A Guide to Choosing the Right Accounting Package in the UK.

As there are a lot of options for accounting partners, it becomes difficult to choose the best one. If you are a business operating in the UK, then you must choose proper accounting packages in the UK that can handle regulations here. An appropriate accounting partner has the ability to streamline operations and handle finances efficiently. While choosing proper accounts packages for small businesses in the UK, you need to consider different aspects. This guide will help you understand and choose the right accounting packages irrespective of your company size.

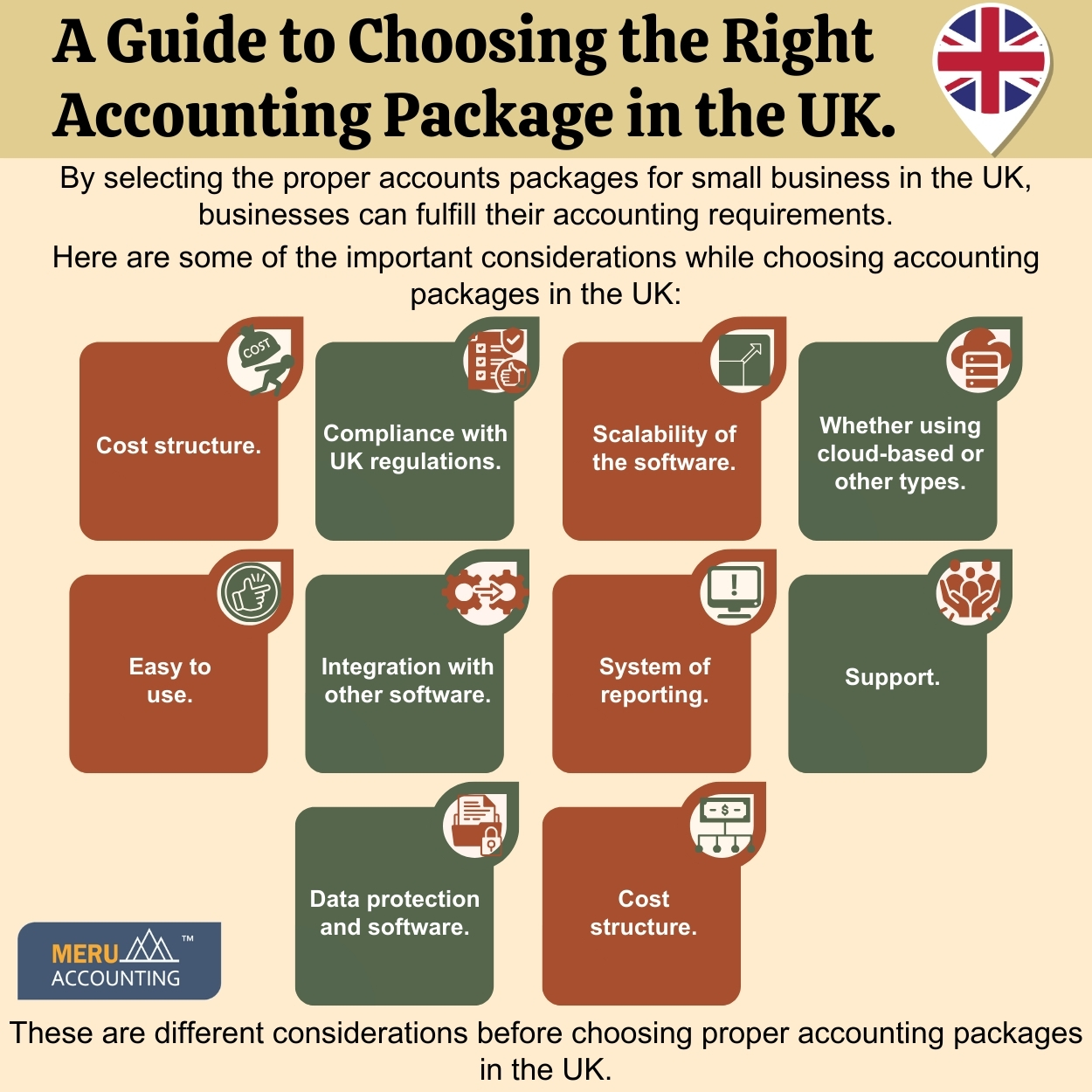

What are the different considerations while choosing proper accounting packages in the UK?

While choosing the proper accounting packages as per your needs and requirements, you need to consider various aspects.

Here are some considerations while choosing proper accounts packages UK:

Understand the business needs

Identify the specific accounting requirements of your business. Consider factors like the size of your business, the complexity of your financial transactions, and the number of users.

Compliance with the UK regulations

Ensure that the accounting package is compliant with UK accounting standards and tax regulations. Check if the software supports Making Tax Digital (MTD), a UK government initiative to digitize tax processes. The accounting package must also handle all the regulations of HMRC.

Scalability of the software

Choose an accounting solution that can grow with your business. Consider future expansion plans and make sure the software can handle increased transaction volumes.

Cloud-based or other options

Decide whether you prefer a cloud-based accounting solution. Cloud-based options offer accessibility from anywhere with an internet connection, automatic updates, and lower upfront costs.

Easy to use

Opt for an accounting package that is user-friendly, especially if you or your team members are not accounting experts. The interface must be easy to operate and a user-friendly interface is important.

Integration with other applications

Check if the accounting software integrates with other tools your business uses, such as CRM, payroll, or inventory management systems. Integration can streamline processes and reduce manual data entry.

Reporting system

Evaluate the reporting features of the accounting package. Ensure it provides the financial reports you need for decision-making and compliance.

Support

A better level of training and nice customer support is important in the accounting package. Look for resources like tutorials, webinars, and responsive customer support to assist you when needed.

Security and data protection

Prioritize the security of your financial data. Check if the accounting software adheres to data protection standards and includes features like encryption and secure backups.

Costing

Understand the pricing structure of the accounting package and choose accordingly that is suitable. Consider factors like subscription fees, additional user costs, and any hidden fees.

These are some of the considerations while choosing proper accounts packages for small businesses UK. Many of the outsourcing firms offer free trials, so you can test them to see which accounting package best suits your business requirements. At Meru Accounting, we schedule a special meeting to discuss all the requirements and client expectations.

If you are finding it difficult to handle your accounting task then you must outsource it to the experts. Meru Accounting provides outsourced accounting tasks for businesses. We help you choose a suitable accounting package and software for your business in the UK. Meru Accounting is an expert accounting service provider across the globe.

FAQs

- Why should I use an accounting package for my UK business?

An accounts tool tracks sales, spend, and tax. It saves time, cuts slip-ups, and gives clear notes for smart plans.

- How do I know which package fits my business needs?

Check the size of your firm, the users, and the type of deals you log. Small firms may need a light tool, while big ones may want more.

- Do all accounting packages meet UK tax rules?

No. You must check if the software works with UK rules and HMRC needs. A good tool should also support Making Tax Digital (MTD).

- Should I choose a cloud-based accounting package?

Yes, cloud tools are great for most firms. They let you log in from any place, update on their own, and lower setup costs.

- Can an accounting package grow with my business?

Yes, if you pick one with scale options. As you add more sales or staff, the right tool can handle new needs without extra stress.

- How do I check if the package is easy to use?

Pick a tool with a plain and clean screen. If your team has no skills in books, a simple tool helps save time and cut slips.

- What other features should I look for?

Check if it links with payroll, CRM, or stock tools. Strong links reduce handwork. Also, make sure it has clear reports, good data security, and fair pricing.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 203 868 2860

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2026 Meru Accounting. All Rights Reserved.

Privacy Policy

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds