What is the importance of bookkeeping?

In the realm of financial management, the importance of bookkeeping emerges as an irreplaceable pillar, facilitating effective organizational operations and strategic decision-making. Bookkeeping, often referred to as the art of methodical record-keeping, is a meticulous process that tracks and documents financial transactions and activities within an entity. This practice goes beyond being a mere administrative task; it is the cornerstone upon which the best bookkeeping practices are built, ensuring accurate financial insights and regulatory compliance.

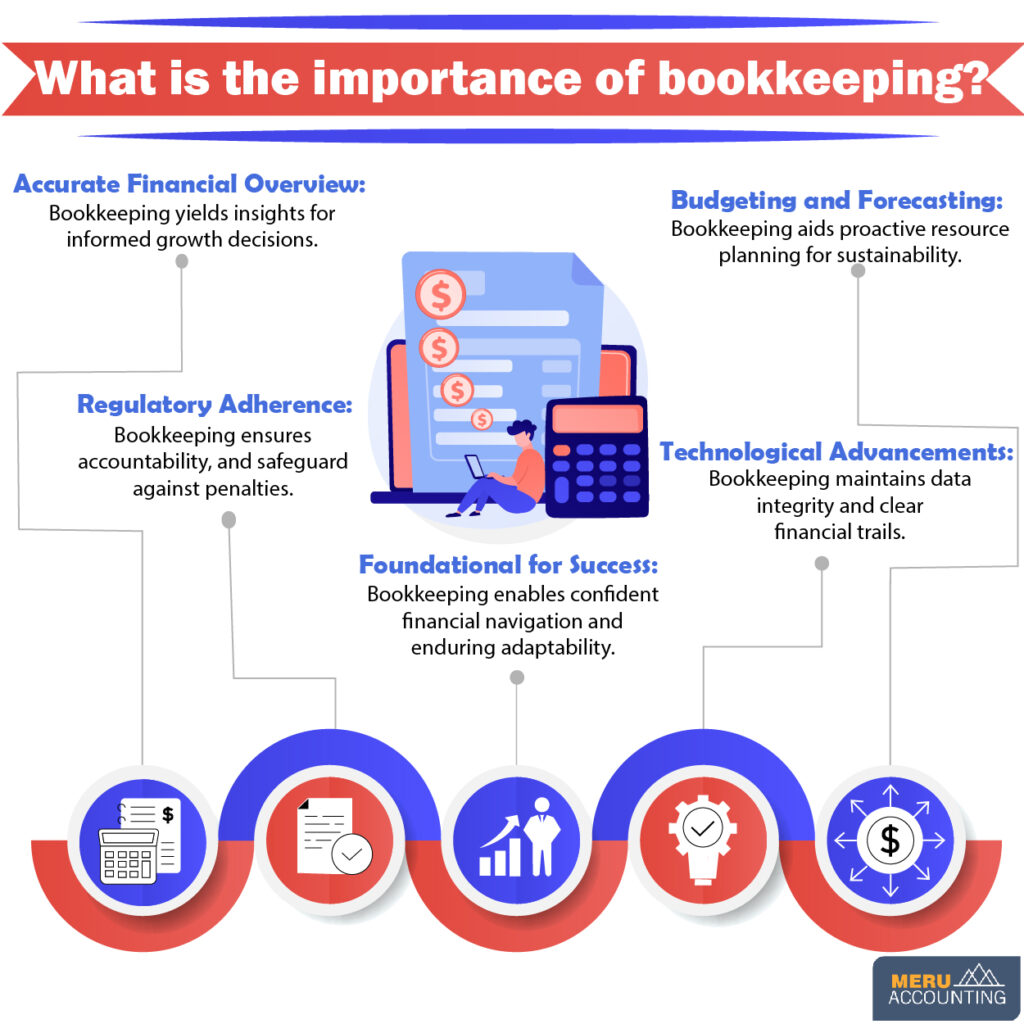

Let’s delve into the key reasons why bookkeeping holds such a vital role:

1. Accurate Financial Overview:

Bookkeeping involves meticulous tracking and documentation of financial transactions. This compilation of data provides a precise understanding of an organization’s financial health, encompassing revenues, expenditures, assets, and liabilities. This accuracy empowers businesses to make well-informed decisions aligned with growth strategies.

2. Regulatory Adherence:

In today’s complex regulatory landscape, businesses must adhere to various financial regulations and taxation requirements. The best bookkeeping practices ensure organized and accessible financial records for audits and compliance checks. This fosters transparency and accountability, safeguarding the entity from penalties and legal consequences.

3. Budgeting and Forecasting:

Bookkeeping plays a pivotal role in budgeting and financial forecasting. Historical financial data maintained through consistent bookkeeping serves as the foundation for creating reliable financial projections. By identifying trends and patterns, organizations can proactively allocate resources, enhancing sustainability and growth prospects.

4. Technological Advancements:

With the rise of technology, bookkeeping has evolved. Automated bookkeeping systems and software enhance accuracy and efficiency. However, the core importance of bookkeeping remains unchanged. It ensures data integrity, reduces errors, and maintains a clear trail of financial activities, whether through manual or digital methods.

5. Foundational for Success:

Ultimately, the importance of bookkeeping goes beyond administrative tasks. It stands as the bedrock of financial management, enabling businesses to navigate their financial landscapes confidently. Embracing best bookkeeping practices is indispensable for enduring success, fostering adaptability to changes and a robust financial foundation.

The importance of bookkeeping cannot be overstated. By keeping accurate financial records, businesses can improve their financial performance, stay compliant with tax laws, and make informed decisions about their future.

Here are some additional tips for businesses that want to improve their bookkeeping practices:

The best bookkeeping practices will vary depending on the size and complexity of the business. However, some common best practices include:

- Using a systemized approach to record transactions.

- Keeping accurate and up-to-date records.

- Reconciling bank statements regularly.

- Preparing financial statements on a regular basis.

- Hiring a qualified bookkeeper if necessary.

Recognizing the multifaceted importance of bookkeeping is crucial for businesses striving for growth and sustainability. Whether through manual methods or automated systems, the essence of accurate and consistent bookkeeping remains a cornerstone of success. By seamlessly integrating technological advancements into our services, we at Meru Accounting exemplify how staying at the forefront of innovation can further amplify the foundational role of bookkeeping in fostering business success.

By leveraging advanced technologies and in-depth industry knowledge, at Meru Accounting we offer best bookkeeping practices that ensure accurate record-keeping, regulatory compliance, and seamless financial analysis and thus play a pivotal role in addressing the multifaceted challenges of financial management by enabling proactive decision-making.

FAQs

- Why is bookkeeping so important for a small firm?

Bookkeeping gives clear insight into cash in and out. With this, small firms know if they make gains or face risk. It helps them plan with ease and keep growth on track.

- How does bookkeeping help with tax rules in the UK?

When books stay neat and up to date, firms file taxes with no stress. Good records cut the chance of fines and show proof if HMRC calls for a check.

- Can good bookkeeping improve cash flow?

Yes. When you track each spend and sale, you see trends fast. It lets you plan for bills, save for growth, and spot gaps in time.

- What role does bookkeeping play in budgets?

Past data from books is key to setting a fair budget. Firms use it to track costs, set goals, and avoid overspending. It also helps with long-term plans.

- Do tech tools make bookkeeping less of a task?

Yes. Bookkeeping apps save time, cut errors, and give live reports. Still, the core aim stays the same: clean and true books.

- What risks come with poor bookkeeping?

Poor books can cause missed bills, cash loss, or tax fines. Lack of data can block a loan or push a firm off its plan.

- Should a start-up hire an expert bookkeeper?

It can help. A skilled bookkeeper knows the best rules and tools. This frees the owner to grow sales while still having clear books. - How does bookkeeping link to long-term success?

It is the base of sound finance. With the right books, firms adapt, meet rules, and build trust. In short, it is not just a task but a growth path.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 203 868 2860

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2026 Meru Accounting. All Rights Reserved.

Privacy Policy

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds