- Schedule Meeting

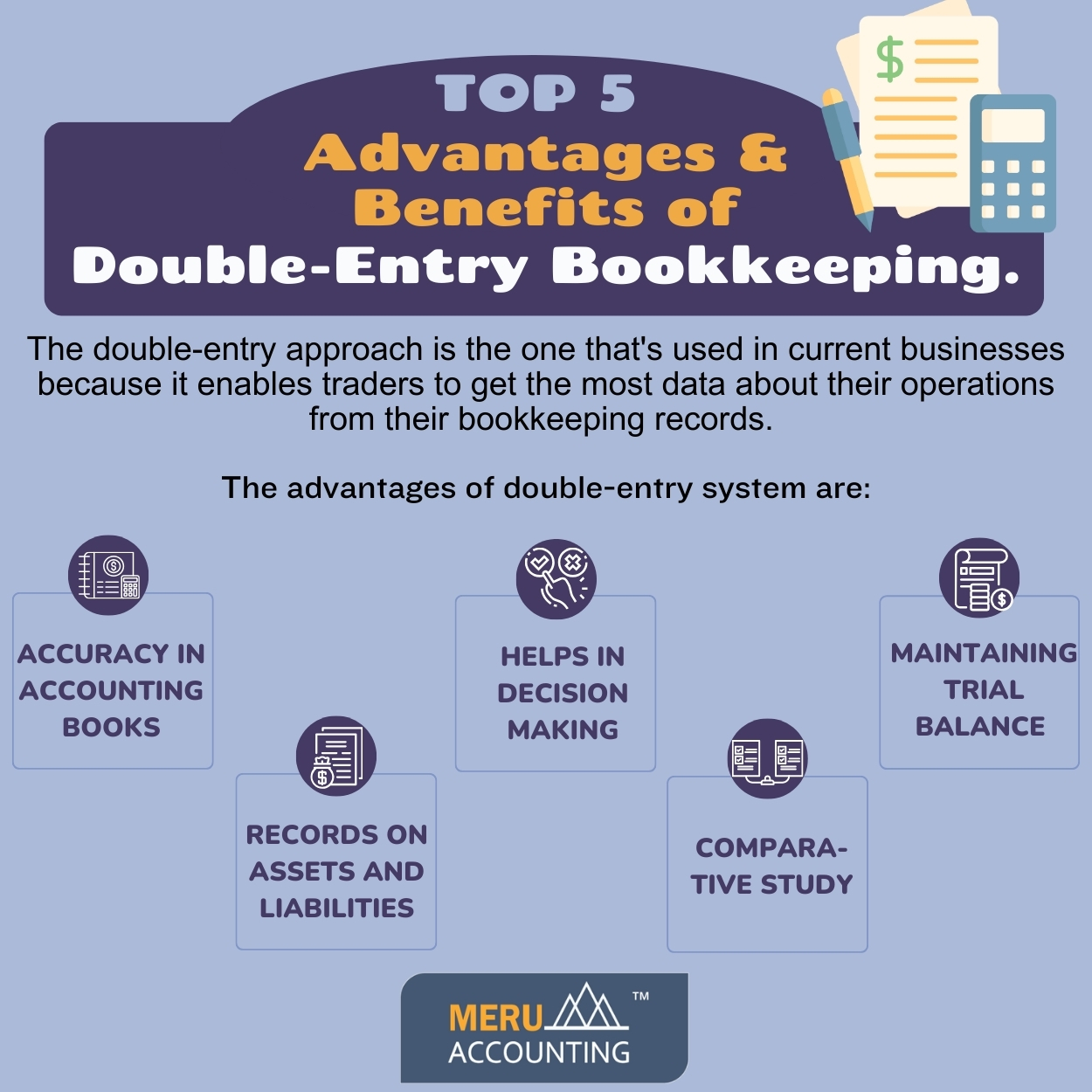

Top 5 Advantages & Benefits of Double-Entry Bookkeeping

The double-entry approach is regarded as the most reliable way to record transactions in financial accounting. Contrary to single-entry accounting, double-entry accounting is based on a set of rules that demand that two entries be made for every documented transaction.

Even if a counter account may occasionally be used, the basic idea is that for every debit, there is a credit, and vice versa. This careful style of bookkeeping allows you to keep accurate, comprehensive records of all financial operations within the organization, as opposed to single-entry bookkeeping.

Benefits of Double-Entry Bookkeeping.

Hence, in this blog, we are going to learn about Double-Entry System Advantages.

The following are some major Advantages of Double-Entry System:

1. Accuracy of Accounting Records

One of the Double-Entry System Advantages is having accurate records as it crucial for business success. Using double-entry accounting allows you to obtain data for financial statements or reports swiftly.

Every important detail is covered, making any misconduct clear. Due to the extensive asset records provided by double-entry accounting, it is easy to determine who owes the company money and who has to be paid off.

2. Keep track of your assets and liabilities

Double-entry bookkeeping, in contrast to other approaches, permits entries to include both an organization’s assets and liabilities.

Single-entry accounting allows you to track every transaction as an expense or revenue, while double-entry bookkeeping offers you access to assets, liabilities, and taxes—the components of a balance sheet.

A balance sheet, which accounts for both an organization’s assets and liabilities, is an essential component of record-keeping

3. Establishing A Trial Balance

One of the Advantages of Double-Entry System is the simplicity of generating a balance sheet and an income statement, which when combined yield a trial balance of all your ledger accounts based on your financial requirements.

An income statement can be used to assess your company’s development and impact, as well as financial costs and earnings. Sales and purchases are recorded as entries in the ledger, allowing top management to quickly track which areas require more funding and where expenses may be efficient.

4. Making Crucial Decisions is Easy

One of the Double-Entry System Advantages is that it helps to make important decisions it provides important financial information. So, that business owners, creditors, or even management can consider it when making choices.

The main advantage of double-entry bookkeeping is having a methodical way to track each component of a financial transaction in chronological order. It also takes the entry adjustment into account in order to have accurate data at the conclusion of the fiscal year.

5. Comparative research

The sending and receiving book balances run parallel and remain unbroken. It is said that the donating account has been credited and the receiving account has been debited.

The annual balance sheet and profit and loss statement are quickly completed by adding up the fundamental difference between the two. The outcomes of recent years can be contrasted with those of earlier years. Future planning is supported by it.

Meru accounting can be consulted for more concepts relating to bookkeeping as it is one of the best sites for finance related queries.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 (0) 203 868 2860

- [email protected]

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2025 Meru Accounting. All Rights Reserved.

Privacy Policy

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 73 6051 0348

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds