- Schedule Meeting

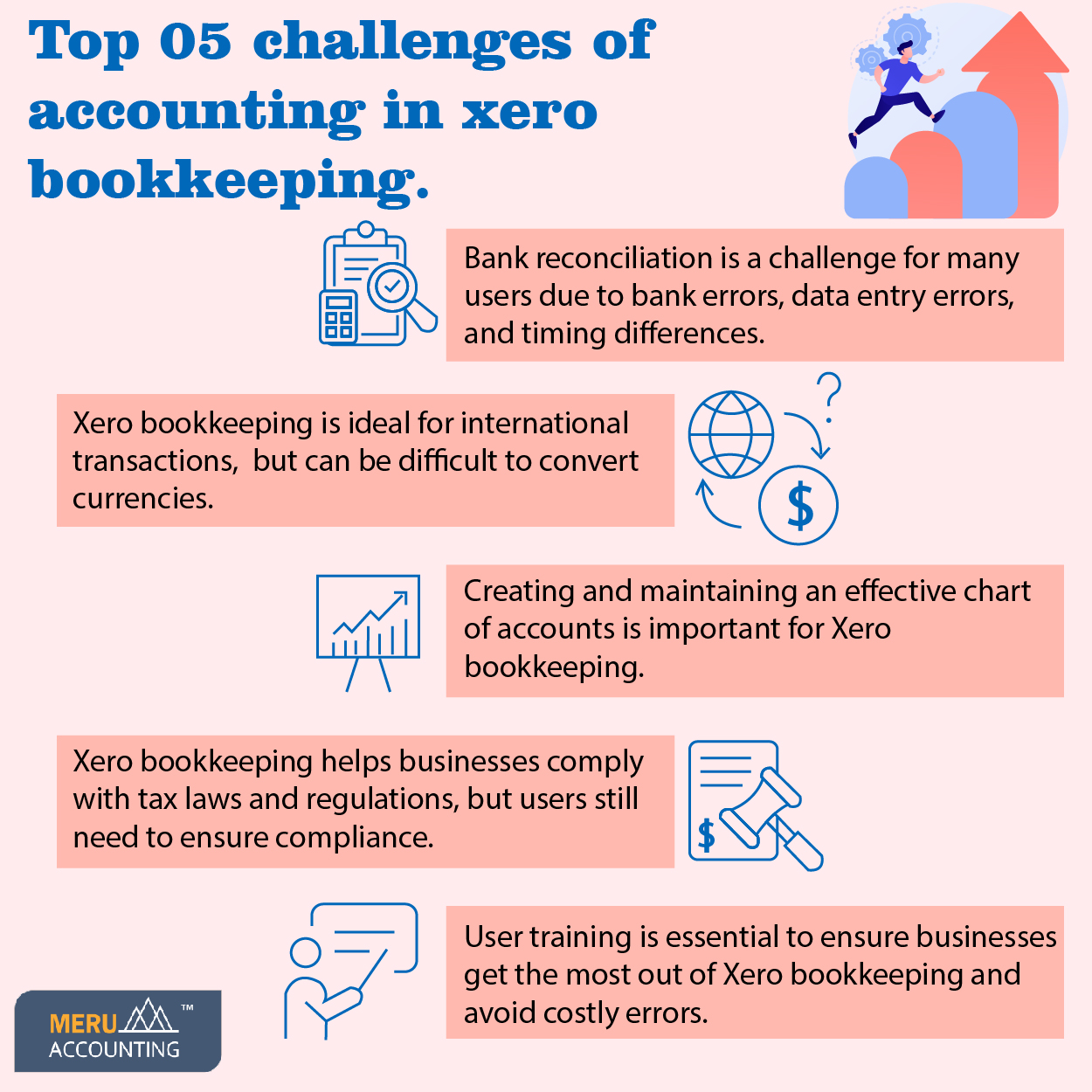

Top 05 challenges of accounting in Xero bookkeeping.

Xero bookkeeping is a popular accounting software that offers numerous benefits to businesses, including efficient record-keeping, real-time tracking of financial information, and simplified tax compliance.

However, like any other accounting software, Xero accounting services also present certain challenges to users. The challenges in xero bookkeeping include issues with bank feeds, reconciliations, inventory management, reporting, and integrations.

Understanding and addressing these challenges is crucial for accountants to effectively use Xero accounting services and ensure accurate financial records for their clients.

Xero Expert India can help businesses set up and use Xero, provide training, and offer ongoing support to ensure that businesses get the most out of the software.

Now let’s discuss the top 5 challenges in Xero bookkeeping:-

Bank Reconciliation:

One of the primary challenges of accounting in Xero bookkeeping is bank reconciliation. Bank reconciliation involves matching the transactions in a company’s bank account with the transactions in its accounting software.

Outsource Xero accounting services automates this process to a large extent, but it is still a challenge for many users. This is because discrepancies between the bank account and the accounting software can occur due to various reasons such as bank errors, data entry errors, and timing differences.

Multi-Currency Transactions:

Another challenge of accounting in Outsource Xero Accounting Services is handling multi-currency transactions. Xero bookkeeping supports over 160 currencies, making it an ideal software for businesses with international transactions.

However, it can be a challenge for users to accurately convert currencies and track exchange rate fluctuations, especially if they have limited knowledge of foreign exchange markets.

Chart of Accounts:

The chart of accounts is a crucial component of accounting in Xero bookkeeping, as it provides a structured way to categorize transactions.

However, creating and maintaining an effective chart of accounts can be challenging for many users, especially if they are not familiar with accounting principles. The chart of accounts must be comprehensive, yet simple enough to be easily understood by all stakeholders.

Tax Compliance:

Tax compliance is another challenge of accounting in Xero bookkeeping. Although Xero bookkeeping makes it easier to track financial information, businesses still need to comply with tax regulations in their respective jurisdictions.

This involves staying up-to-date with tax laws and regulations, filing tax returns accurately and on time, and calculating taxes correctly.

Xero bookkeeping can help with tax compliance by automating certain processes, such as tax calculations, but users still need to ensure that they are complying with all tax laws and regulations.

User Training

Finally, a significant challenge of accounting in Xero bookkeeping is user training. Xero bookkeeping is a powerful software that requires a certain level of knowledge and skill to use effectively.

Many users may find it challenging to understand the various features and functions of the software, especially if they have limited experience with accounting software. User training is therefore critical to ensure that businesses get the most out of Xero bookkeeping and avoid costly errors.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 73 6051 0348

- Email: [email protected]

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2025 Meru Accounting. All Rights Reserved.

Privacy Policy

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 73 6051 0348

- Email: [email protected]

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds