. Contractors often have multiple projects underway at the same time, and it can be difficult to keep track of all of the costs associated with each project.

2. Billing errors :

Another challenge is billing customers. Contractors typically bill their customers based on a percentage of completion, which can make it difficult to estimate how much to bill for each job.

3. Irregular cash flow :

Contractors often have to deal with irregular cash flow. This is because they may not receive payment from customers until a project is completed. As a result, it is important for contractors to have a good understanding of their cash flow and to make sure that they have enough money to cover their expenses.

Investing in the right accounting software and seeking professional guidance when necessary can streamline your bookkeeping processes. Remember that accurate and organized Construction Company bookkeeping is the foundation upon which you can build a thriving construction business.

Meru Accounting, as a proficient bookkeeping firm, can be a vital asset when it comes to bookkeeping for contactors looking to streamline their financial operations in their business. Our team is well-versed in tracking project-specific expenses, managing payroll for construction workers, and ensuring tax compliance within the construction sector.

Meru Accounting‘s commitment to precision and transparency ensures that your construction company’s financial records are always in excellent hands, giving you the peace of mind to focus on what you do best – building success.

FAQs

- Why does a construction firm need its bookkeeping system?

A construction firm must track many costs across jobs. A set system keeps each job’s spend and pay clear, which helps spot gains or losses fast. - What type of software is best for builders?

Firms in this trade use tools like QuickBooks or Xero. These apps let you track job costs, send bills, and make reports that match the needs of the field. - How do I track costs for more than one project?

Set up each job with its account. Log all costs and pay tied to that job. This way you can see if one job makes a gain or runs a loss. - How does bank match-up help in this process?

Bank match-up, or reconcile, checks that bank notes and books show the same sum. This step finds slips and makes sure the books are right. - Why do cash flow issues hit builders hard?

Builders often wait for pay until a job ends. This gap can strain cash flow. Good books show when pay is due and help plan funds to meet costs on time. - How do billing errors hurt a construction firm?

Wrong bills may cause late pay or lost trust. Since many firms bill on job stage, clear books help make sure bills match real work done. - Can good bookkeeping help growth in this field?

Yes. Clean, up-to-date books give clear views of spend, gains, and cash flow. This helps firms plan, cut waste, and grow with less risk.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 203 868 2860

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2026 Meru Accounting. All Rights Reserved.

Privacy Policy

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds