Common Tax Mistakes and How a Tax Advisor Can Help

Navigating tax season can be daunting, and many individuals make common mistakes that can lead to costly consequences. From overlooked deductions to misfiled forms, these errors can diminish your refund or result in penalties. A tax advisor can help you avoid these pitfalls, ensuring your return is accurate and maximizing your potential savings while providing peace of mind throughout the process.

Brief Overview of most Common Tax Mistakes

- Filing Status Errors: Choosing the wrong status can affect tax rates and credits.

- Math Errors: Calculation mistakes can lead to underpayment or overpayment.

- Missing Deadlines: Late filings can incur penalties.

- Omitting Income: All income must be reported to avoid audits.

- Neglecting Deductions/Credits: Overlooking eligible deductions can mean missing out on savings.

- Incorrectly Claiming Dependents: Only eligible dependents should be claimed.

- Not Keeping Records: Poor documentation can complicate audits.

- Ignoring Tax Law Changes: Staying updated is essential to avoid errors.

- Misreporting Retirement Contributions: Accurate reporting is crucial for tax implications.

- Inadequate Estimated Tax Payments: Self-employed individuals must make timely payments to avoid penalties.

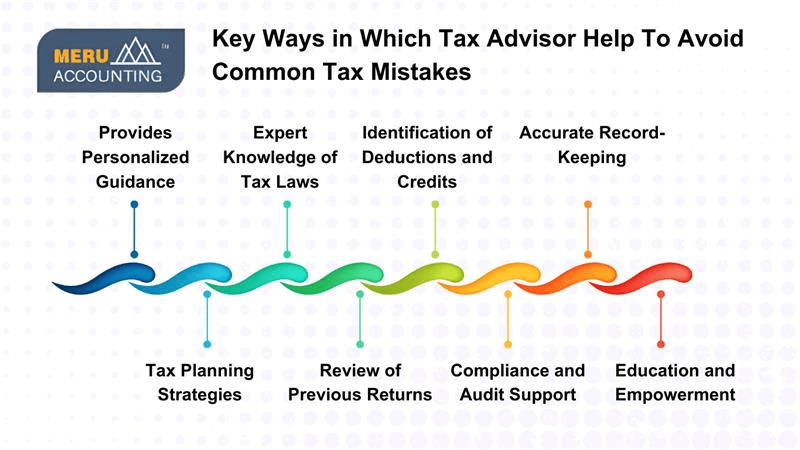

How Tax Advisor provides efficient tax advice to avoid common tax mistakes?

1. Provides Personalized Guidance

Tax advisors take the time to understand your unique financial situation, including income sources, investments, and personal circumstances. This tailored approach allows them to recommend specific strategies that align with your goals, reducing the likelihood of errors.

2. Expert Knowledge of Tax Laws

Tax laws are constantly evolving, and keeping up with changes can be overwhelming. Tax advisors stay informed about current regulations, new tax codes, and potential implications for their clients. Their expertise helps you navigate these complexities, ensuring compliance and minimizing risks.

3. Identification of Deductions and Credits

Many taxpayers miss out on valuable deductions and credits simply because they’re unaware of what they qualify for. A tax advisor can identify eligible expenses related to business operations, education, homeownership, and more. This not only reduces your taxable income but also helps you avoid overpaying taxes.

4. Accurate Record-Keeping

Tax advisors emphasize the importance of accurate record-keeping and can help you establish efficient systems for tracking income, expenses, and relevant receipts. Their tax advice minimizes errors and prepares you for potential audits.

5. Tax Planning Strategies

A proactive tax advisor will work with you throughout the year, not just at tax season. They develop strategic plans as well as provide efficient tax advice that consider your future financial goals, allowing you to take advantage of tax-saving opportunities. This might include timing income, managing investments, or planning for retirement contributions.

6. Review of Previous Returns

If you’ve filed your taxes in the past, a tax advisor can review your previous returns for potential mistakes or missed deductions. This can lead to amendments that may result in refunds, and it also helps ensure future filings are more accurate.

7. Compliance and Audit Support

Understanding tax compliance is vital to avoid penalties. In the event of an audit, they can provide support and representation, helping to clarify any discrepancies and minimize stress.

8. Education and Empowerment

Beyond immediate tax advice, a good tax advisor educates clients about tax principles and best practices. By empowering you with knowledge, you can make informed decisions and feel more confident in managing your finances.

Conclusion

In conclusion, working with a tax advisor for their efficient tax advice, Meru Accounting, can significantly reduce the risk of common tax mistakes and enhance your overall financial strategy. Our expertise in tax laws, personalized guidance, and proactive planning ensure that you not only remain compliant but also maximize deductions and credits. By partnering with Meru Accounting, you gain a valuable ally in navigating the complexities of taxes, ultimately leading to more efficient financial management and peace of mind during tax season.