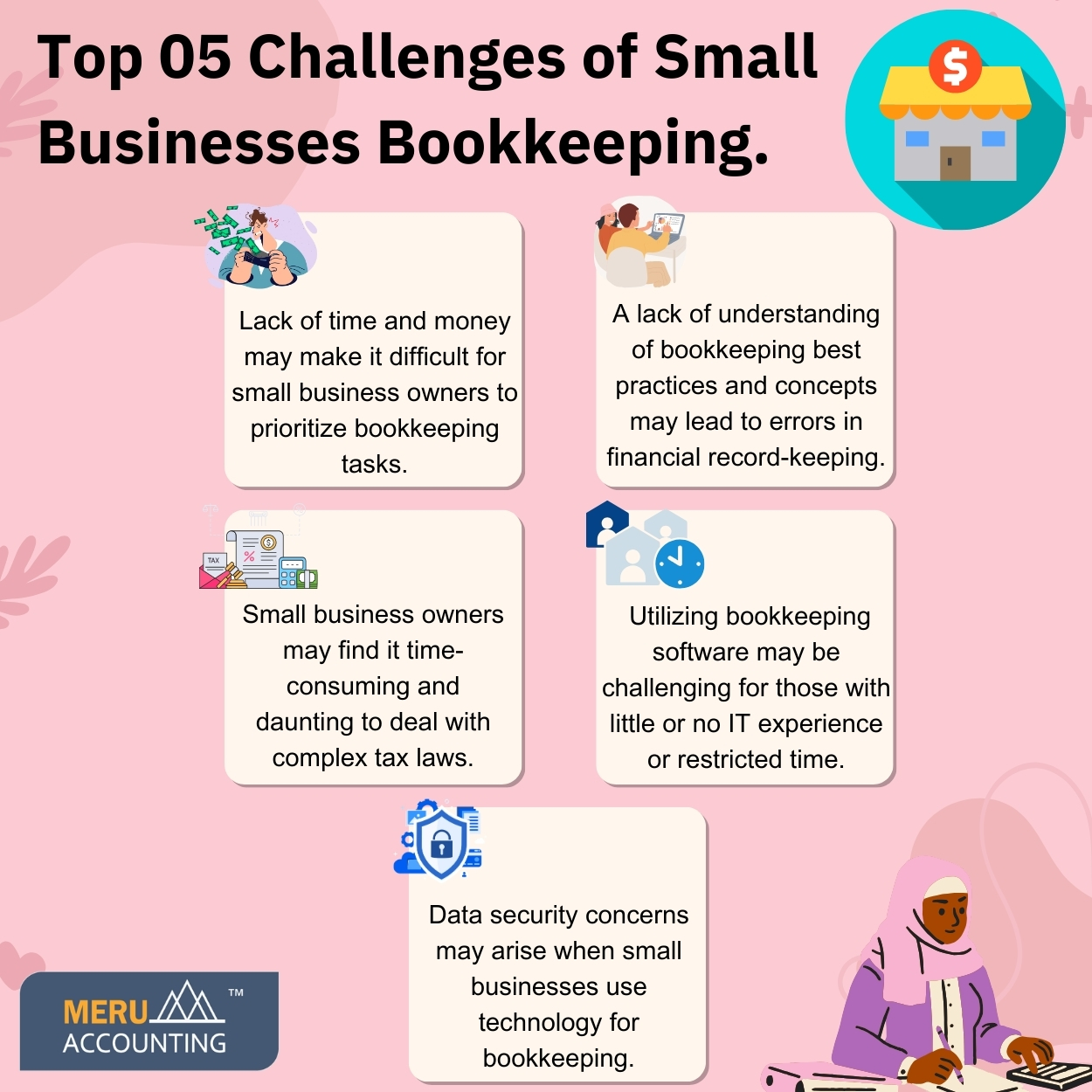

Top 05 Challenges of Small Businesses Bookkeeping

Small businesses face a variety of challenges, and bookkeeping is no exception. Keeping track of financial transactions and ensuring accurate record-keeping can be a daunting task for Small Business Bookkeeping owners, especially those with limited resources and time, increases Problems Faced By Small Businesses.

Here Are The Top Five Problems Faced By Small Businesses In Maintaining Books:

1. Limited Time and Resources:

Small Business Bookkeeping owners often have to wear multiple hats and juggle various responsibilities. As a result, bookkeeping can often take a backseat to more pressing tasks. This can lead to financial records being neglected or not kept up-to-date, which can create problems in the long run.

2. Lack of Expertise:

Bookkeeping For Small Business requires a certain level of knowledge and expertise, which many Small Business Bookkeeping owners may not have. Without a proper understanding of bookkeeping principles and best practices, small business owners may struggle to accurately record and report their financial transactions.

3. Complexity of Tax Regulations:

Small Business Bookkeeping owners must navigate a complex web of tax laws and regulations, which can be overwhelming and time-consuming. This can lead to mistakes and costly penalties if not done correctly.

4. Difficulties with Software:

Small business owners may find it difficult to choose the right bookkeeping software for their business, especially if they are not familiar with the various options available. Additionally, using bookkeeping software can be challenging for those who are not tech-savvy or who do not have the time to learn new software.

5. Security Concerns:

With the increasing reliance on technology for bookkeeping, small business owners must also be mindful of data security. Hackers and online threats can pose a risk to financial data, and small business owners may not have the resources to invest in robust security measures.

Despite these challenges, Small Business Bookkeeping is essential for the success and growth of a business. Accurate financial records provide valuable insights and help small business owners make informed decisions about their business.

To overcome these challenges, small business owners can consider hiring a virtual bookkeeper or using bookkeeping software. A virtual bookkeeper can handle all of the bookkeeping tasks for a small business, freeing up time for the owner to focus on other areas of the business. Bookkeeping software can also streamline the process and make it easier for small business owners to track their financial transactions. Another option is to outsource bookkeeping to a professional accounting firm. This can be a more expensive option, but it can also provide peace of mind knowing that the financial records are being handled by professionals.

Overall, Bookkeeping For Small Business presents its own unique set of challenges. By being aware of these challenges and seeking out solutions, small business owners can overcome them and ensure the success of their business.

Small and medium-sized businesses in the US, UK, Australia, New Zealand, Hong Kong, Canada, and Europe can turn to Meru Accounting, a CPA firm, for complete outsourced bookkeeping and accounting solutions.

FAQs

- Why are books hard for small firm owners?

Small firm heads often lack the time or skill to run books. They focus on sales and daily tasks, so logs fall behind. This can cause late posts and slips.

- What happens if I don’t keep my books up to date?

If you fail to update records, you may lose track of cash flow, miss tax deadlines, or make wrong plans. Inaccurate books can even harm your growth or cause fines.

- How do tax rules add stress to bookkeeping?

Tax laws change fast and are hard to track. Owners with less skill may file incorrect reports. This can bring fines or add costs.

- Can software fix bookkeeping issues for small firms?

Yes. Apps can send bills, track spend, and sync bank feeds. But some may find it set up if they are not used to tech.

- Is it safe to keep money records online?

Yes, if you use safe apps with data backup. Most tools add locks and two-step checks. Still, owners must stay alert to scams.

- Should I hire a bookkeeper or manage it myself?

If books take too much time, it is wise to hire help. A virtual or outsourced bookkeeper can manage tasks while you focus on growth.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 203 868 2860

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2026 Meru Accounting. All Rights Reserved.

Privacy Policy

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds