The Impact of Accurate Accounting on UK Manufacturing Businesses

For manufacturing companies to succeed and expand in the UK, accurate accounting is crucial. Manufacturing accounting calls for careful cost analysis, inventory control, and financial planning in addition to tracking expenditures and income. In a market that is getting harder to compete in, manufacturing companies may stay profitable and competitive by using proper accounting procedures.

Manufacturing accounting is a specific area of accounting that includes budgeting, cost control, and financial planning to guarantee profitability. Maintaining financial stability, adhering to rules, and making well-informed judgments all depend on accurate production accounting.

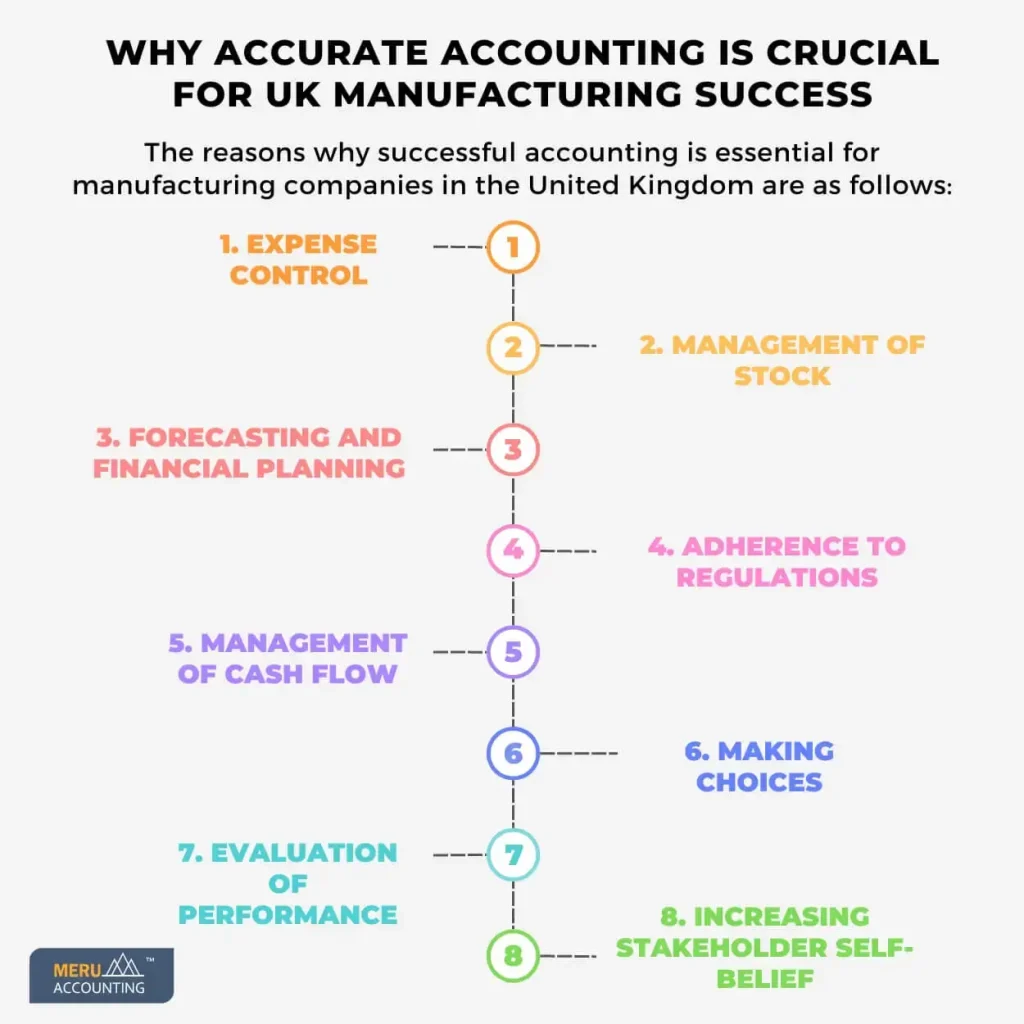

Accurate Manufacturing Accounting is important for UK success for:

Expense Control

Accurate cost management enables businesses to enhance profitability and effectively regulate production expenses.

Features:

- Monitor expenses, both direct and indirect

- Examine variations in costs.

- Put cost-cutting strategies into action

Management of Stock

Accounting for manufacturing businesses includes Production processes that run smoothly when inventories are managed effectively, since it avoids overstocking or stockouts.

Features:

- Track the quantity of inventories in real time.

- maximize the turnover of inventory

- Cut down on holding expenses

Forecasting and Financial Planning

Manufacturers can better prepare for growth and challenges in the future by using accurate financial planning for manufacturing accounting.

Features:

- Create thorough projections and budgets.

- Determine patterns and trends

- Make a plan for growth and capital expenditures.

Adherence to Regulations

Respecting financial regulations keeps you out of trouble with the law and away from fines in accounting for manufacturing businesses.

Features:

- Make sure that UK accounting rules are followed.

- Make sure your financial statements are accurate.

- Keep accurate records for audits.

Management of Cash Flow

A business that effectively manages its cash flow will consistently have sufficient funds available to meet its financial obligations.

Features:

- Track the inflow and outflow of funds.

- Effectively manage working capital

Making Choices

Long-term planning and strategic decision-making for accounting for manufacturing businesses are aided by accurate financial data.

Features:

- Describe the financial results in detail.

- Analyze the profitability of various product categories.

- Make wise investment choices.

Evaluation of Performance

Analyzing financial performance makes it easier to spot opportunities for development and progress.

Features:

- Examine the performance metrics that matter most.

- Compare the achieved results to the intended results.

- Put corrective measures in place

Increasing Stakeholder Self-Belief

Accurate and transparent financial reporting in manufacturing businesses fosters trust among creditors, investors, and other stakeholders.

Features:

- Give financial reporting.

- Show that you are financially stable.

- Draw in possible partners and investors

Conclusion

For manufacturing companies to succeed in the UK, accurate accounting is essential. It guarantees efficient financial planning, cash flow management, regulatory compliance, cost control, inventory control, and strategic decision-making. Manufacturing companies can improve their performance, win over stakeholders, and guarantee long-term profitability by keeping precise financial records.

To assist companies in streamlining their accounting procedures and achieving financial success, Meru Accounting provides specialized manufacturing accounting services. Our team of professionals can help you with financial planning, inventory control, cost management, and other areas. Contact us to find out how we can support the success of your manufacturing company.

FAQ

- Why is good math work key for UK makers?

Good math work helps makers track costs and stock. It shows where cash goes and helps keep costs low. This lets firms win in a tough field. - How does good math work help cut costs?

It shows the true cost of parts, work, and fees. This helps firms spot waste and stop it fast. It also helps set prices that bring cash in. - Can math work stop stock from piling up or running out?

Yes. Good math work tracks stock well. It helps keep just the right amount on hand to keep work smooth and cut waste. - How does math work help plan for the days to come?

It gives facts that help firms estimate sales and set a cash plan. This lets them act fast when things change. - Why must math work meet UK laws?

Good math work keeps books right and clear. This keeps firms from fines or pain and wins trust from banks and backers. - How does math work help keep cash flow smooth?

It tracks cash in and out. This helps firms pay bills on time and plan for slow times. - Can math work show where to put cash to grow?

Yes. It shows which goods or steps bring the most cash. This helps firms pick the best spots to grow. - How does math work build trust with banks and backers?

Clear books show a firm is sound and runs well. This helps bring in cash from those who can help.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 203 868 2860

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2026 Meru Accounting. All Rights Reserved.

Privacy Policy

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds