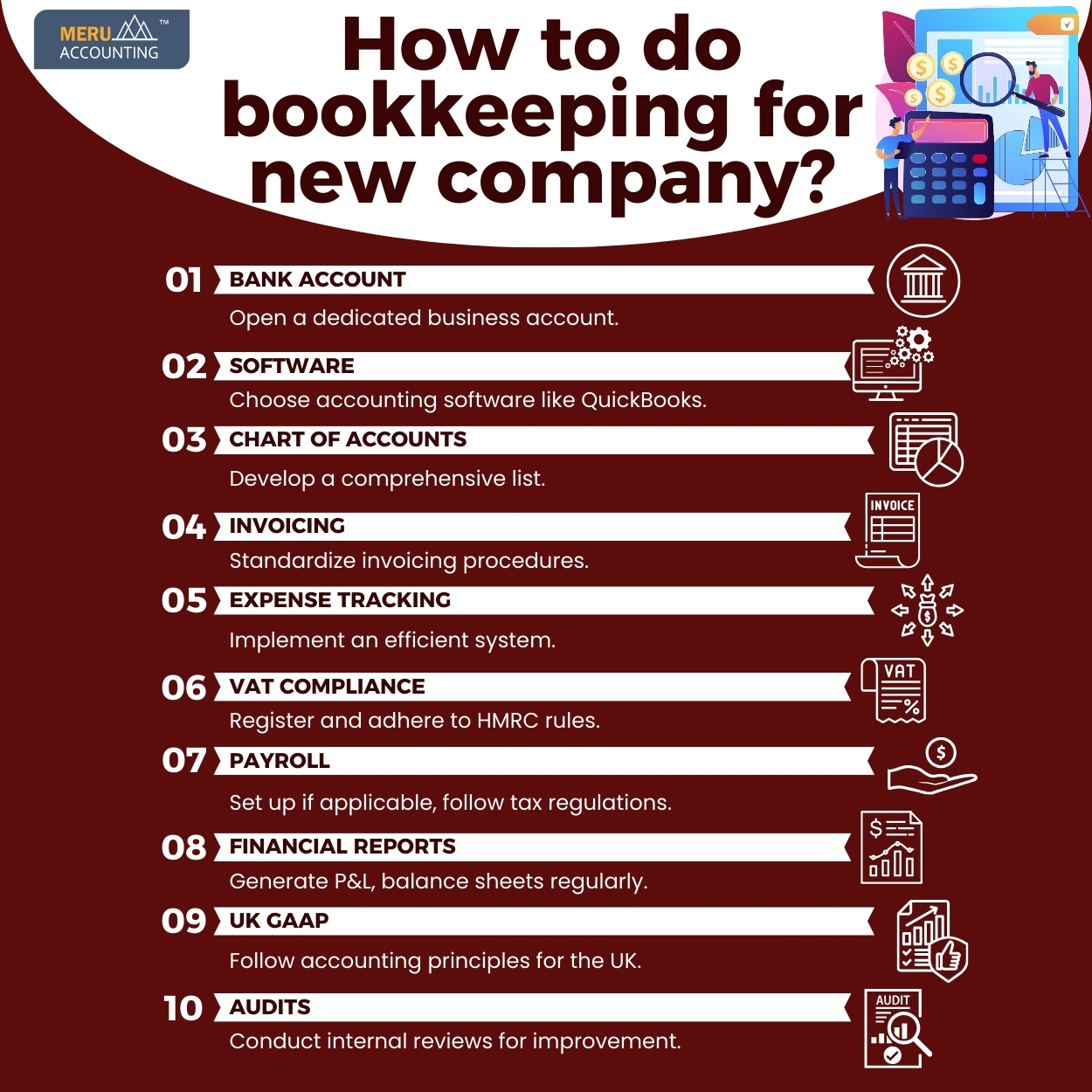

How to do bookkeeping for a new company?

Starting a new company in the UK comes with the responsibility of establishing efficient bookkeeping practices. Proper company bookkeeping is essential for financial transparency, compliance with regulations, and informed decision-making. Here is a step-by-step guide to help you set up company bookkeeping for your new venture.

Establish a Business Bank Account

Begin by initiating the process of opening a specialized business bank account. This separation between personal and business finances is crucial for accurate record-keeping and ensures compliance with regulatory requirements.

Choose an Bookkeeping company System

Selecting the right accounting system is pivotal. Many businesses use accounting software such as QuickBooks, Xero, or Sage. These platforms streamline financial processes, including invoicing, expense tracking, and generating financial reports.

Chart of Accounts

Develop a chart of accounts tailored to your business structure. This list categorizes all transactions, making it easier to track and report financial activities. Typical classifications comprise of resources, debt, stock, earnings, and outlays.

Invoice and Expense Management

Create a standardized invoicing system for clients, including payment terms and details. Consistent invoicing helps in maintaining cash flow. Simultaneously, implement a robust expense management system to track all business expenditures, ensuring accurate financial records.

Track Income and Expenses Regularly

Consistent tracking of income and expenses is crucial for real-time financial awareness. Regular updates prevent errors and facilitate timely decision-making. Schedule regular reviews to ensure all transactions are accurately recorded.

VAT Registration and Compliance

If your business reaches the VAT (Value Added Tax) threshold, you must register for VAT. Ensure compliance with HM Revenue & Customs (HMRC) regulations, and keep accurate records of all VAT-related transactions.

Payroll Setup

If you have employees, it is best if you can put them on payroll. This includes registering with HMRC as an employer, calculating and deducting taxes, and issuing payslips. Accurate payroll management is essential for both legal compliance and employee satisfaction.

Bank Reconciliation

Regularly reconcile your business bank statements with your accounting records. This process ensures that all transactions are accounted for and identifies any discrepancies that need correction.

Financial Reporting

Make financial reports on a regular basis, such as cash flow statements, balance sheets, and profit and loss statements. These reports provide insights into your company’s financial health and aid in making informed business decisions.

Compliance with UK GAAP

Adhere to the Generally Accepted Accounting Principles (GAAP) specific to the UK. Following these standards ensures consistency and transparency in financial reporting, essential for legal compliance and gaining the trust of stakeholders.

Hire a Professional Accountant

Consider hiring a professional accountant to navigate complex tax regulations and ensure compliance. An accountant can also provide valuable financial advice and assist in optimizing your tax strategy.

Regular Audits and Reviews

Conduct regular internal audits to identify any discrepancies or areas for improvement in your bookkeeping processes. External audits may also be necessary for certain businesses, depending on their size and industry.

Jotting it down

Establishing robust bookkeeping practices from the start is crucial for the success of your new company in the UK. By following these steps and staying informed about changes in tax regulations with the help of a bookkeeping company like Meru Accounting, you can maintain accurate financial records, ensure compliance, and position your business for long-term growth.

FAQs

- What is the first step in bookkeeping for a new company?

Begin by opening a bank account for your business. This keeps your money split from your cash and helps track funds well.

- How do I choose the right bookkeeping system?

Pick a tool or app that fits your firm. Tools like Xero, QuickBooks, or Sage can track pay, bills, and sales with ease.

- Why do I need a chart of accounts?

A chart of accounts sorts all money in and out. It shows where cash comes from and goes, so you can plan and report correctly.

- How should I track invoices and expenses?

Send invoices on time and log each bill. Use a simple system to track both client pay and costs. This keeps cash flow smooth.

- Do I need to handle VAT for my new company?

Yes, if your sales pass the VAT limit, you must register and report to HMRC. Track VAT on each sale and buy to stay correct.

- How do I set up payroll for my staff?

Register with HMRC as an employer. Track pay, deduct tax, and give payslips on time to keep staff and the law happy.

- Why is bank reconciliation important?

Match your bank notes with your books each month. This shows all cash moves are logged and finds any errors fast.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 203 868 2860

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2026 Meru Accounting. All Rights Reserved.

Privacy Policy

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds