How to Prepare Balance Sheet from Trial Balance?

The financial statements balance sheet and income statement are prepared using the trial balance and additional information. The accounting transaction is first posted as journal entries, then posted to the general ledger, and then flows into the trial balance.

What is a trial balance?

A trial balance is a statement that lists all the general ledger accounts and sums up their balances. It lists all the debit and credit balances. The sum of all the debit balances must equal the credit balances. If it doesn’t tally, then there are some errors in trial balances. The preparation of a trial balance helps in easy checking and locating any errors in the overall accounts.

What is the balance sheet?

The balance sheet is a financial statement that shows the financial position of the company on a particular date. It helps us to know what a company owns and what a company owes. It shows the business’s net assets or worth (difference between assets and liabilities).

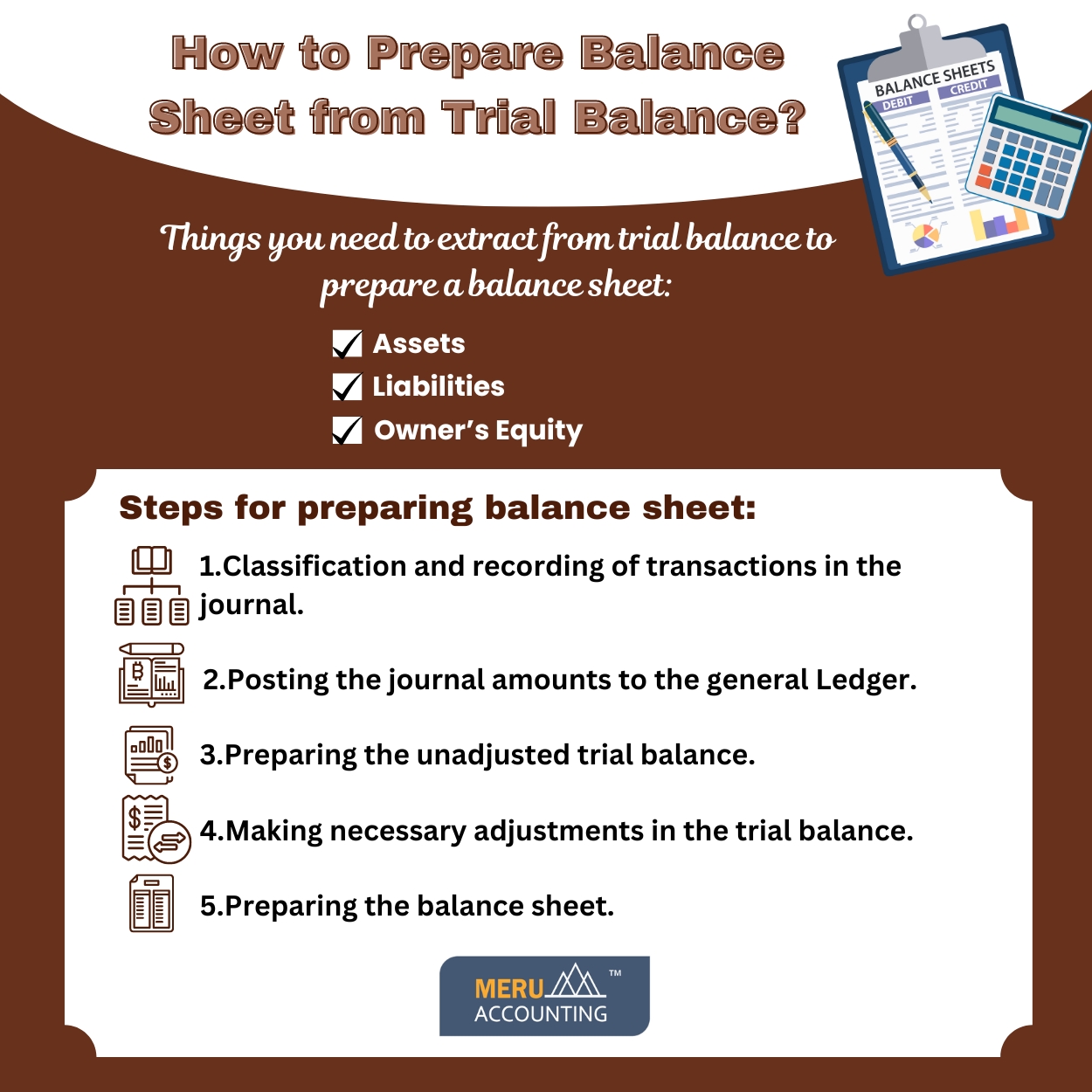

How to prepare a Balance Sheet from Trial Balance?

In order to prepare a balance sheet, we need to collect the information—assets, liabilities, owner equity, and other information—from the trial balance.

Let’s understand with an example:

Following is the trial balance of XYZ company on 31st December 2022

TRIAL BALANCE FOR XYZ at 31st December 2022

| DEBIT in $ | CREDIT in $ |

Capital account |

| 5,000 |

Drawing | 5,900 | |

Purchases | 73,000 | |

| Sales | 56,000 | |

Commissions | 720 | |

| Bank Charges | 910 |

|

Interest Expense | 1,000 | |

| Rent Expenses | 550 |

|

Depreciations | 420 | |

Tax Expense | 620 |

|

| Receivables | 10,200 |

|

Payables | 9200 | |

| Cash | 20,000 |

|

Furniture and Equipment | 15,000 | |

| Loan | 21,000 | |

Insurance | 3,080 | |

| Owner Equity | 10,000 | |

| 116,400 | 116,400 |

Now let’s look at the following figures:

Assets

- Cash

- Furniture

- Receivables

Liabilities

- Loans

- Payables

Owner’s Equity

- Capital

- Owner’s Equity

- Drawings

The above figures will flow into the balance sheet. The basic equation of the balance sheet is:

Assets – liabilities = Owner’s Equity (Net Assets)

Using the figures from the trial balance, we can prepare the balance sheet below. Note that there are two methods of preparing a balance sheet: the “T” format and the list format. Either of the two can be used, the only difference is the way of representing the information.

BALANCE SHEET FOR XYZ AS ON 31 DECEMBER 2022 | |||

ASSETS | AMT IN $ | LIABILITIES | AMT IN $ |

Cash | 20,000 | Loan | 21,000 |

| Furniture | 15,000 | Payables | 9,200 |

Receivables | 10,200 | ||

| TOTAL ASSETS | 45,200 | TOTAL LIABILITIES | 30,200 |

| Owner’s Equity | ||

| Capital | 5,000 | ||

| Add: Owner’s Equity at the beginning | 10,000 | |

| Less: Drawings | 5,900 | ||

| Add: Net profit after tax | 5,900 | |

| OWNER EQUITY | 15,000 | ||

TOTAL | 45,200 | TOTAL | 45,200 |

Note: The net profit is calculated from the profit and loss account. Here, net profit is assumed.

Simplify your financial reporting with Meru Accounting

We are an outsourced accounting and bookkeeping firm backed by a dedicated team of CPAs, CAs, and qualified accountants. We use updated technology and the latest accounting software that helps to automate manual tasks and focus more on financial reporting and analysis.

Book a no-obligation appointment with us.

FAQs

- Why do we need a trial balance before making a balance sheet?

The trial balance checks if total debits and credits match. When it tallies, you know the books are right, and you can use it to build the balance sheet with ease. - What happens if my trial balance does not match?

If debits and credits don’t match, there is an error. You may have missed a post, made a wrong entry, or added a figure twice. Fixing this is key before you start the balance sheet. - What data from the trial balance goes into the balance sheet?

You pull out assets like cash, furniture, and dues owed to you. Then you add liabilities like loans and vendor dues. Last, you include equity, which is the owner’s share. - How do I find owner’s equity from a trial balance?

Owner’s equity is made up of capital, profit, and drawings. You add the capital and profit, then subtract drawings. This shows the true worth of the firm after dues are paid. - Which format is better, T format or list format?

Both formats are right. The T format shows assets on one side and liabilities plus equity on the other. The list format stacks them. The choice is about style, not rules. - Do I need profit and loss data to finish the balance sheet?

Yes. You need the net profit from the income statement. It flows into owner’s equity. Without it, the balance sheet won’t show the right net worth of the firm. - Can small firms prepare a balance sheet without software?

They can. With a clear trial balance and simple math, small firms can make one on paper or in Excel. But software saves time and cuts errors. - Why is a balance sheet important for any business?

It shows what the firm owns and owes on a set date. Owners, banks, and investors use it to check the health of the firm and plan next steps.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 203 868 2860

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2026 Meru Accounting. All Rights Reserved.

Privacy Policy

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds