How do you maintain accounts in educational institutions?

Are you an educational institution in the UK that is struggling to maintain efficient accounting? You then need to have a different approach to it. Many of these institutions have experienced inefficiencies in their bookkeeping and accounting work. They are now understanding the importance of different approaches to education bookkeeping. This can help to keep better financial transactions in the accounting books. Here, we will look more at maintaining better education accounting. It can help them to keep better accounting and improve their financials.

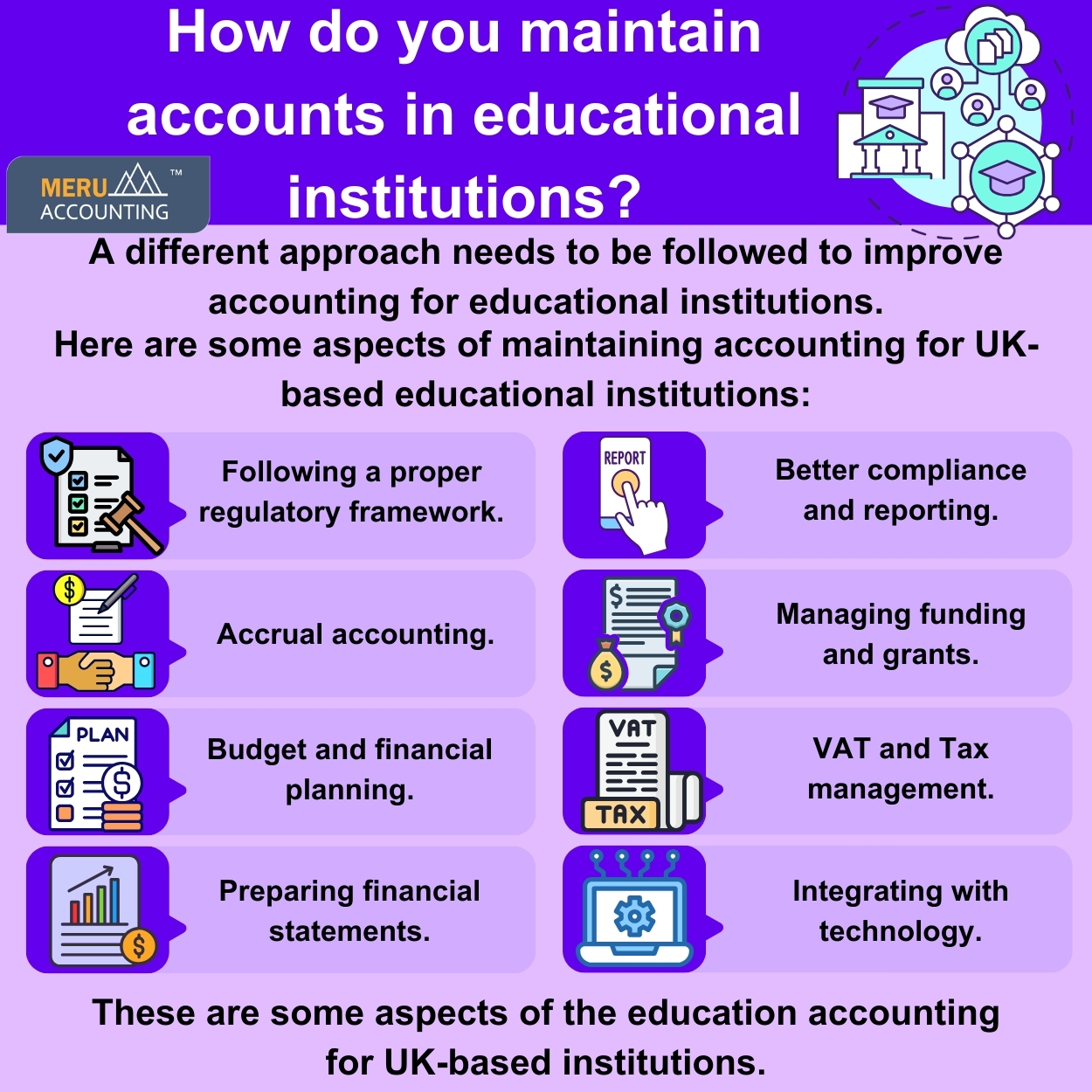

What approach to follow for improving education accounting in the UK?

Here are some of the important aspects to improve the accounting for the educational institutions:

Follow the proper regulatory framework

Educational institutions in the UK are subject to financial regulations and reporting requirements set by regulatory bodies. Some of these bodies are the Education and Skills Funding Agency (ESFA) for schools and the Office For Students (OFS) for higher education providers. With this framework, it can improve accounting for the education sector.

Accrual accounting approach

Educational institutions typically use accrual accounting, which records transactions when they occur rather than when cash is received or paid. This provides a more accurate representation of the financial position and performance of the institution. It helps to have better control over the finances of the institution.

Budgeting and financial planning

Education accounting involves the preparation and monitoring of budgets to ensure effective financial planning. Institutions develop annual budgets that allocate resources for various departments and activities throughout the academic year.

Different financial statements

Educational institutions produce financial statements, including the income statement, balance sheet, and cash flow statement. These statements provide a comprehensive overview of the financial health of educational institutions.

Compliance and reporting

Compliance with regulatory requirements is crucial and different aspects of HMRC guidelines. Educational institutions must adhere to accounting standards and regulations and submit financial reports to relevant authorities. These reports often include the financial statements, notes to the financial statements, and other required disclosures.

Funding and grants

Educational institutions in the UK receive funding from various sources, including government grants, tuition fees, and donations. Proper procedures are essential in education bookkeeping to track and manage funds in accordance with regulatory guidelines.

VAT and Taxation

Education accounting also involves managing Value Added Tax (VAT) and ensuring compliance with taxation regulations. Educational institutions may have specific exemptions and considerations related to their tax status for specific educational intuition.

Technology integration

Many educational institutions use accounting software to streamline financial processes. This helps to enhance reporting accuracy and improve the overall efficiency of the accounting.

These are some ways to improve the accounting for the educational institutions. Educational institutions are encouraged to stay abreast of updates to accounting standards and regulatory requirements to ensure compliance and financial transparency. Professional advice from accountants and financial consultants with expertise in the education sector is needed here to ensure better financial growth.

If you find it difficult to maintain the education bookkeeping in-house then you can outsource this task to the experts. Meru Accounting provides expert education accounting services for educational institutions in the UK. Their approach to accounting will ensure better financial health for educational institutions. Meru Accounting is an expert accounting service provider for UK-based educational institutions.

FAQs

- Why do schools and colleges need a clear accounting plan?

A clear plan helps track cash, cut waste, and prove funds are used in the right way. It also makes audits and checks less stressful for the staff.

- How does accrual accounting help in the education sector?

Accrual records each deal when it takes place, not when cash is paid. This way, schools get a true view of what they earn and spend, which aids in smart plans.

- What role does a budget play in school accounts?

A budget sets out how much each team or task can use in a year. It helps avoid overspend, and it makes sure funds reach key needs like staff, tools, or student care.

- Do UK schools need to follow strict rules in accounts?

Yes. Schools and universities must meet rules set by groups like ESFA and OFS. These rules make sure funds are used fair, and that reports match UK laws.

- How do grants and fees affect school accounts?

Most schools run on a mix of grants, fees, and gifts. Each source must be tracked on its own to prove the money is used for the right cause.

- Do schools in the UK need to deal with tax and VAT?

They do. Some schools get VAT breaks, but they still need to track what tax rules apply. Good tax care helps cut risk and keeps the school in line with HMRC.

- Can tech tools make school accounting smoother?

Yes. Cloud-based tools save time, cut errors, and give staff real-time data. They also make it easy to share reports with boards and fund groups.

- Should schools hire professional accountants for their books?

It is smart to do so. A professional with school sector skills can guide on rules, VAT, and reports. This cuts risk, boosts trust, and helps the school grow in a safe way.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 203 868 2860

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2026 Meru Accounting. All Rights Reserved.

Privacy Policy

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds