Don’t Make These Mistakes – Working with VAT Schema

Value-Added Tax (VAT) laws are still a crucial part of doing business in a number of different industries in 2024. The VAT schema, a structured method for submitting VAT-related data to tax authorities, is a basic component of VAT compliance. Businesses must comprehend the VAT system and abide by its rules in order to assure compliance and prevent penalties.

The format for electronic transmission of VAT data, including product types, tax rates, and invoice totals, is specified in this schema. Adhering to a certain VAT schema ensures that VAT data is effortlessly understood and processed by various software systems, hence reducing errors and streamlining tax authority compliance. This blog will delve into the intricacies of VAT schema guidelines 2024, outlining best practices and common mistakes to steer clear of in 2024.

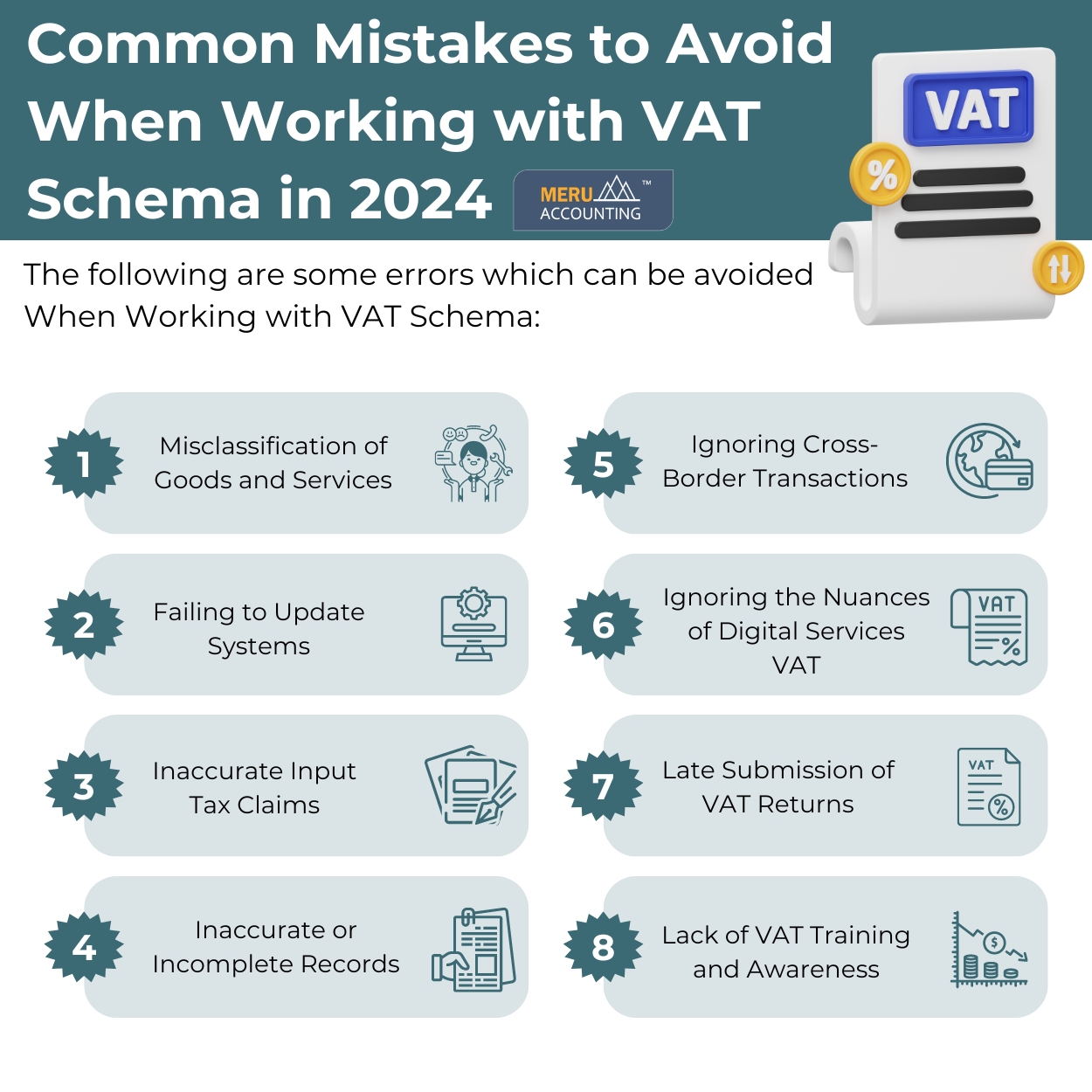

VAT Schema Guidelines 2024 to avoid common errors

Following are the VAT schema guidelines 2024 to avoid common errors:

Misclassification of Goods and Services:

One of the most frequent errors is classifying goods and services incorrectly in order to avoid paying VAT. To guarantee reliable reporting, it is crucial to comprehend the appropriate VAT rates and classifications for any good or service.

Failing to Update Systems:

Organizations should update their systems in accordance with changing VAT legislation and schema requirements. Inaccuracies in VAT reporting and compliance may arise from systems that are not kept current with the most recent recommendations.

Inaccurate Input Tax Claims:

When claiming input tax credits, businesses frequently make mistakes that result in either an over or under-claim. In order to optimize tax recovery and guarantee compliance with VAT legislation, input tax must be precisely recorded and documented.

Inaccurate or Incomplete Records:

It is critical to keep accurate and comprehensive records for VAT compliance. Failure to keep detailed records of transactions, invoices, and VAT returns can result in errors and compliance issues.

Ignoring Cross-Border Transactions:

Companies that do cross-border business must abide by certain VAT regulations. Disregarding these regulations may result in penalties, VAT obligations, and problems with compliance.

Ignoring the Nuances of Digital Services VAT:

As digital services proliferate, companies need to be aware of the nuances of the VAT laws that apply to digital goods and services. Penalties and compliance problems may arise from non-compliance with the VAT regulations pertaining to digital services.

Late Submission of VAT Returns:

In order to prevent fines and compliance problems, VAT returns must be submitted on time. Businesses need to make sure that returns are submitted accurately and on time, as well as meet the dates for reporting VAT.

Lack of VAT Training and Awareness:

Lastly, companies frequently make mistakes as a result of staff members’ lack of VAT training and awareness. Making Investments in VAT training programs and ensuring staff are aware of VAT regulations and guidelines can help prevent errors and improve compliance.

Conclusion

Companies must avoid common blunders when utilizing the VAT schema in 2024 in order to maintain compliance and reduce the possibility of fines. Follow the above-mentioned VAT Schema Guidelines 2024 to avoid common errors. Meru Accounting can assist companies with managing the difficulties of VAT legislation and schema requirements. We also provide VAT consultancy services. Businesses can achieve compliance with confidence, optimize their VAT operations, and prevent errors by utilizing our counsel and expertise. To find out how Meru Accounting can assist your company with VAT compliance, get in touch with us now.

FAQs

- What is a VAT schema, and why do I need it?

A VAT schema is a set of plans for sending VAT data to ta authorities. It helps firms report VAT right, cut errors, and stay within the law. - How do I stop misclassifying goods or services?

Check VAT rates for each product or service. Use current guides and train staff to mark codes correctly to avoid mistakes. - Why should I update my systems for VAT?

VAT rules can change. Update your software and books to keep reports and filings correct and to cut mistakes. - What errors happen with input tax claims?

Firms may claim too much or too little tax. Track VAT paid on buys and keep clear records to fix this. - How do I keep VAT records correct?

Save invoices, receipts, and logs. Track VAT paid and VAT collected in one place to keep records full and clear. - Are cross-border sales treated the same for VAT?

No. Sales to other lands need different VAT rules. Learn the rules to stay clear of fines and file VAT right. - What are the VAT rules for digital sales?

Digital products and services follow different VAT rules based on where the customer lives. Track sales and add the right VAT to avoid fines.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 203 868 2860

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2026 Meru Accounting. All Rights Reserved.

Privacy Policy

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds