- Schedule Meeting

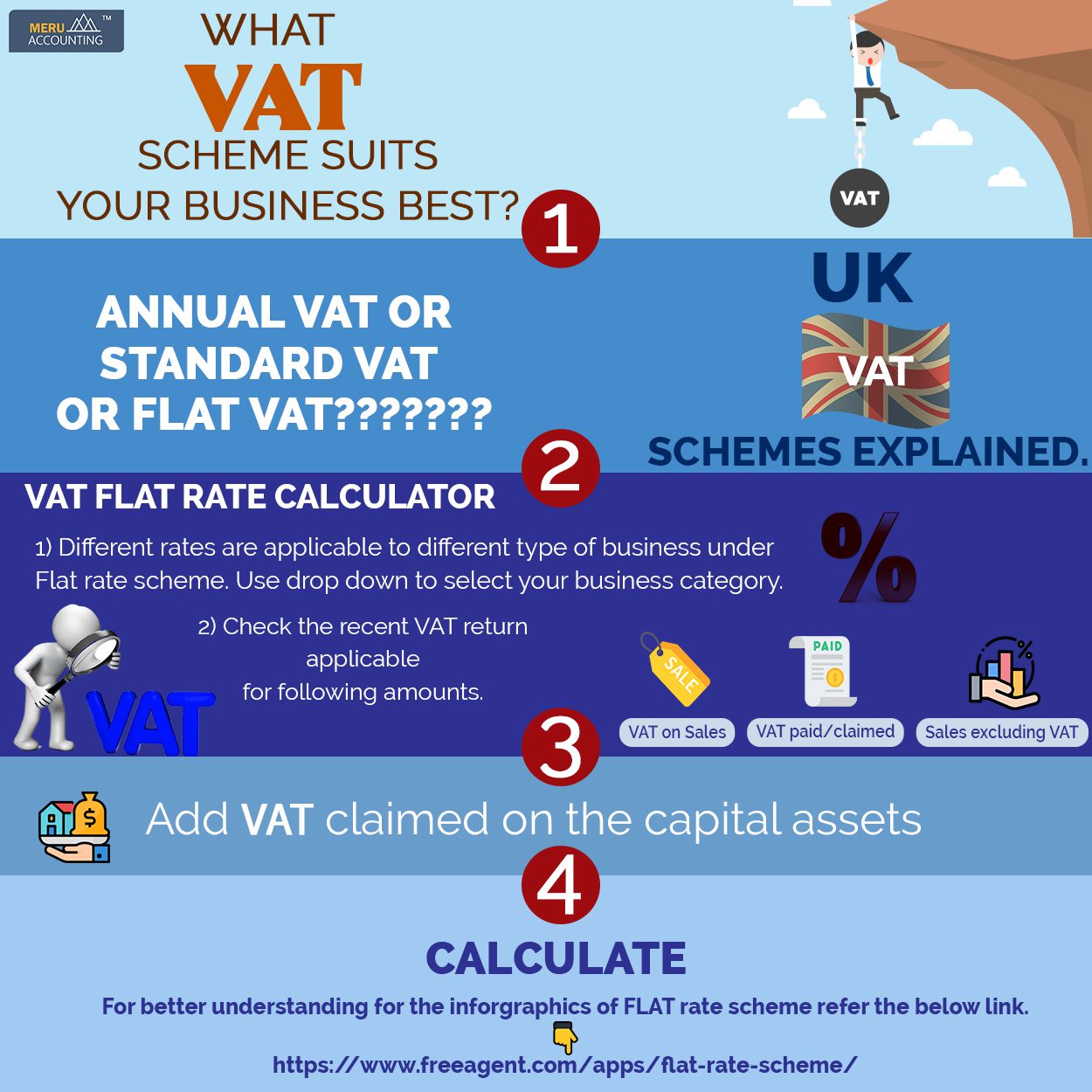

What VAT Scheme suits best for your business?

Value-added tax (VAT) is one of the tedious and complicated tax regimes that every business has to follow.

If your business has taxable turnover exceeding the threshold limit of £ 85,000 or is likely to exceed, VAT registration is compulsory.

You can even opt for VAT registration if your business doesn’t exceed the threshold limit. However, you must look out for the pros and cons before making any decision. Your accountant would be the best person to guide you and provide customized advice suitable for your business.

Still need help reachout to Meru Accounting. We have a dedicated team of tax professionals experienced in UK tax accounting.

Did you know about the various VAT schemes available?

There are various VAT schemes available to report VAT in the UK. This scheme simplifies your VAT return filling. You can choose any one of them that suits your business and for better cash flow. If your business is categorized to a specific sector, registering for a sector-specific VAT scheme may be mandatory. Otherwise, most of the VAT schemes in the UK apply to general business.

During VAT registration, opting for various scheme impacts when and how to calculate VAT payments to HMRC. So, it becomes very crucial to select the right scheme(s) for your business. It is better to get a proper understanding of the several options before submitting the VAT application.

Here is brief information about the various VAT schemes:

1. Standard VAT scheme : It is the usual standard scheme across the UK. According to this scheme, it is mandatory to fill and submit VAT returns for every quarter in a year. You are liable to pay VAT on that sales also, even though it is unrealized from the customer.

VAT payable to HMRC :

VAT on all invoiced sales – VAT on all invoiced purchases.

Both VAT due and VAT refund are repayable quarterly.

2. Standard VAT Scheme- Cash Basis: This a variation of the Standard VAT scheme – where you can calculate your VAT return on a cash basis. It is not a separate scheme but an alternative method of calculation. You don’t need to apply HMRC for changes, but a consistent approach must be there

To calculate VAT only sales invoice that has been paid in that quarter and paid purchase for that quarter is considered.

3. Flat VAT rate: While you register for VAT, you have registered for standard VAT automatically. This scheme may not be suitable for your business. Flat VAT scheme is a popular choice among small business owners to simplify the VAT filing. It makes preparation and calculation of VAT easy, quick and hassle-free.

Under this scheme, while you charge VAT at a standard rate of 20% from your customer, you only pay a certain percentage of gross sales to HMRC instead of offsetting the VAT paid on purchases.It consumes less time in listing the VAT on expenses and simple calculation.

4. Annual VAT Scheme: The Annual VAT scheme you pay VAT on account of either nine monthly payments or three-quarter payments. You then fill a single annual VAT return that works to figure out any balance due to or refund balance from HMRC.

It simplifies the tons of paperwork for VAT filings. But this scheme is applicable only if your estimated taxable income is no more than £ 85,000.

You have to apply for this scheme when registering for VAT. And also combine it with the Standard Cash basis and Flat VAT rate.

For more queries and Solution:

You can contact and get expert advice from our tax professionals at Meru Accounting, a leading bookkeeping service provider.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 (0) 203 868 2860

- [email protected]

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2025 Meru Accounting. All Rights Reserved.

Privacy Policy

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 73 6051 0348

- Email: [email protected]

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds