The Importance Of Hiring A Certified Bookkeeper For Your Business.

While you are operating any business in the UK, you have to be very peculiar about the bookkeeping. Proper bookkeeping is important to bring accuracy to the accounting books and meet other obligations.

You need to ensure proper Value Added Tax (VAT) management and comply with HM Revenue & Customs (HMRC). So, a certified bookkeeper can be helpful for your business to bring bookkeeping efficiency.

Their expertise can meet all the obligations as per the HMRC guidelines in the UK. Professional bookkeepers have proper knowledge about the guidelines needed and bring efficiency to it. Many businesses in the UK are looking to bring efficiency in bookkeeping.

What Is The Importance Of Hiring A Certified Bookkeeper For Business In The UK?

UK taxation accounting laws are very complicated and you need experts to handle it.

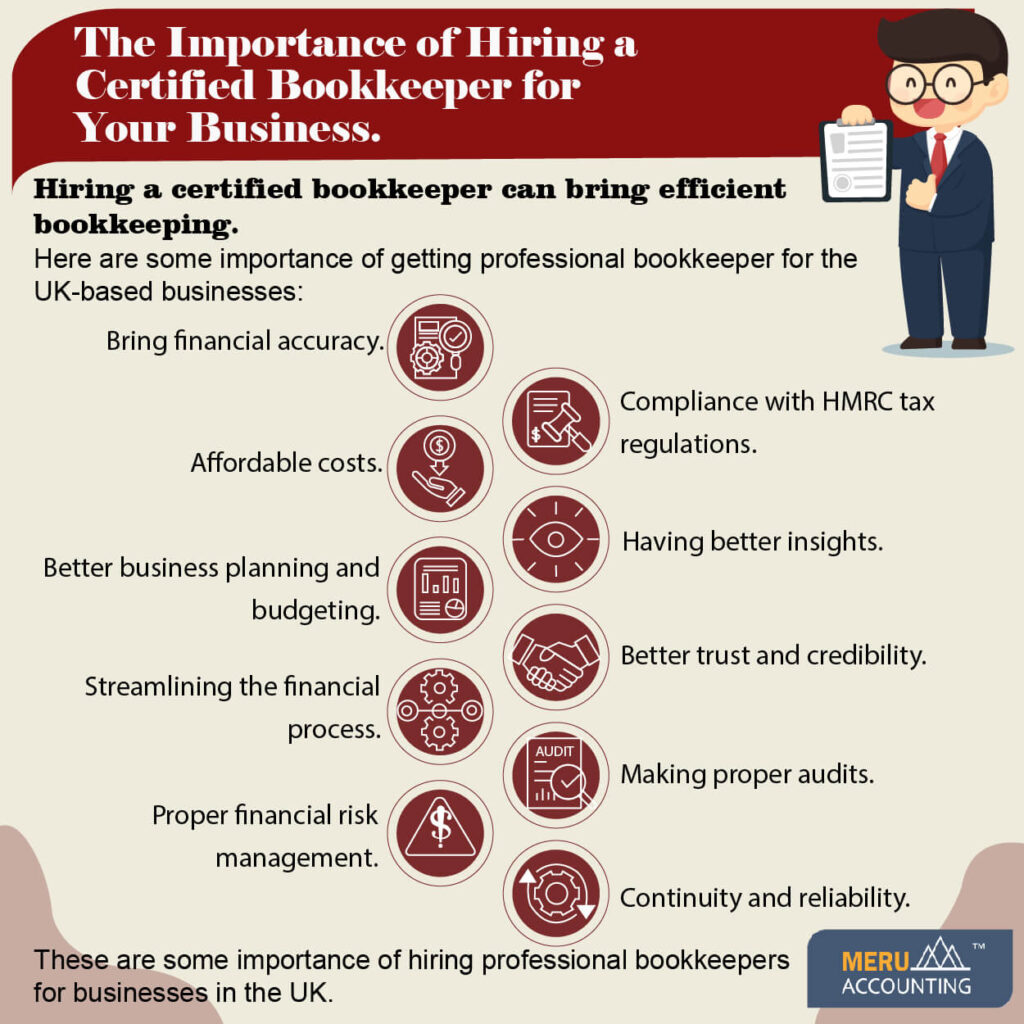

Here are some of the importance of hiring a professional bookkeeper for a UK-based business:

1. Financial Accuracy

Certified bookkeepers possess the necessary expertise and knowledge to accurately record and maintain financial transactions. This ensures that all financial records are precise, up-to-date, and compliant with relevant accounting standards.

2. Compliance With Tax Regulations

Tax laws and regulations in the UK can be complex and ever-changing. A certified bookkeeper is well-versed in these regulations and can help businesses stay compliant. They can minimize the risk of penalties and fines resulting from incorrect or late tax filings.

3. Cost Efficiency

Outsourcing bookkeeping to a certified professional allows business owners and staff to focus on core operations and strategic decision-making, rather than getting bogged down in administrative tasks. Moreover, a bookkeeper can work efficiently, potentially saving costs associated with hiring and training in-house staff.

4. Better Business Insights

Professional bookkeepers can provide valuable insights into a company’s financial health and performance. Through regular financial reports and analysis, they can identify areas of improvement, potential cost savings, and opportunities for growth.

5. Business Planning And Budgeting

A bookkeeper can assist in creating realistic budgets and financial forecasts based on historical data. These projections can be crucial for setting achievable business goals.

6. Trust And Credibility

They can add a layer of trust and credibility to a company’s financial records. It demonstrates to stakeholders, including investors, lenders, and clients.

7. Streamlined Financial Processes

Certified bookkeepers are often familiar with various accounting software and tools. It can streamline financial processes and enhance efficiency in managing financial data.

8. Preparation For Audits

In case of an audit, having accurate and well-organized financial records is essential. A certified bookkeeper can ensure that all financial documentation is in order and ready for inspection, making the audit process smoother.

9. Financial Risk Management

Maintaining accurate and organized financial records can help a business identify potential financial risks. They can take proactive measures to mitigate them properly.

10. Continuity And Reliability

A certified bookkeeper can provide continuity in the financial management of a business. In case of staff turnover, having a certified professional ensures that there is no disruption in maintaining financial records.

These are some importance of hiring certified bookkeepers for businesses in the UK. If you are finding inefficiency in the bookkeeping then you can outsource it to the experts.

Meru Accounting provides outsourced bookkeeping services for businesses in the UK. They have a well-qualified certified bookkeeper who can handle all activities efficiently. Their professional bookkeepers are qualified and have good knowledge of HMRC guidelines. Meru Accounting is a popular accounting services providing agency across the globe.

FAQs

- Why should a UK business hire a certified bookkeeper instead of handling it in-house?

A certified bookkeeper brings skill and deep tax law knowledge. This cuts the risk of costly errors, keeps records clean, and frees owners to focus on growth.

- How can a bookkeeper help with UK tax rules?

UK tax rules change a lot and are hard to track. A skilled bookkeeper makes sure returns are on time and match HMRC rules, which cuts the risk of fines.

- Does hiring a bookkeeper save money for small firms?

Yes. It avoids costs from staff training and slips. A bookkeeper also works quickly and spots waste, which can bring long-term savings.

- What insights can a certified bookkeeper give to owners?

They give reports that show profit, cash flow, and spending trends. These facts guide smart steps, like cutting costs or planning growth.

- Can bookkeepers help with business budgets?

Yes. They use past data to build real forecasts and set clear spend plans. This helps firms reach goals while keeping funds safe.

- How does a bookkeeper add trust with clients or banks?

Accurate books prove that a firm runs with care and fairness. This trust can draw in investors, win client faith, and make it easier to get loans.

- What role does a bookkeeper play during audits?

They keep records neat and ready for review. This makes audits less tense, saves time, and shows that the firm meets all set rules.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 203 868 2860

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2026 Meru Accounting. All Rights Reserved.

Privacy Policy

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds