What is CPA in bookkeeping?

As a business owner, you know the importance of bookkeeping to keep the finances of your organization smooth. A Certified Public Accountant [CPA] is very important that can maintain your bookkeeping with proper standards.

CPA is an accounting professional who gets licensed to work on accounting for the businesses. Getting CPA bookkeeping is crucial, as they have relevant education, experience, and examination requirements set by the relevant professional bodies in their jurisdiction.

They provide different types of accounting-related services. Businesses in the UK must choose proper CPA bookkeeping services, to ensure that they comply properly with the HMRC guidelines.

It is very important for UK-based businesses to deal with tax and accounting regulations as per HMRC regulations. The general accountants bookkeepers may not be able to work on the accounting properly. We will check out more about the bookkeeping with CPA.

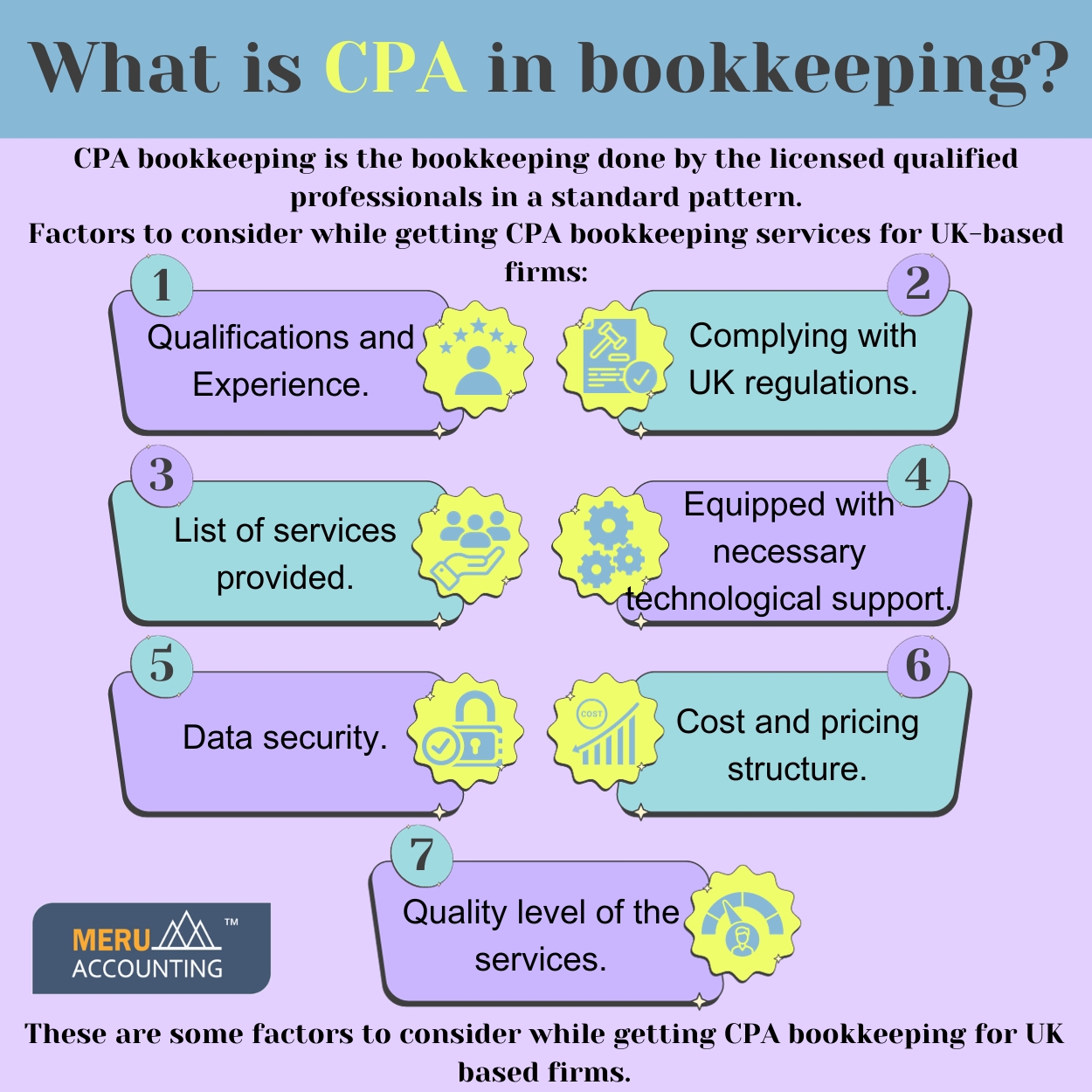

What factors to consider while choosing CPA bookkeeping services for your business in the UK?

If you need quality bookkeeping for your business then it is important to consider some factors.

Here are some important factors to consider when you are looking for CPA bookkeeping in UK:

1. Qualifications and Experience

Ensure that the CPA (Certified Public Accountant) you are considering has the appropriate qualifications and experience in providing bookkeeping services for UK firms. Look for certifications such as ACCA (Association of Chartered Certified Accountants) or ACA (Association of Chartered Accountants) and check their track record with similar clients.

2. Compliance with UK Regulations

Bookkeeping services for UK firms must adhere to specific accounting standards and regulations. Confirm that the CPA or accounting firm is knowledgeable about UK GAAP (Generally Accepted Accounting Principles) or IFRS (International Financial Reporting Standards), as applicable to your business.

3. List of Services

Assess the scope of bookkeeping services offered by the CPA or accounting firm. Determine if they can handle tasks such as transaction recording, bank reconciliation, payroll processing, VAT returns, financial statement preparation, and tax compliance.

4. Technology and Software

Inquire about the bookkeeping software and technology the CPA or accounting firm utilizes. Ensure that they use modern, efficient systems that are compatible with your business’s needs. Cloud-based solutions can offer convenience and accessibility.

5. Data Security

Data security is crucial when outsourcing bookkeeping services. Verify that the CPA or accounting firm has robust security measures in place to protect your financial information.

6. Cost and Pricing Structure

Evaluate the pricing structure of the CPA or accounting firm’s bookkeeping services. Compare their fees with other providers in the market while considering the quality of service offered. Make sure there are no hidden costs and that the pricing aligns with your budget.

7. Quality of service

Request references from existing or past clients of the CPA or accounting firm. Hearing about their experiences can provide insights into the quality of service, and reliability you can expect.

It can be difficult for any general accountants bookkeepers to provide such a level of quality services. So, bookkeeping from CPA is important for your business.

If you are looking for CPA for your bookkeeping task then Meru Accounting is a nice choice. Meru Accounting is an expert in providing these services for UK-based businesses. They have experience working for different niches of businesses in the UK. Meru Accounting is a well-known accounting services providing agency across the globe.

FAQs

- What makes a CPA different from a normal bookkeeper?

A CPA has a license and deep skills in tax and rules. A normal bookkeeper may track sales and buys, but a CPA can guide with law, reports, and tax needs. - Why should UK firms use CPA bookkeeping?

UK firms face strict HMRC rules. A CPA knows GAAP, IFRS, and VAT needs. This makes sure books are fair and tax is done with no fines. - How do I check if a CPA is fit for my firm?

You should check their certificates, like ACCA or ACA. Ask for past work with firms like yours. Look at their skills in payroll, VAT, and reports. - Can a CPA help with VAT and tax work, too?

Yes. A CPA does more than books. They track VAT, file tax, and prepare full-year accounts. This saves time and cuts stress for owners. - What role does tech play in CPA bookkeeping?

Most CPAs use cloud tools like Xero or QuickBooks. With these, you get real-time data, a safe store of files, and ease of use from any place. - How safe is my data with a CPA firm?

A good CPA firm uses firewalls, locks, and strong passwords. Ask them how they keep your data safe and if they meet UK data laws. - How much do CPA bookkeeping services cost in the UK?

Cost will change by scope, size, and the needs of your firm. Some charge by task, others by month. Always ask for full fees and check for no hidden costs.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 203 868 2860

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2025 Meru Accounting. All Rights Reserved.

Privacy Policy

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 73 6051 0348

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds