Common Tax Mistakes and How a Tax Advisor Can Help

Navigating tax season can be daunting, and many individuals make common mistakes that can lead to costly consequences. From overlooked deductions to misfiled forms, these errors can diminish your refund or result in penalties. A tax advisor can help you avoid these pitfalls, ensuring your return is accurate and maximizing your potential savings while providing peace of mind throughout the process.

Brief Overview of most Common Tax Mistakes

- Filing Status Errors: Choosing the wrong status can affect tax rates and credits.

- Math Errors: Calculation mistakes can lead to underpayment or overpayment.

- Missing Deadlines: Late filings can incur penalties.

- Omitting Income: All income must be reported to avoid audits.

- Neglecting Deductions/Credits: Overlooking eligible deductions can mean missing out on savings.

- Incorrectly Claiming Dependents: Only eligible dependents should be claimed.

- Not Keeping Records: Poor documentation can complicate audits.

- Ignoring Tax Law Changes: Staying updated is essential to avoid errors.

- Misreporting Retirement Contributions: Accurate reporting is crucial for tax implications.

- Inadequate Estimated Tax Payments: Self-employed individuals must make timely payments to avoid penalties.

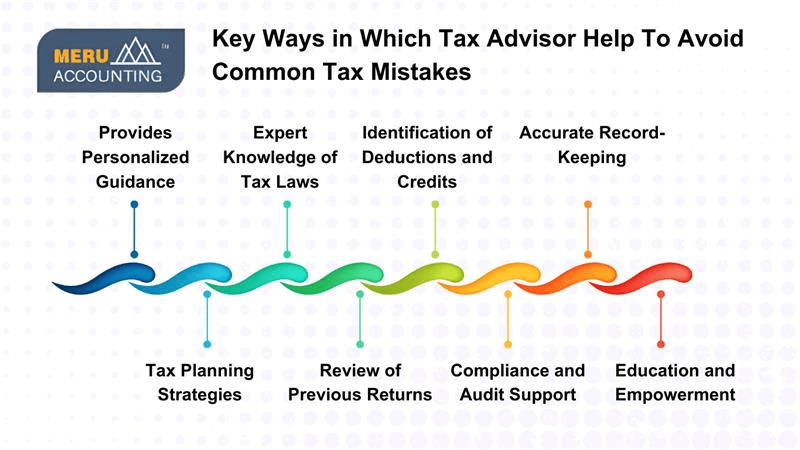

How Tax Advisor provides efficient tax advice to avoid common tax mistakes?

1. Provides Personalized Guidance

Tax advisors take the time to understand your unique financial situation, including income sources, investments, and personal circumstances. This tailored approach allows them to recommend specific strategies that align with your goals, reducing the likelihood of errors.

2. Expert Knowledge of Tax Laws

Tax laws are constantly evolving, and keeping up with changes can be overwhelming. Tax advisors stay informed about current regulations, new tax codes, and potential implications for their clients. Their expertise helps you navigate these complexities, ensuring compliance and minimizing risks.

3. Identification of Deductions and Credits

Many taxpayers miss out on valuable deductions and credits simply because they’re unaware of what they qualify for. A tax advisor can identify eligible expenses related to business operations, education, homeownership, and more. This not only reduces your taxable income but also helps you avoid overpaying taxes.

4. Accurate Record-Keeping

Tax advisors emphasize the importance of accurate record-keeping and can help you establish efficient systems for tracking income, expenses, and relevant receipts. Their tax advice minimizes errors and prepares you for potential audits.

5. Tax Planning Strategies

A proactive tax advisor will work with you throughout the year, not just at tax season. They develop strategic plans as well as provide efficient tax advice that consider your future financial goals, allowing you to take advantage of tax-saving opportunities. This might include timing income, managing investments, or planning for retirement contributions.

6. Review of Previous Returns

If you’ve filed your taxes in the past, a tax advisor can review your previous returns for potential mistakes or missed deductions. This can lead to amendments that may result in refunds, and it also helps ensure future filings are more accurate.

7. Compliance and Audit Support

Understanding tax compliance is vital to avoid penalties. In the event of an audit, they can provide support and representation, helping to clarify any discrepancies and minimize stress.

8. Education and Empowerment

Beyond immediate tax advice, a good tax advisor educates clients about tax principles and best practices. By empowering you with knowledge, you can make informed decisions and feel more confident in managing your finances.

Conclusion

In conclusion, working with a tax advisor for their efficient tax advice, Meru Accounting, can significantly reduce the risk of common tax mistakes and enhance your overall financial strategy. Our expertise in tax laws, personalized guidance, and proactive planning ensure that you not only remain compliant but also maximize deductions and credits. By partnering with Meru Accounting, you gain a valuable ally in navigating the complexities of taxes, ultimately leading to more efficient financial management and peace of mind during tax season.

FAQs

- Why do so many people make tax mistakes?

Most people don’t track tax rules or file with care. Lack of time, wrong forms, or missed steps can all lead to slips. - Can a tax advisor fix past tax errors?

Yes. A tax professional can check old forms, fix flaws, and file new ones if you missed out on funds or made a wrong claim. - What’s the top reason for tax fines?

Late forms and wrong sums top the list. Not paying on time or missing key information can lead to fees or audits. - Will a tax advisor help me save on taxes?

Yes. They spot claims you can use, cut your bill, and show ways to plan to keep more of your funds. - How do tax advisors help self-employed people?

They help track costs, set pay goals, and stay on top of tax dates. This cuts risks and keeps your books clean. - Do I need a tax professional if I have a low income?

Even with less pay, a pro can help you find tax perks, check rules, and keep your form safe from key slips. - What records should I keep for tax time?

Save pay slips, bills, bank notes, and all tax forms. A tax professional can help sort and store them for smooth checks. - How do tax advisors help in case of an audit?

They deal with tax staff, show your facts, and help you stay calm. With a pro, you don’t face audits alone.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 203 868 2860

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2026 Meru Accounting. All Rights Reserved.

Privacy Policy

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds