What To Do When A Client Doesn’t Pay On Time?

As a business owner, you rely on your clients to pay on time in order to maintain a positive cash flow and keep your business running smoothly. Unfortunately, there may be times when a client does not pay on time, leaving you in a difficult situation.

In this article, we will explore what to do when a client’s payment is late, including steps you can take to collect the outstanding balance and avoid similar situations to Prevent Late Payments in the future.

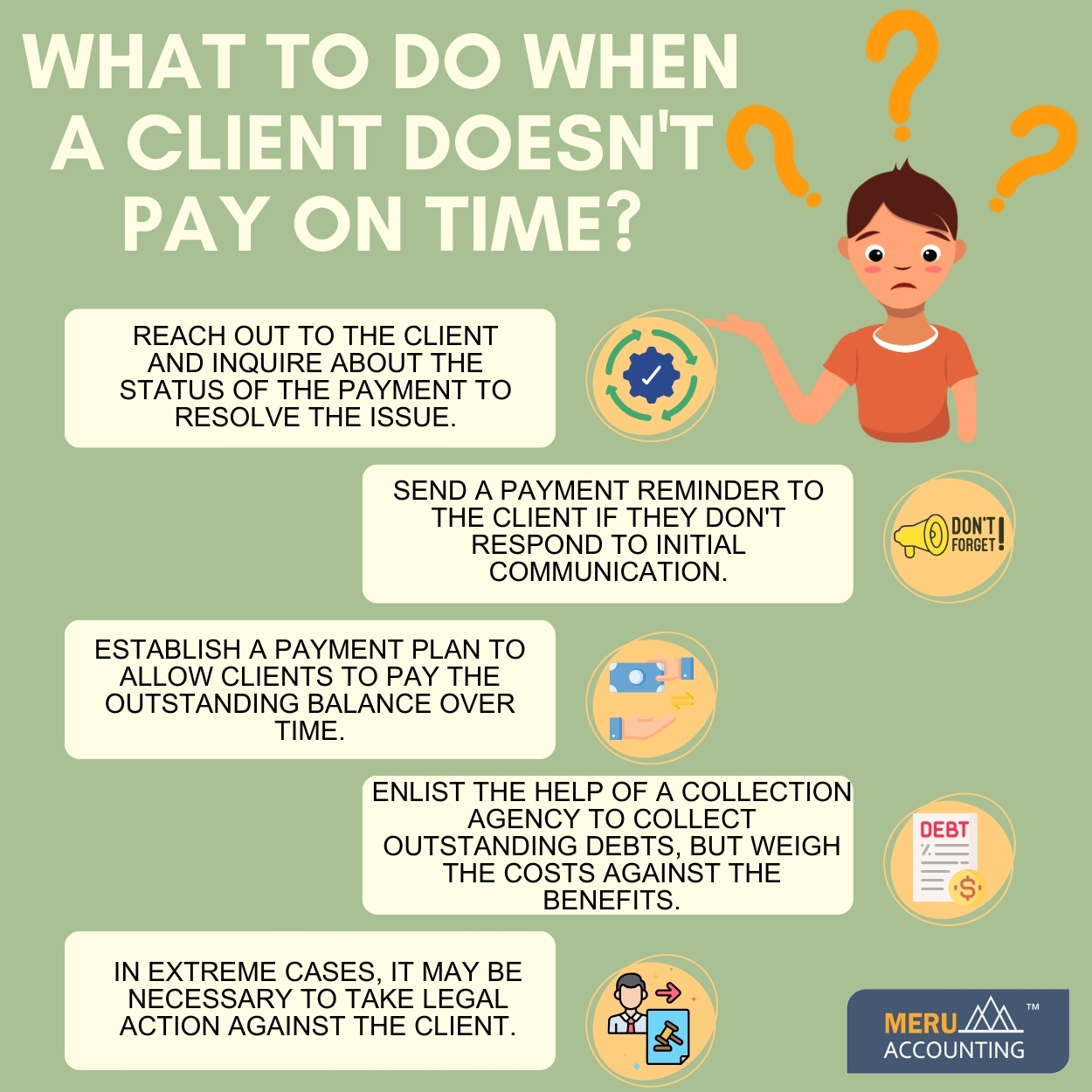

When A Client Doesn’t Pay On Time, the following should be followed:-

-

Communicate with the Client:-

The first step in dealing with a client who doesn’t pay on time is to communicate with them that why their payment is late. Reach out to the client and inquire about the status of the payment. It is possible that the Late-Paying Clients simply forgot or that there was a misunderstanding about the payment terms. If this is the case, a friendly reminder may be all that is needed to resolve the late payments issue.

-

Send a Payment Reminder:-

If the client does not respond to your initial communication for the late payments, send a payment reminder. This can be done via email or letter and should include a clear and concise message outlining the outstanding balance and the deadline for late payments. Be sure to maintain a professional tone in your communication, even if you are frustrated with the situation of to Prevent Late Payments.

-

Offer a Payment Plan:-

If the client is experiencing financial difficulties, it may be helpful to offer a payment plan. This will allow the client to pay the outstanding balance over a period of time, rather than in a lump sum. Be sure to establish clear payment terms and include them in a written agreement.

-

Enlist the Help of a Collection Agency:-

If the client still does not pay, it may be necessary to enlist the help of a collection agency. These agencies specialize in collecting outstanding debts from Late-Paying Clients and can be a valuable resource in getting the payment you are owed. Keep in mind that using a collection agency can be costly, so be sure to weigh the costs against the potential benefits before taking this step.

-

Take Legal Action:-

In extreme cases, it may be necessary to take legal action against the client. This can be a complex and expensive process, but it may be the only option for recovering the outstanding balance from Late-Paying Clients. Be sure to consult with a lawyer before taking this step to ensure that you are following the appropriate legal procedures.

How to Avoid Similar Situations in the Future:

While it can be difficult to deal with a client whose payment is late, there are steps you can take to avoid Prevent Late Payments situations in the future. Here are a few tips:

-

Establish Clear Payment Terms:-

Be sure to establish clear payment terms with your clients from the beginning. This should include the payment amount, due date, and any late payment fees or penalties.

-

Invoice Promptly:-

Invoice your clients promptly to avoid any confusion or misunderstandings about payment terms.

-

Follow Up on Late Payments:-

Follow up promptly on any late payments to ensure that the issue is resolved quickly.

-

Screen Clients Carefully:-

Screen clients carefully before doing business with them to minimize the risk of non-payment.

Meru Accounting is a CPA firm that provides guidance in developing desired policies for various large and small business enterprises, assists clients in understanding how sales taxes differ across countries, and provides additional accounting services such as accounts payable and accounts receivable aging facilities, as well as creative ideas for business growth.