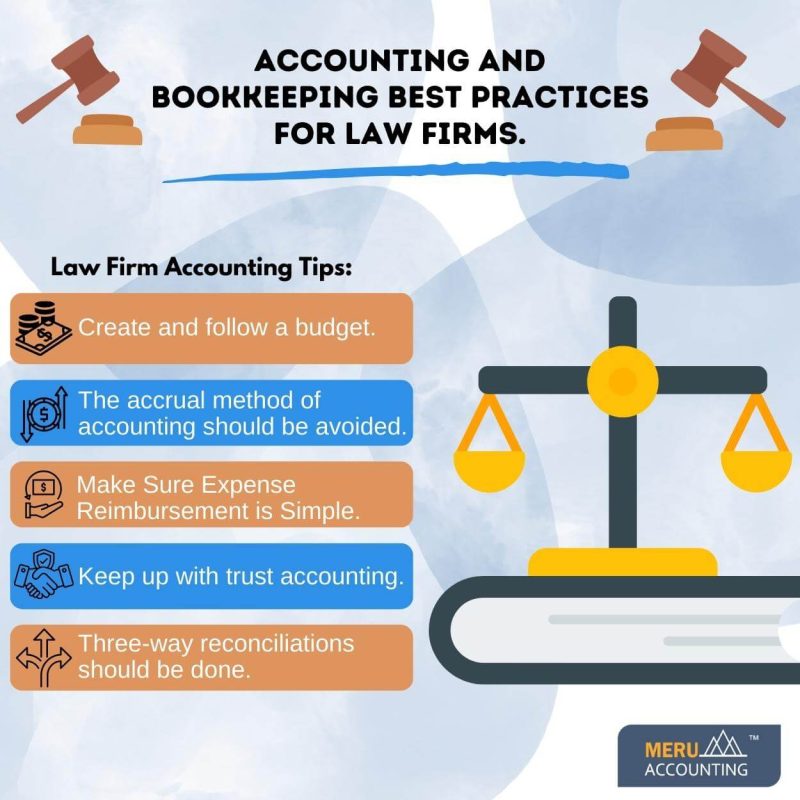

Accounting And Bookkeeping Best Practices For Law Firms.

It’s essential to comprehend the essentials of accounting and bookkeeping to ensure that your business adheres to moral standards. In this article, we go through law firm accounting best practices for precise and efficient law firms.

Law Firm Accounting Tips:

- Create And Follow A Budget

One of the law firm accounting best practices is to create a budget outline. Setting a budget for your legal practice is crucial in order to establish expectations for cash flow and expenses as well as income targets.

Setting aside money for more significant costs like annual bar association dues, legal research services, and IT updates is simpler when you have a budget.

Although there are several ways to create a budget, you must first develop a plan of action. Make a list of your necessary expenditures first, such as rent, license fees, and utilities.

You can assess your financial situation realistically after projecting your income.

- The Accrual Method Of Accounting Should Be Avoided

Prior to filing their first tax return, new businesses must choose their preferred accounting technique. You can choose between the accrual and cash methods, but since legal firms are often PSCs, regardless of size, they are permitted to employ the cash method of accounting.

The cash approach makes it simpler to pay the tax due and more accurately aligns taxable income with cash received.

By utilizing it on your first return, you may use the cash method of accounting. You must submit a request to the IRS to switch to the cash method if you have previously filed a tax return using the accrual method.

- Make Sure Expense Reimbursement Is Simple

It’s an excellent idea to mandate that all workers and partners use a business credit card to ensure simple expense reimbursements.

By doing this, a more direct paper trail is created, and tracking spending for each client and partner is made simpler. Advance client costs are the usual name for reimbursable expenses.

- Keep Up With Trust Accounting

For law firm accounting tips, trust accounting is a crucial component of accounting. It is the practice of retaining client funds granted in trust, such as unearned fees paid as retainers, court expenses, settlement funds, or advanced costs, in a different account from legal office operating funds.

Because there are so many strict regulations regarding what you can and cannot do with trust accounts, they are one of the accounting areas where law firms make mistakes most frequently. These restrictions carry serious consequences, including disbarment.

- Three-Way Reconciliations Should Be Done

In a three-way reconciliation, the trust bank account, trust ledger, and individual client ledgers are balanced. Every state bar association mandates that law firms reconcile their trust bank statement on a monthly or quarterly basis to the individual balances of their customers.

In 30 to 90 days, you must execute a three-way reconciliation between the trust bank account, trust ledger, and individual client ledgers as required by every state bar. It is one of the best practices of law firm accounting tips.

Meru Accounting is a proficient site for more information on accounting and bookkeeping practices for law firms.

FAQs

- Why does a law firm need a set budget?

A set budget helps a firm track spending, plan for dues, and meet cash flow goals. It also keeps big costs like IT and bar fees from being a shock. - Should small law firms use the cash or accrual method?

Most firms use the cash method since it links tax to cash in hand. It is clearer and makes taxes less hard than the accrual method. - How can firms make expense claims easy?

Firms can give staff and partners a firm card. This makes a clear trail and helps track client costs with less mix-up. - What is trust accounting in law firms?

Trust accounting is when client funds, like retainers or case costs, are held in a trust account. These must stay apart from firm cash to meet state bar rules. - What happens if a firm mishandles trust funds?

If a firm breaks trust rules, the risks are high. It can lead to fines, loss of client trust, or even loss of law license. - Why are user skills important for success with Xero?

A three-way check makes sure the trust bank, trust ledger, and client ledger all match. It keeps firm books clear and meets bar rules.

- How often should law firms do reconciliations?

Most state bars need a check each month or at least once in three months. This keeps errors small and shows clients that funds are safe.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 203 868 2860

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2026 Meru Accounting. All Rights Reserved.

Privacy Policy

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds