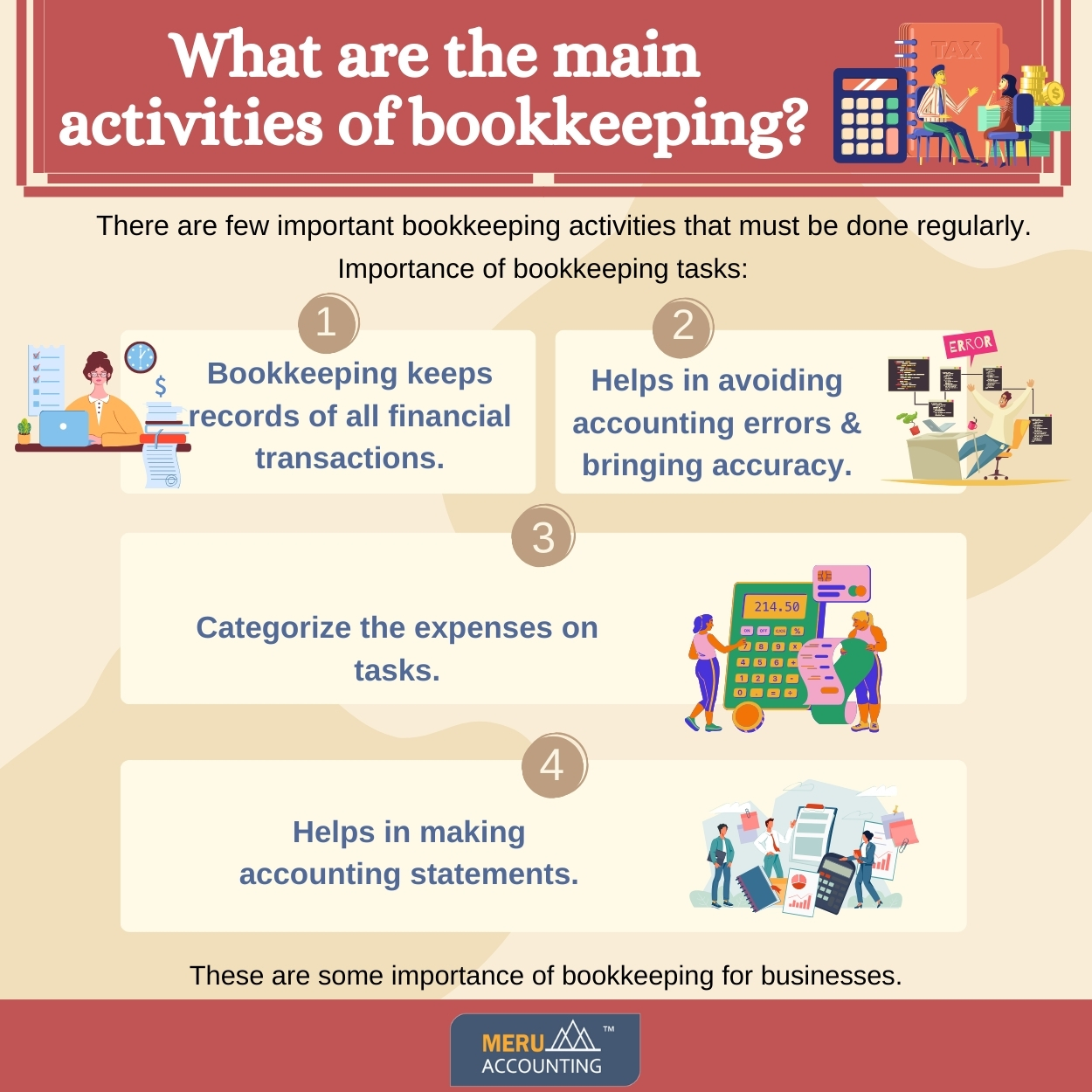

What are the main activities of bookkeeping?

Bookkeeping is one of the fundamental processes in accounting that is essential for every business.

Its primary task is to record financial transactions at the proper places in the accounting books. If you are a UK-based business then need to ensure that bookkeeping and accounting are done as per HMRC guidelines.

A proper following of bookkeeping activities can improve better accuracy in accounting.

Many small businesses in the UK tend to neglect bookkeeping activities and several companies do not even have dedicated bookkeepers.

Now there are some main activities in accounting that have to be done in a proper way.

It is also applicable to small businesses too.

Few bookkeeping tasks have to be done on a daily basis that records all the financial transactions.

What are the main bookkeeping activities that are essential in accounting?

Some bookkeeping tasks are very essential for the business organization in the UK and need to be done regularly.

Here are some of the main activities of bookkeeping:

1. Recording paying bills

Businesses have to deal with different types of bills like rent, utilities, invoices, etc. In order to avoid unnecessary piling of the bills, it is essential to address these bills soon.

2. Follow up on emails

Now, most businesses are following paperless activities for tasks like bank & credit, cheques, card statements, invoices, etc. So, proper tracking of all the emails is essential for the bookkeepers.

3. Reconciliation of transactions

If a bank account is integrated with the accounting software then you do not have to worry about it. You only have to check all the pending transactions in the business properly.

4. Recording up-to-date information

You need to keep a record of all the financial information properly. A regular archiving of the files must be done to ensure that the records are kept properly.

5. Categorization of expenses

Businesses have some expected expenses and few unexpected expenses. Proper categorization of all the expenses depending on different criteria must be done.

6. Sending invoices to customers

Bookkeepers must ensure that all the invoices of the businesses are sent to the customers. This will help to ensure proper payments to the company over a longer duration.

7. Reconcile bank accounts

Reconciling the bank accounts regularly is essential to ensure that there are no errors or frauds. It will bring better accuracy to the accounting system of the business to help achieve its stability.

8. Keep checking on budget

Bookkeepers must keep a proper check on their budget to ensure that the expenses do not exceed as per decided. It will also encourage better decision-making for the management and business owners.

9. Keep data backup

Although you take all care of the data while handling bookkeeping, they still are prone to problems. like stolen, misused, or lost which can cause many problems. So, a regular backup of the financial data must be done.

10. Petty cash management

Petty cash is very essential to keep day to day based bookkeeping tasks smooth. Also, it is essential to keep track of all the expenses. So, you need to manage the petty cash properly.

Conclusion

These are some important bookkeeping activities to be done properly in the bookkeeping. Performing these main activities in accounting as per HMRC rules will help businesses to run better.

Meru Accounting provides outsourced bookkeeping activities for different businesses in the UK. All team members here are well-qualified, having nice experience in bookkeeping.

They use accounting software to do bookkeeping tasks to manage it properly. Meru Accounting is a popular accounting service-providing agency around the world.

FAQs

- Why do firms make a trial balance before the balance sheet?

A trial balance makes sure the debit and credit sides are equal. Firms use it to catch errors in books before they draft the balance sheet. - How often should a trial balance be made?

Most firms make it each month or quarter. This helps them keep ledgers clean and ready for year-end reports. - Who uses a trial balance and who uses a balance sheet?

A trial balance is for in-house staff like bookkeepers and accountants. A balance sheet is for banks, investors, and other outside groups who judge the firm’s health. - Can a company share a trial balance with investors?

No, a trial balance is not for public view. It is just an in-house tool. Investors rely on the balance sheet and other audited reports. - Why is a balance sheet seen as more formal than a trial balance?

A balance sheet must be checked by an auditor. It is part of the firm’s main reports. A trial balance does not need outside sign-off. - How do trial balances and balance sheets link in the accounting cycle?

The trial balance comes first to make sure books are right. Then firms use it to build the balance sheet, which shows the firm’s worth. - What key data does a balance sheet give that a trial balance does not?

A balance sheet shows assets, debts, and equity at a set date. A trial balance only shows if debit and credit totals match. - Why do some firms check trial balances more often than balance sheets?

Because trial balances help spot small errors early. Balance sheets are built less often since they need full review and audit.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 203 868 2860

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2026 Meru Accounting. All Rights Reserved.

Privacy Policy

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds