Where to Get Help with Your CT600 Tax Return: A Guide for Businesses

Filing the CT600 tax return for your company can feel complicated, but it’s a necessary part of running a business in the UK. This form is required by HMRC and shows how much profit your company has made and how much tax it needs to pay. It’s important because it helps you stay within the law and avoid any penalties.

The CT600 tax return must be completed each year, and it includes details about your company’s income, expenses, and any tax deductions. While it might seem tricky, there are plenty of resources available to help make the process easier. Below are several ways to make filing your company tax return CT600 simpler.

Different ways to simplify filing your CT600 tax return

HMRC Guidance

The official HMRC guide on the GOV.UK website gives step-by-step instructions on how to fill out your CT600 tax return. This guide covers what information you need to include, from financial details to specific tax reliefs your company may be eligible for. The guide ensures that all companies understand the process, making it a good starting point for businesses.

Hiring a Professional Accountant

Professional accountants and tax advisors can help you navigate the complexities of the company tax return CT600. Their expertise ensures that your tax return is completed accurately, and they can offer personalized advice tailored to your company’s financial situation. Hiring an accountant saves time and reduces the risk of mistakes that could lead to penalties.

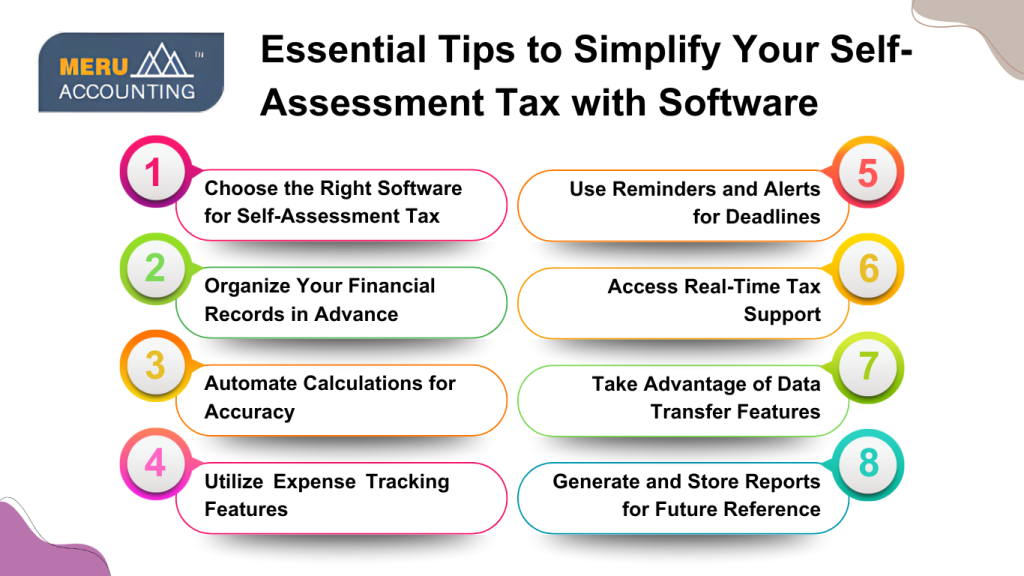

Using Accounting Software

Many popular accounting software platforms, such as QuickBooks, Xero, and Sage, offer tools designed to help businesses file their CT600 tax return. These software solutions often include automated calculations, guides, and prompts, making it easier to input the correct information. By using accounting software, you can avoid manual errors and ensure your company tax return CT600 is accurate.

HMRC Online Filing Service

HMRC offers an online service where you can submit your CT600 tax return directly. This service includes prompts to guide you through the filing process, ensuring you complete each section accurately. The online platform also helps to identify errors and omissions before submission, minimizing the chances of mistakes.

Local Tax Clinics and Workshops

Some local business organizations and chambers of commerce offer tax clinics or workshops where you can receive help with your CT600 tax return. These sessions provide hands-on assistance, allowing you to ask specific questions and receive direct guidance. This can be especially helpful for smaller businesses or startups unfamiliar with the tax return process.

HMRC Helplines and Support

If you have specific questions or encounter issues while filling out your company tax return CT600, you can contact HMRC’s helpline for assistance. HMRC also offers webchat services for more immediate help. These support options ensure that you can resolve any problems quickly and efficiently.

Guides and Templates

There are also several free guides and templates available online to help with completing your CT600 tax return. These resources can provide extra clarity on the form’s requirements, particularly for businesses that don’t have access to professional help. Templates can be especially useful for ensuring that the format and structure of your submission are correct.

Conclusion

Whether you use professional accountants, online software, or free guides, the goal is to ensure your company tax return CT600 is filed accurately and on time. For businesses looking for expert help, Meru Accounting offers comprehensive accounting services, helping companies manage their tax obligations efficiently and effectively.

FAQs

- Do I need an accountant to file my CT600 tax return?

No, but hiring one can help. An accountant can check for errors, apply the right tax reliefs, and make sure the form is filed on time. Many small firms use one to save time and stay safe from fines.

- Can I file the CT600 form myself online?

Yes, you can use HMRC’s online service to file your CT600. The site gives tips as you go, which helps avoid small errors. You need your company’s login details to use this tool.

- What if I send my CT600 late?

HMRC will give a fine if you miss the due date. The more you wait, the more you pay. File on time to skip the cost and keep your firm in good shape.

- What documents should I have before I start the CT600?

Have your firm’s full year accounts, income and cost records, and any tax relief claims. These will help you fill in the form with the right data and avoid delays.

- Can I use free tools to help with my CT600?

Yes, there are free guides, templates, and help notes online. These tools help you learn what to add in each part of the form. Some sites also have sample CT600 forms to follow.

- Is it safe to use a tool for CT600?

Yes. Apps like Xero, Sage, and QuickBooks let you file with ease. They check your sums and send the form to HMRC for you.

- What if I slip up on my CT600?

You can fix it. Send a new form or call HMRC. Spot the fault fast and make it right to dodge fines or more stress.

- Who can I contact if I have a CT600 question?

HMRC’s helpline and webchat are good places to start. You can also ask your local tax clinic or speak with a tax expert for more help.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 203 868 2860

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2026 Meru Accounting. All Rights Reserved.

Privacy Policy

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds