What is the role of a corporate tax accountant?

If you are running a business in the UK then a proper tax compliance is utmost important for you. Here, it is important to keep corporate accounting in standard format as per the HMRC regulations. For fulfilling the tax requirements any general accountant may not give the quality service. Here, you need an expert corporate tax accountant who can handle the corporate taxes efficiently. Their responsibilities extend beyond basic bookkeeping and financial reporting. They must focus specifically on navigating the complex corporate accounting.

In the UK, where tax regulations are intricate and subject to frequent changes, corporate tax accountants are indispensable assets. They aim to optimize their tax liabilities while ensuring compliance with the law.

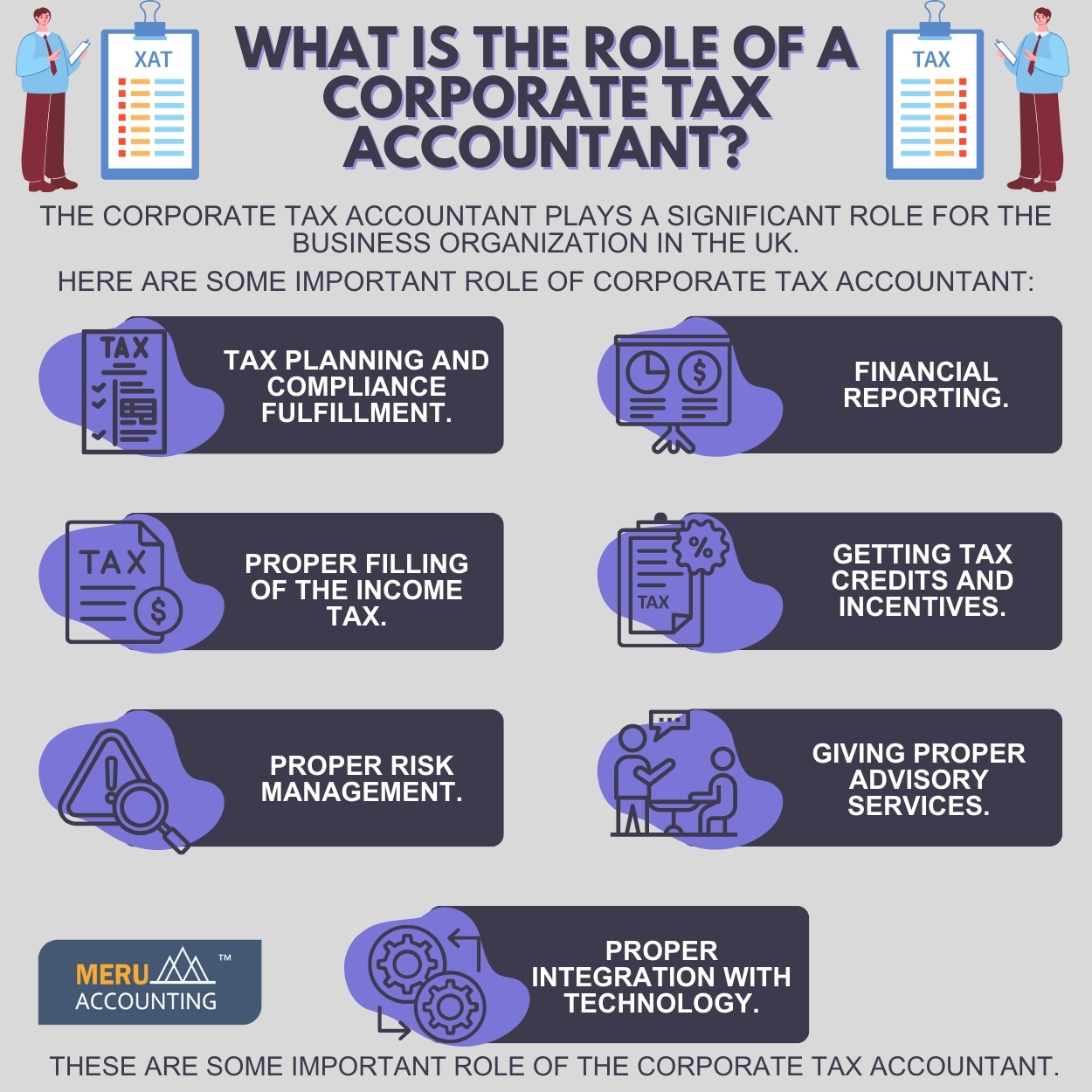

What role does the corporate tax accountant have in the organization?

Here is the list of important role played by the corporate tax accountant in an organization:

Tax Planning and full-fulfilling compliance

They are responsible for developing and implementing effective tax strategies that align with the financial goals of the company. This includes staying abreast of the latest tax laws and regulations to ensure compliance. They work closely with other departments to structure transactions and operations in a tax-efficient manner, minimizing the overall tax burden.

Financial reporting

Accurate financial reporting is a cornerstone of corporate tax accounting. Tax accountants prepare financial statements that comply with both corporate accounting standards and tax regulations. They ensure that financial reports reflect a true and fair view of the company’s financial position, enabling stakeholders to make informed decisions.

Proper income tax filings

Corporate tax accountants are responsible for preparing and filing various tax returns, including Corporation Tax returns, Value Added Tax (VAT) returns, etc. Ensuring timely and accurate submissions is critical to avoiding penalties and maintaining the company’s financial integrity.

Getting better with tax credits and incentives

Identifying and maximizing tax credits and incentives is another key responsibility. Corporate tax accountants explore opportunities for the company to benefit from available tax reliefs, credits, and incentives provided by the government. This proactive approach helps businesses reduce their tax liabilities and improve overall financial performance.

Better risk management

Mitigating tax-related risks is an ongoing task for corporate tax accountants. They conduct thorough risk assessments, identifying potential areas of concern and implementing strategies to minimize exposure to tax-related risks. This includes managing audits and investigations by tax authorities.

Advisory services

They serve as advisors to management on tax-related matters. They provide insights into the tax implications of business decisions, mergers, acquisitions, and restructuring activities. This advisory role is instrumental in guiding strategic decision-making processes.

Integrating with technology

Embracing technological advancements is a key aspect of modern corporate tax accounting. Tax accountants leverage accounting software and digital tools to streamline processes. This enhances accuracy, and improve efficiency in managing tax-related tasks.

These are some main role of the corporate tax accountant in the business organization. These professionals serve as strategic partners, helping companies navigate the complexities of tax laws. As the regulatory environment continues to evolve, the demand for skilled corporate tax accountants in the UK is expected to remain high for the financial well-being of organizations.

If you are looking for expert corporate tax accountant then Meru Accounting is a better choice. Meru Accounting has a significant experience in the corporate accounting in the UK. Their team has good knowledge about the HMRC guidelines in the UK. Meru Accounting is a proficient corporate tax accountant services providing accounting company around the world.

FAQs

- What does a corporate tax accountant do?

A tax guide plans and files taxes for a firm. They make sure the firm pays the right tax on time and follows all rules. - Why is a corporate tax accountant important for a business?

They help the firm save cash, cut tax risks, and stay in line with HMRC rules. Their work keeps the firm safe from fines and errors. - How do corporate tax accountants help with tax planning?

They look at the firm’s books and find ways to cut tax bills. They also give tips on moves that bring tax relief or perks. - Can a tax accountant handle my VAT and corporation tax?

Yes. They plan and file all tax forms, like VAT and corporate tax, on time and right. - Do they advise on business decisions?

Yes. They tell the team how taxes may affect buyouts, mergers, or shifts in the firm. Their tips help leaders act smart. - How do they use tech to improve their work?

They use tools and software to track books, count tax, and file reports. Tech helps them work fast and cut mistakes.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 203 868 2860

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2025 Meru Accounting. All Rights Reserved.

Privacy Policy

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 73 6051 0348

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds