- Schedule Meeting

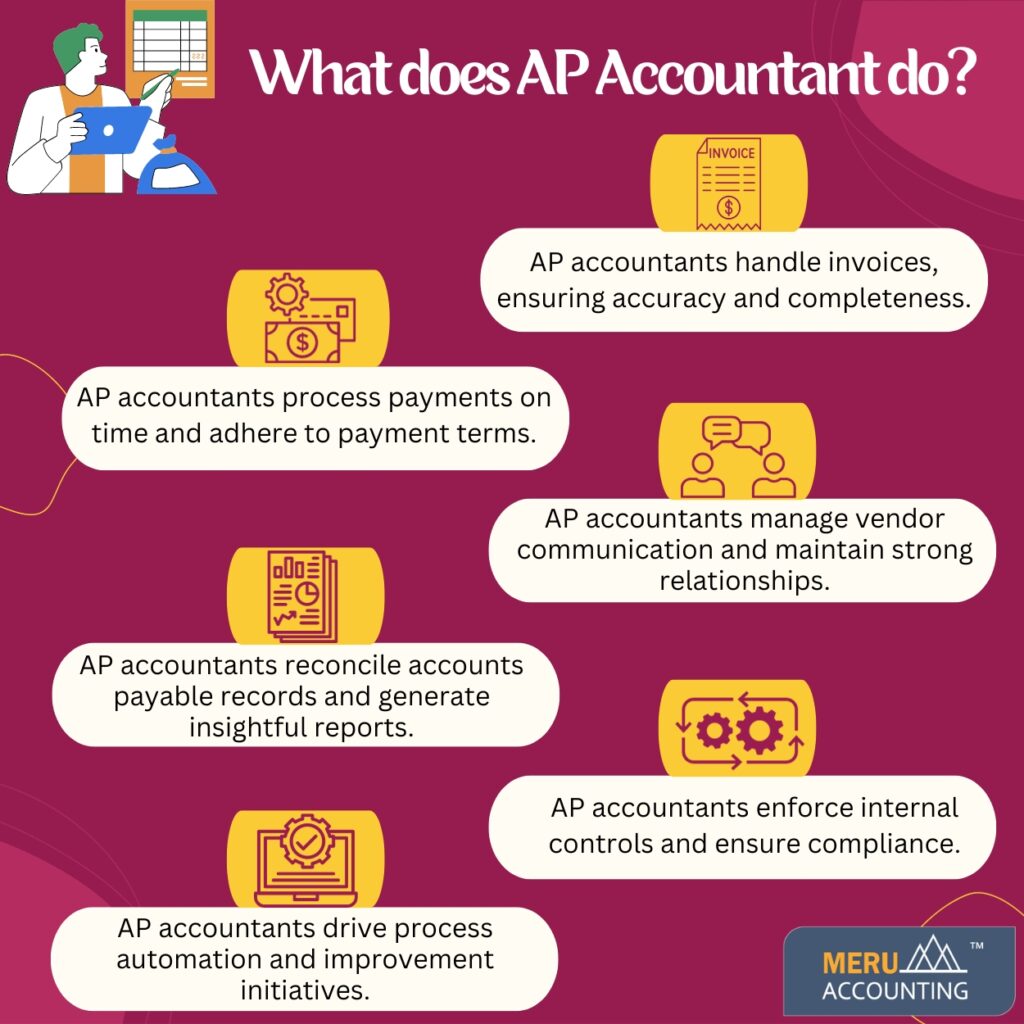

What does AP Accountant do?

In organizations, AP accountants are responsible for managing accounts payable procedures with precision and financial knowledge. They play a crucial role in maintaining solid vendor relationships and ensuring efficient financial transactions and record-keeping.

1. Handling and examining invoices

Processing and confirming invoices is one of an AP accounting service provider’s main duties. They check incoming invoices to make that all pertinent facts, such as vendor information, purchase orders, and payment terms, are precise and comprehensive.

A/P accountants reconcile any discrepancies or inaccuracies by comparing invoices with the related paperwork and purchase agreements. They keep precise financial records and guard against any potential payment complications thanks to their attention to detail.

2. Quickly Processing Payments

Making sure payments are processed on schedule is the responsibility of AP accountants. They check the terms of payment, plan payments in accordance with predetermined deadlines, and guarantee adherence to internal rules and regulations.

To guarantee that payments are completed quickly and in compliance with contractual requirements, AP accountants collaborate closely with other departments including procurement and finance.

AP accountants help to maintain good vendor connections and prevent late payment fees by efficiently managing the payment process.

3. Communication and Vendor Management

For an organization to run smoothly, maintaining solid connections with vendors is important. A point of contact for questions from vendors, the AP accounting service provider handles correspondence about invoices, payments, and any other financial issues.

To promote strong connections, they respond to vendor complaints, settle payment disputes, and keep lines of communication open. Better terms, discounts, and strengthened supplier relationships are all benefits of efficient vendor management.

4. Reporting and Reconciliation

In order to reconcile accounts payable records with vendor statements and internal financial statements, AP accountants are essential.

By keeping an accurate and up-to-date accounts payable ledger, they make sure that all payments and transactions are appropriately recorded.

Accountants for payables (AP) also regularly produce reports on cash flow forecasts, outstanding balances, and accounts payable ageing. These reports offer insightful information that is useful for financial analysis and decision-making.

5. Internal and Outer Controls

An important part of managing accounts payable is adhering to internal and financial regulations. All payments and transactions must follow corporate regulations, regulatory requirements, and accounting standards, which are ensured by AP accountant.

To prevent fraud, mistakes, and unauthorized payments, they implement and oversee internal control measures. Accountants for purchasing provide a contribution to the organization’s overall financial integrity by upholding tight compliance.

6. Process Automation and Improvement

As technology develops, process automation and optimisation initiatives engage AP accountants more and more.

They explore opportunities to automate payment approvals, install electronic invoicing systems, and use data analytics technologies to streamline accounts payable procedures.

AP accountants increase productivity, decrease manual errors, and free up time for more critical financial activities by embracing technology and streamlining processes.

Conclusion

AP accountants from Meru Accounting play a vital role in ensuring the efficient operation of accounts payable procedures, including invoice processing, payment processing, vendor management, reconciliation, compliance, and process development.

Their expertise contributes to successful vendor relationships, effective financial administration, and overall organizational performance.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 (0) 203 868 2860

- [email protected]

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2025 Meru Accounting. All Rights Reserved.

Privacy Policy

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 73 6051 0348

- Email: [email protected]

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds