How to Save Money with Effective Payable Accounting

Implementing effective payable accounting can lead to significant cost savings for businesses. By optimizing accounts payable processes, companies can improve cash flow, reduce errors, and capitalize on early payment discounts.

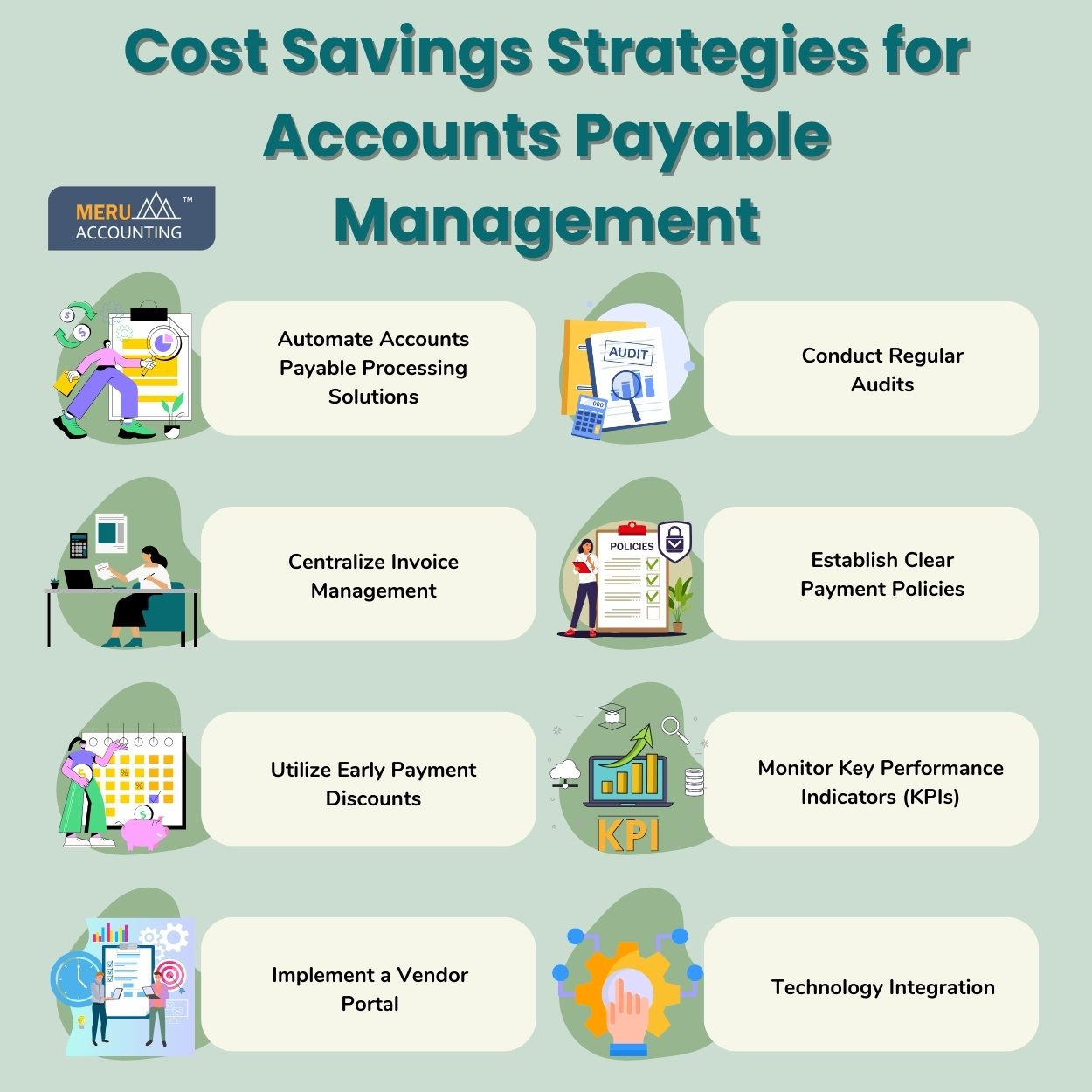

Automate Accounts Payable Processing Solutions

Automation is a key strategy in effective payable accounting. Automating accounts payable processing solutions minimizes manual intervention, reduces errors, and speeds up invoice processing. Automated systems can match invoices with purchase orders and receipts, ensuring accuracy and reducing the risk of overpayments.

Centralize Invoice Management

Centralizing invoice management is another crucial aspect of payable accounting. A centralized system allows for better tracking and control of invoices. It ensures that all invoices are processed through a single platform, which streamlines the approval process and improves visibility. This centralization helps in identifying and addressing variations quickly.

Utilize Early Payment Discounts

Taking advantage of early payment discounts is an effective cost-saving strategy in payable accounting. Businesses can benefit from supplier discounts by paying invoices before the due date. This not only saves money but also strengthens supplier relationships, potentially leading to more favorable terms in the future.

Implement a Vendor Portal

A vendor portal is an excellent tool for enhancing accounts payable processing solutions. This allows vendors to submit their invoices digitally and check for the payment status. This reduces the administrative burden on the accounts payable team and ensures timely processing of invoices. A vendor portal also facilitates better communication between the business and its suppliers.

Conduct Regular Audits

Regular audits are essential for maintaining effective payable accounting. Audits help in identifying inefficiencies, detecting fraud, and ensuring compliance with company policies and regulations. By regularly reviewing accounts payable processes, businesses can implement corrective actions to improve efficiency and reduce costs.

Establish Clear Payment Policies

Having clear payment policies is critical in payable accounting. These policies should outline the procedures for invoice submission, approval, and payment. Clear guidelines ensure consistency and prevent delays in the accounts payable process. Well-defined payment policies also help in avoiding late fees and maintaining good supplier relationships.

Monitor Key Performance Indicators (KPIs)

Monitoring KPIs is vital for assessing the effectiveness of payable accounting processes. Key metrics such as invoice processing time, payment accuracy, and discount capture rate provide insights into the efficiency of the accounts payable function. Reviewing KPIs regularly can help in recognizing areas for improvement and implementing suitable changes.

Technology Integration

Integrating payable accounting systems with other business applications, such as ERP and procurement software, enhances data accuracy and streamlines processes. Seamless integration allows smooth flow of information between systems, and reduces manual data entry leading to minimal errors. This integration supports a more cohesive and efficient accounts payable process.

Conclusion

Effective accounts payable accounting uses automation, centralization, clear policies, and continuous improvement. By partnering with Meru Accounting, businesses can save money, work more efficiently, and build strong supplier relationships. Investing in accounts payable solutions and regularly reviewing processes helps businesses stay competitive and financially healthy.

FAQs

- How can payable accounting help my business save money?

It cuts waste, reduces errors, and helps you take early pay deals. When done right, it also boosts cash flow and keeps costs low. - Why should I automate accounts payable?

Automation speeds up work, lowers errors, and makes invoice checks fast. It links each bill to orders and receipts so you pay the right amount. - What is the benefit of a single invoice hub?

A single hub for all bills helps track, approve, and store them in one place. This makes it easy to spot mistakes and fix them fast. - How do early pay discounts work?

Suppliers may cut the bill if you pay before it’s due. These small cuts add up and can save a lot each year while building trust with vendors. - Why should I set up a vendor portal?

A vendor portal lets suppliers send bills online and check pay status. This saves time for both sides and makes pay cycles smooth. - How do audits improve payable accounting?

Audits spot waste, fraud, and slow steps. They also check if rules are met, so you can make fixes and run the process better. - What role do payment rules play?

Clear rules make sure bills are sent, checked, and paid the same way each time. This helps avoid late fees and keeps vendor trust high. - How does tracking KPIs help?

By tracking key points like pay speed and error rate, you see where you can do better. This helps cut costs and speed up pay cycles.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 203 868 2860

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2026 Meru Accounting. All Rights Reserved.

Privacy Policy

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds