How to avoid a late filing penalty?

When you are running a business, filing of income tax return is very important as per regulations. Although many businesses do make proper preparation of income tax returns, they just fail to do it before the given duration.

If your business is operating in the UK, then you must be very peculiar in filing the income tax returns as per the HMRC guidelines.

Failing to do so, you may have to face a huge late filing penalty. A lot of business organizations cannot do it before the due date, as there are several tasks in making income tax returns.

Some of the main tasks are VAT Return Preparation, making Profit Loss statements, Balance sheets, etc. All these aspects have to be done properly in the timeframe properly.

When will the company have late filing penalties?

When you are a new company which is about to file a first set of accounts, it must be delivered within 21 months of the incorporation date.

Within a period of 9 months, the accounts must be delivered after the end of the company’s financial year. Once you comply with the Companies Act requirement, the account is considered delivered.

Failing to deliver, an automatic late filing penalty is applied. The amount of penalty you receive will depend on the period late you send the accounts.

The penalties will be as given below:

- If late for less than one month – £150

- If late between one month to three months – £375

- If late between three to six months – £750

- If more than six months late – £1500

If you are late for two consecutive financial years to file the accounts then the fees will be doubled.

Is it possible to appeal a late filing penalties?

If you have sufficient reasons then there are some exceptional circumstances you can appeal to a late filing penalty.

You need the following things to appeal – authentication code, company number, penalty reference, the reason for the appeal, and necessary supporting documents.

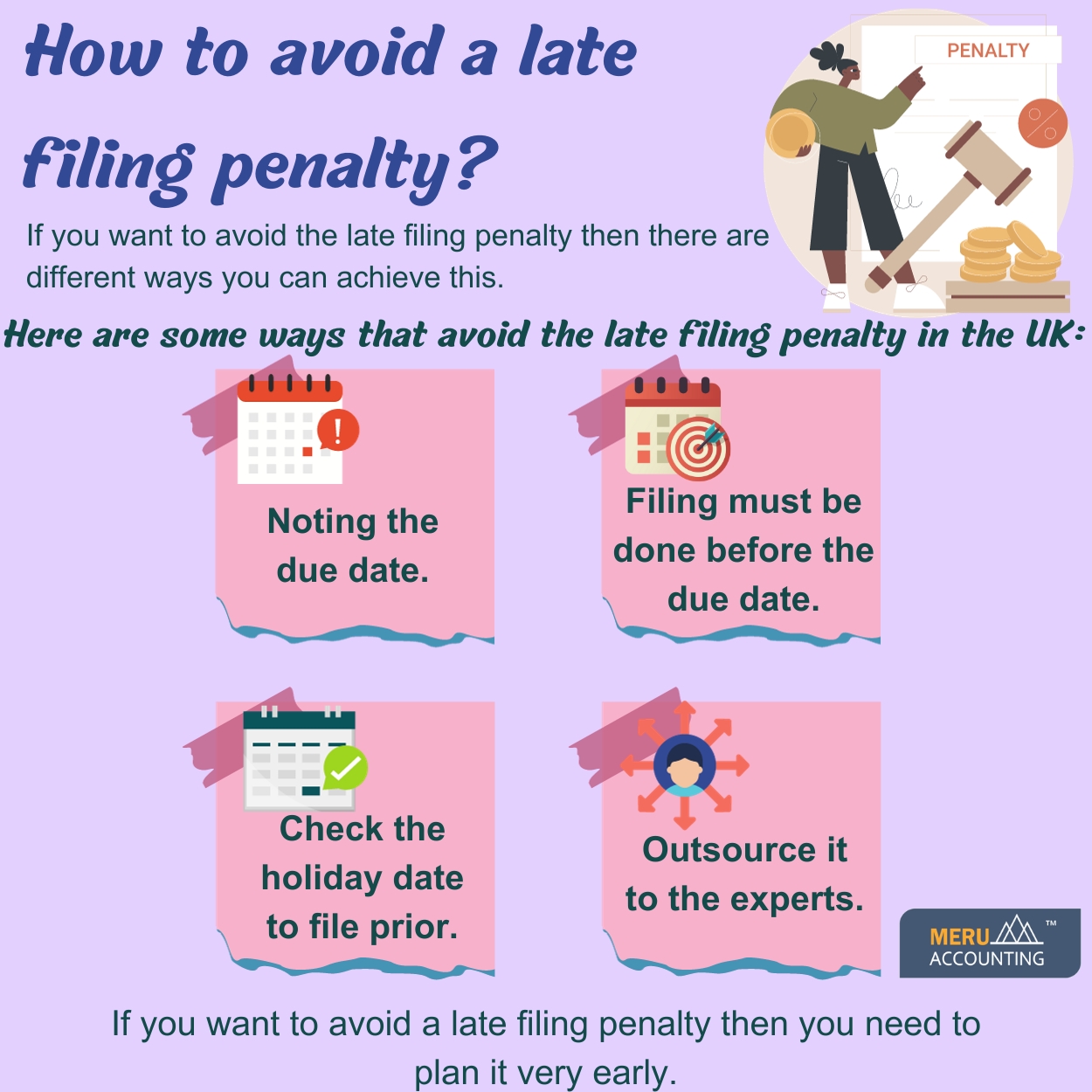

How can the late filing penalty be avoided?

You can avoid the late filing penalty in the following ways:

1. Note the due date

You need to check the due date of accounts and note it in a diary or some proper place. Set an auto alert message to you where you can prepare.

2. Try to do filing a few days before the due date

Although all filing processes are online where the filing is done instantly, you still must not wait for the last due date. You might have any urgency or technical glitch that can make you late.

3. Consider the holiday date

You need to check the last date and if there is any public holiday on it. Here, you need to do filing before the last date.

4. Outsource to experts

If you are a small or medium business, that could not dedicate so much time to filing then you can outsource it to experts. They will properly manage to do VAT return preparation, profit loss statement, etc. for filing before the due date.

In this way, you can avoid late filing penalty easily. If you find it difficult to manage then you can outsource this task to experts.

Meru Accounting provides outsourced filing services for UK-based companies. They have worked for many companies in the UK for filing tax returns.

Their expert team has good knowledge of HMRC guidelines to comply with everything properly.

Meru Accounting is a proficient accounting service providing agency around the world.

FAQs

- What causes most firms to miss their filing date?

Most firms miss deadlines due to poor preparation, last-minute work, or a lack of staff. Some also face tech issues or forget to plan for holidays that fall on due dates. - How much can a late filing penalty cost in the UK?

The cost depends on how late you file. It can start at £150 for less than a month late and rise to £1,500 if the delay goes beyond six months. - Can small firms cut the risk of late fines?

Yes, Small firms can set alerts, keep clear books, and file for a few days. They can also hire a tax professional to save time and ease stress. - Is it wise to file on the last day?

No. Filing at the last hour is a risk. A net fail, tech glitch, or rush task can cause a slip. File soon to stay safe and calm. - Can I fight a late-file fine if I had fair cause?

Yes. If you had things out of your hands, like sick leave or site failure, you can fight it. You must show proof, a firm ID, a fine note, and cause. - What role does outsourcing play in avoiding penalties?

Outsourcing helps firms that lack time or skill. Experts handle VAT, profit and loss, and balance sheets. This makes sure the filing is done right and on time.

- Do late files two years in a row cost more?

Yes. If a firm files late for two years straight, the fine is twice as much. That is why a plan and an early file are key to saving cash. - What is the best way to track filing dates?

The best way is to note the due date in a planner or use digital alerts. Many firms also link alerts to their email or phone for quick reminders.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 203 868 2860

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2026 Meru Accounting. All Rights Reserved.

Privacy Policy

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds