Experience Hassle-Free

Accounting for Construction

With over 9+ years of experience, we are a trusted partner for accounting and bookkeeping services in the UK. Whether you’re a startup, a small business, or an established enterprise, our services can meet the unique needs of your industry. Our deep understanding of UK regulations and best practices can empower your financial journey and drive you toward long-lasting success!

Bookkeeping software expertise

Our Services

We are a group of professionals who offer accounting and bookkeeping services to our clientele across the UK. We offer standard as well as tailored accounting and bookkeeping solutions based on the specific requirements of our clients, ensuring them the best results with our services.

Setting Up Xero/Quickbooks

Fill out our checklist to complete the Setup of your Cloud Software in a day. We provide step by step guidance.

Day To Day Bookkeeping

We will ensure that your books are upto date on the daily/weekly basis so you can stay on top of the Financial position.

Monthly Management Reports

We provide customized reports based upon client requirement. (Sales Perfomance, KPI’s, Overheads reporting, etc)

VAT Returns

We deal with VAT very closely for our clients to ensure that VAT claim is correctly calculated and Submitted Timely.

CIS Returns

Construction Companies enjoy error free and timely submission of CIS returns to HMRC through our services.

Payable Accounting

We track your accounts on a very regular note and also help your business run smoother.

Payroll Setup And Processing

Our procedure will take complete care of your Employee Setup, RTI Filings, Pensions , PAYG Liabilities, P45, P60.

Year End Finalization

We shall provide you complete Financials which can easily be used in preparation and completing Corporate Tax Return.

Why Are We The 1st Choice Of U.K. Businesses Accounting &

Tax Return Preparation

Reduce 50% in Current Costs

You will see a Cost reduction of at least 40-50% as compared to local Bookkeeper or Accountant.

Self Hosted PMS

Our standardized processes and decent Project Management system helps to communicate with you clearly and efficiently.

Faster Turnaround

We generally reply to every emails same day or within maximum 24 hours.

Starting from

£8

Per Hour Bookkeeping service

Detailed & Regular Work Updates

We send emails that carry all the necessary information you need to carry out business operations.

Monthly Meetings with CPA

We conduct monthly meetings with CPA’s for effective communication and understanding client needs.

Meeting Deadlines

We finish all our work prior to deadlines to prevent any kind of chaos during finalization. .

Detailed Checklists

We prepare a well-defined checklist of all the requirements for you so that you don’t have any confusion.

High Quality of Work

Our Standardized Procedures and Checklists will ensure error free work. .

Cloud AddOns Expertise

Receipt Bank

Receipt Bank converts those annoying bits of paper – receipts and invoices – into Xero data!

Hubdoc

With Hubdoc, you can automatically import all your financial documents & export them into data you can use.

Spotlight Reporting

Attractive performance reports quickly and efficiently. Ideal for organizations that need deeper insight and analysis.

Gusto

Gusto offers fully integrated online payroll services that includes HR, benefits, and everything else you need for your business.

AutoEntry

AutoEntry captures, analyses and posts invoices, receipts and statements into your accounting solution.

Shopify

Connect Shopify and Xero to effectively manage your online sales, inventory and accounting requirements.

CONTACT US FOR ANY QUESTIONS

Introduction

Bookkeeping and accounting play an essential role in the construction industry. Accurate financial records are crucial for businesses to effectively manage cash flow, estimate project costs, and make informed decisions about their projects. With complex projects, multiple subcontractors, and fluctuating costs, keeping track of finances can become overwhelming without proper support. This is where Meru Accounting comes in. Our professional accounting services are tailored specifically to the unique needs of construction businesses. By outsourcing your financial management to experts who specialize in serving the construction industry, you can focus on what you do best – building exceptional structures – while leaving the financial aspects in capable hands.

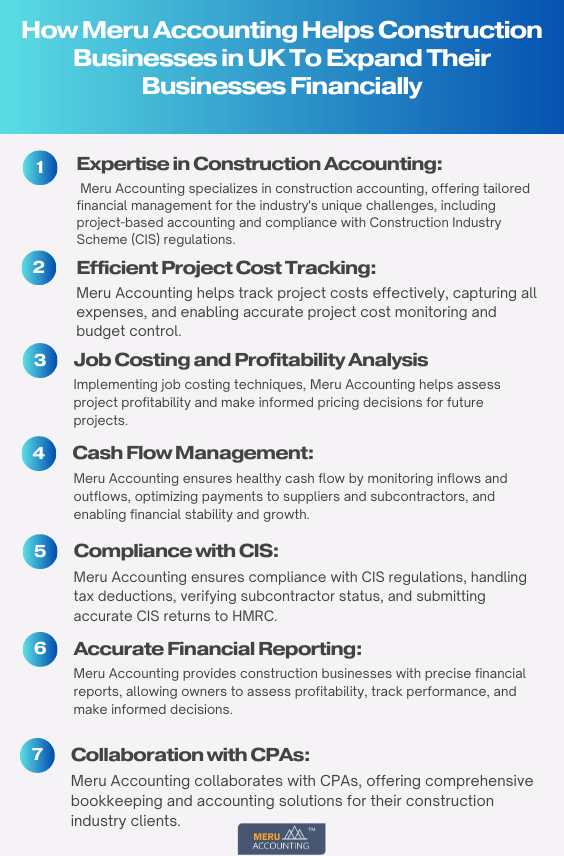

Our team of experienced accountants possesses industry-specific knowledge and expertise in Construction Accounting. We understand the complexities of project-based accounting, job costing, and compliance with Construction Industry Scheme (CIS) regulations. With this specialized knowledge, we ensure accurate and compliant financial management tailored to the construction industry.

We also understand the importance of utilizing the right accounting software for construction businesses. We can guide you in choosing the most suitable software solution for your specific needs, whether it’s industry-specific software like Sage 50 Construction Accounting or QuickBooks Contractor Editions, or cloud-based platforms like Procore Financials. These software solutions offer features tailored to the construction industry, such as job costing capabilities, project management integration, and real-time reporting options, enabling better decision-making based on accurate and up-to-date financial data.

Need For Construction Business in The UK For Accounting and Bookkeeping Services

- As a leading provider of accounting and bookkeeping services for construction businesses in the UK, Meru Accounting understands the unique financial challenges you face.

- We offer specialized accounting and bookkeeping services tailored specifically to the needs of the construction industry, providing support in managing complex projects, multiple subcontractors, and fluctuating costs.

- Our services are enhanced with cutting-edge software tools designed specifically for the construction industry, including cloud-based solutions and software packages like Sage 50 Construction Accounting and QuickBooks Contractor Editions.

- These software solutions offer a range of features, such as job costing capabilities, project management integration, time tracking functionalities, and real-time reporting options, empowering you to make better decisions and optimize financial performance.

- Our goal is to provide valuable insights into improving profitability, enabling you to achieve financial success in the highly competitive construction industry.

Accounting For Mining Companies From Meru Accounting

How Does Construction Accounting Differ From General Accounting?

- Categorization of sales: Unlike the regular business, construction business stands for a wide range of selling products like engineering, coasting, labour, designs, a service provided, etc.

- Expense calculation: In a typical business, the expenses are mostly pre-decided or can be predicted, but in the construction business, this is never the case. the categorization of the goods sold is differently accounted for in the construction business.

- Knowing the break-even point: Break Even point can be achieved by the balancing relation of income and expenses, but in the construction business, it’s very complex as there are already too many categories of the items that make it hard to comprehend.

How Can Meru Accounting Help You In That?

Xero Addon For Construction Industry: Workflow Max Benefits

- We can have separate projects in Workflow max.

- We can have various tasks in that.

- In each task, we can assign the Cost and Profit.

- We can assign tasks to each of the team members.

- It automatically creates invoices in a single click.

- We can convert the cost of WIP into the Sales Invoice automatically

- We can have the Budgeted Cashflow automatically from Xero.

- It can automatically convert purchase orders to a bill in Xero instead of Duplicate Data entry.

- We can assign margins in the% form to the cost.

- We will be able to have Tracking of Profits for individual projects in Workflow Max.

- You will have all the project’s performance on your Dashboard of Workflow max.

How Outsourcing Services Give Solutions Tailored to A Particular Construction Business?

- Tailored Solutions: Outsourcing in the construction industry offers customized solutions tailored to the unique needs of each business, whether small contractors or large companies.

- Access to Experienced Professionals: Outsourcing provides access to experienced professionals with a deep understanding of construction accounting, ensuring accuracy and compliance with industry-specific regulations.

- Streamlined Processes and Improved Efficiency: Outsourcing day-to-day bookkeeping tasks like payroll management and tax filing streamlines processes, allowing businesses to focus on managing projects and clients.

- Utilization of Advanced Software Systems: Outsourcing services utilize advanced software systems designed for construction accounting, automating tasks and generating insightful financial reports for informed decision-making.

How Meru Accounting Helps Construction Businesses in the UK To Expand Their Businesses Financially?

Conclusion

Hiring Virtual Accountant With Meru Accounting

Meru Accounting provides world-class services that cater to all the needs of cloud accounting and bookkeeping of your business.

We work on the best accounting software like Xero and Quickbooks, as well as add-ons that will make sure all your work is up-to-date.

Help you with switching from your traditional software to Xero and Quickbooks.

We also manage VAT, CIS, CT 600 Tax return, Companies house Tax return, Confirmation Statement, Payroll RTI return submissions which gives your onstop solution for all.

When you choose to outsource your accounting work with us, it benefits you in the following ways:

- 1. Cost-saving

- 2. Access to skilled and experienced professionals

- 3. Better management of books of accounts

- 4. Decreased chances of errors

- 5. Improve business efficiency

- 6. De-burdens in-office employee’s dependency

- 7. Better turnaround time

We work on virtual technologies like Team Viewer, Virtual Private Network (VPN) to share and access data from your system.

You have to share your accounting software login details.

Through that, we complete all of your work and update it on the cloud, so you can have access to your data from anywhere and at any time.

Software is not a barrier for us. Due to our strong and professional accounting knowledge, we can prepare your books in almost any of the accounting software.

Our experts are always all ears to listen to your queries regarding bookkeeping and accounting or our services. You can contact us anytime by visiting: Contact Us page.

We provide our bookkeeping services at the rate of US $10 per hour. So, you only need to pay for the amount of time actual work is done.

We take certain preventive measures to secure your data, like:

- Cyberoam Firewall to prevent any kind of foreign threat.

- Dual-step authentication

- Implement anti-virus

- Limit user access so that login details are with a few people.

Meru Accounting work on some of the best accounting software’s like:

- Xero

- Quickbooks

- Netsuite

- Saasu

- Wave

- Odoo

Along with that, we also work with many add-ons like Workflow Max, Receipt Bank, Slack, TradeGecko etc., to extend your software’s capacity and improved work experience.

To book for trial, call us on our numbers or Please fill out the form here.

Our Work Information

We have combined team of Professionals. Seniors are generally Certified Chartered Accountants. Junior Bookkeepers are having Qualifications like Bachelors of Commerce, Masters of Commerce, Masters in Business Administration in the subject of Accounts and Finance, Intermediate level Qualification of Chartered Accountancy, etc.

For information visit our work methodology page.

We prepare a checklist of information required for bookkeeping and send you at timely intervals so as to ensure that we can do bookkeeping faster.

We can provide to you once we move ahead in our interview.

We serve clients on MYOB and have expertise working in Essentials, Account Rights Plus, etc.

Yes, We are presently processing Payroll for Number of clients in US , UK and Australia and take care of complete payroll activities.

Goods and Service tax (GST) is levied on sales of all the goods and services in Australia. GST is generally chargeable at 10% of value of sales.

Business Activity Statement is a predefined form to be submitted to the Australian Tax office by all the business persons in order to report on their all the tax obligations during the period covered.

BAS is generally required to be filed quarterly by various businesses.

Individual Business Owners

Yes, Owner of the business can prepare sign and lodge the tax return on his own. Its not mandatory that the Tax return needs to be signed by an EA or CPA.

No , its not mandatory that it should be prepared by only CPA or EA. It can be prepared by anyone who has PTIN.

We have Enrolled Agent who has the Authority to sign the documents for our clients after completing the through professional check.

Meru Accounting has its operational centre in India and hence the prices are quite less as compared to US based CPA’s and Enrolled Agents.

Meru Accounting has a team of Tax experts. Each Tax expert prepares around 300-400 Tax returns every year for various CPA’s in United States and Individual Businesses like yours. Due to this vast Experience and Robust Quality Check processes in place we can ensure you about correct Tax planning for your firm.

Our Office Address

UK Office

3rd Floor 207 Regent Street, London, W1B 3HH.

Global Production Team (India)

2nd, 3rd ,4th and 5th floor, Shanti Annexe, above Morima, opp. B.d.patel House, Sardar Patel Colony, Sundar Nagar, Naranpura, Ahmedabad, Gujarat 380006