- Schedule Meeting

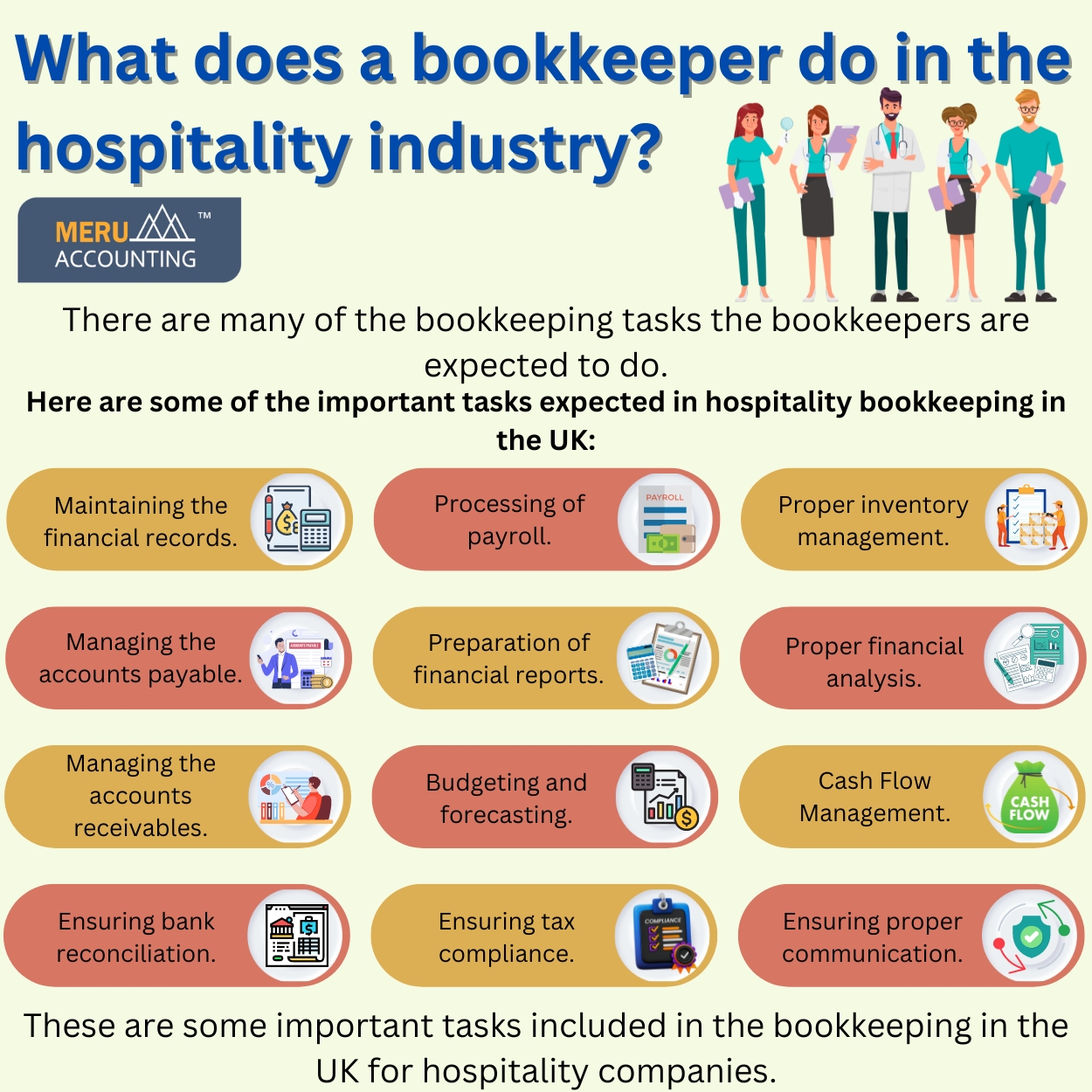

What does a bookkeeper do in the hospitality industry?

Every hospitality industry requires proper financial growth, regardless of the size of the business. Better bookkeeping can take the business to the next level with financial growth. Studies have shown that inefficiency in bookkeeping is one of the important reasons behind the declining financial position of the business. So, proficient hospitality bookkeeping is very important for the company providing hospitality services in the UK. It is with the experts having experience in the hospitality industry, who can provide the desired services. There are several tasks included in the bookkeeping for hospitality.

Which tasks are included in the hospitality bookkeeping?

There are several tasks expected from bookkeepers in the UK-based hospitality industry.

Keeping the financial records

Bookkeepers are responsible for maintaining proper financial records. This includes recording daily sales, expenses, and other financial transactions in accounting software or ledgers.

Accounts Payable

Managing accounts payable involves tracking and processing invoices, ensuring that bills and vendor payments are made on time, and maintaining good relationships with suppliers.

Accounts Receivable

Bookkeepers may be responsible for invoicing customers and ensuring timely payment. They track outstanding balances and follow up with customers regarding overdue payments.

Bank Reconciliation

They reconcile the company’s bank statements with its financial records to ensure that all transactions match and to identify any discrepancies.

Payroll processing

Some bookkeepers may handle payroll tasks, including calculating employee wages, taxes, and benefits. They ensure that all payroll-related taxes and deductions are accurately processed and reported.

Preparing financial reports

Bookkeepers generate financial reports, such as income statements and balance sheets, to provide management with insights into the company’s financial health. These reports will help companies in decision-making.

Budgeting and Forecasting

Help out in budget preparation and financial forecasting. Bookkeepers help management plan for the future and allocate resources effectively.

Ensuring tax compliance

Bookkeepers help ensure the business complies with HMRC guidelines in the UK. They might assist with preparing and submitting tax returns and documents.

Inventory management

In the hospitality industry, maintaining accurate records of inventory, such as food and beverage, linens, and cleaning supplies, is essential. Bookkeepers may be responsible for tracking inventory levels and costs.

Financial analysis

Bookkeepers might analyze financial data to identify trends and areas where the business can improve efficiency or reduce costs.

Cash flow management

Managing and forecasting cash flow is crucial in the hospitality industry. Bookkeepers monitor cash flow to ensure that the business has enough liquidity to meet its financial obligations.

Establish proper communication

Bookkeepers often need to communicate with other team members, accountants, and financial stakeholders. They can provide financial updates and information.

These are some of the important aspects included in the bookkeeping for hospitality in the UK. Expert bookkeepers will be helpful in ensuring accurate records and contributing to the overall financial health.

If you are finding difficulty in managing your hospitality bookkeeping task then you can outsource this to experts. Meru Accounting provides quality bookkeeping for the hospitality industry across the UK. Our team of experts has experience working in the hospitality industry. Meru Accounting is an expert bookkeeping service-providing agency in the UK for the hospitality industry.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 (0) 203 868 2860

- [email protected]

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2025 Meru Accounting. All Rights Reserved.

Privacy Policy

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 73 6051 0348

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds