- Schedule Meeting

What is VAT100 and How to Fill Form VAT100 Correctly?

The VAT100 form is an essential document for VAT-registered businesses in the UK. It’s used to report VAT (Value Added Tax) liabilities and any claims back to HMRC (Her Majesty’s Revenue and Customs). Completing this form accurately is crucial, as it helps ensure you meet VAT obligations and avoid potential issues with HMRC. Whether you’re new to VAT or just need a refresher, this guide will walk you through the steps to fill out the form VAT100 correctly. Meru Accounting offers professional services to assist businesses in staying VAT-compliant and filing their form VAT100 accurately.

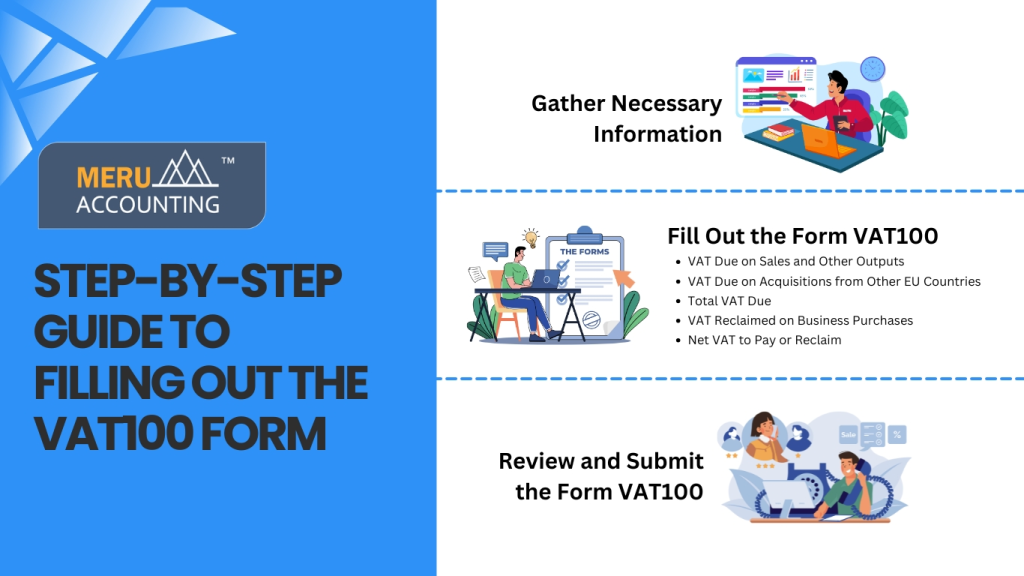

Step-by-Step Guide to Filling Out the VAT100 Form Correctly

Step 1: Gather Necessary Information

Before starting, it’s important to gather all relevant financial information for the period you’re reporting. This includes details about your sales, purchases, and any VAT amounts you have charged or paid. Having these details ready ensures that your form VAT100 can be completed without missing any important data.

Step 2: Fill Out the Form VAT100

Here’s a quick overview of each main section, or “box,” on the VAT100 form and how to fill them out correctly:

- Box 1 – VAT Due on Sales and Other Outputs

In Box 1, enter the total VAT due on your sales and any other taxable supplies for the reporting period. This amount reflects the VAT your business has charged to customers. Make sure to review your records carefully to get an accurate total. - Box 2 – VAT Due on Acquisitions from Other EU Countries

If your business acquired goods or services from other EU countries, record the VAT due on these acquisitions in Box 2. This applies if you’ve brought in supplies from VAT-registered businesses in the EU. - Box 3 – Total VAT Due

Box 3 automatically calculates the total VAT due by adding the figures from Box 1 and Box 2. This is a sum of all VAT you owe to HMRC for the reporting period. - Box 4 – VAT Reclaimed on Business Purchases

Use Box 4 to report the VAT you’ve reclaimed on business purchases and other inputs. This could include VAT on goods and services you’ve bought to operate your business. Ensure you only enter amounts that are eligible for VAT reclaim. - Box 5 – Net VAT to Pay or Reclaim

This box calculates the difference between Box 3 and Box 4. If Box 3 is higher, you’ll need to pay that amount to HMRC. If Box 4 is higher, you may be eligible to reclaim VAT from HMRC. This final amount reflects the net VAT position for your business for the reporting period.

Step 3: Review and Submit the Form VAT100

It’s important to double-check your form VAT100 entries before submitting it to avoid errors. Small mistakes can lead to underpayment or overpayment, which could result in additional paperwork or even penalties. Once you’ve verified everything, you can submit the form online through HMRC’s digital portal. You may also want to review relevant VAT notices to stay updated on any changes in VAT rules.

Conclusion

Accurately completing and submitting the VAT100 form is essential for VAT-registered businesses. Following these steps ensures your business remains VAT-compliant and avoids any unexpected VAT liabilities. For businesses looking to simplify the VAT process, Meru Accounting offers expert support for completing the form VAT100, along with a range of other accounting services. With the right guidance and expertise, managing VAT obligations can be straightforward, letting you focus more on running your business.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 (0) 203 868 2860

- [email protected]

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2025 Meru Accounting. All Rights Reserved.

Privacy Policy

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 73 6051 0348

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds