What is the role of accountant in mining industry?

The mining industry stands out as a key performer in the complex network of industries that contribute to a country’s economic backbone. Accountants’ importance in this fast-paced sector is frequently overlooked. However, the importance of accounting for the mining industry cannot be understated.

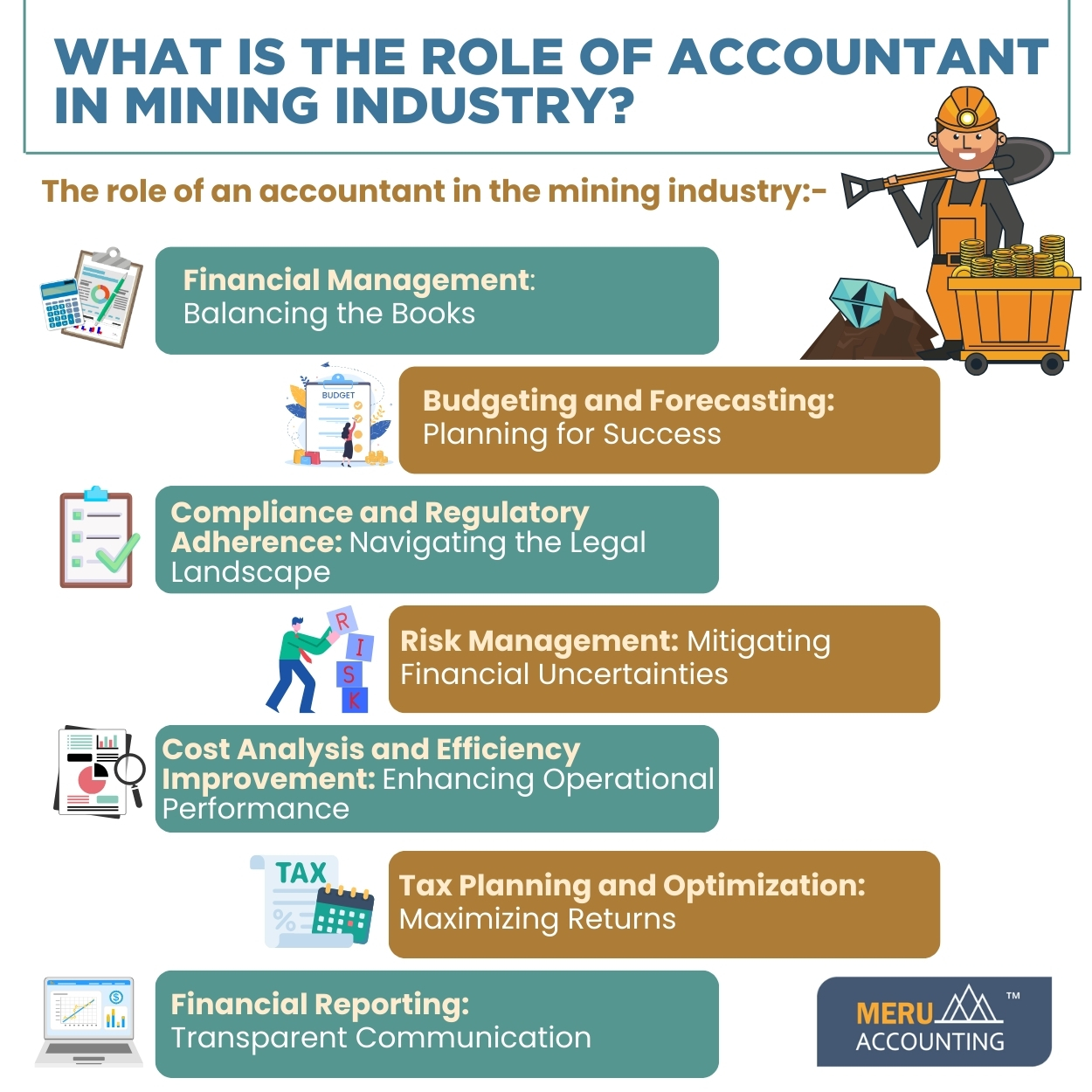

Let’s discuss the role of accountants in the mining industry:

Financial Management: Balancing the Books

The complete oversight of funds is important to an accountant’s function in the mining accounting business. Mining activities require a significant investment, from exploration and extraction to processing and shipment. Accounting for the mining industry is crucial in tracking these expenses and ensuring that financial resources are distributed properly and in accordance with regulatory norms.

Budgeting and Forecasting: Planning for Success

Accounting for mining companies is responsible for budgeting and forecasting in the ever-changing world of mining, where market circumstances, commodity prices, and geopolitical issues can all have an impact on profitability. They help mining firms to make informed financial decisions by examining historical data and market trends. Businesses may overcome risks and plan for long-term success with this proactive approach.

Compliance and Regulatory Adherence: Navigating the Legal Landscape

The mining accounting industry is governed by a complicated regulatory framework. Accounting for the mining industry is critical to ensuring that mining businesses follow financial requirements, tax laws, and environmental regulations. Accountants protect organizations from potential legal traps and contribute to the industry’s overall sustainability by remaining up-to-date on the newest legal standards.

Risk Management: Mitigating Financial Uncertainties

Mining accounting involves numerous risks, ranging from geological uncertainties to market changes. Accountants with financial knowledge work with other stakeholders to build risk management solutions. They assist mining accounting companies in navigating the industry’s unpredictable landscape by detecting potential financial traps and establishing safeguards.

Cost Analysis and Efficiency Improvement: Enhancing Operational Performance

In the mining accounting business, efficiency is the key to success. Accounting for mining companies plays a critical role in analyzing the costs of exploration, extraction, and processing. They find areas where operational efficiency can be improved by rigorous cost analysis, contributing to cost reduction and increased profitability.

Tax Planning and Optimization: Maximizing Returns

In accounting for mining companies, accountants are skilled at handling the complexities of taxation. They create tax solutions that optimize the company’s tax situation while guaranteeing compliance with tax rules. Accountants assist mining firms in maximizing their earnings and reinvesting in sustainable practices by discovering applicable tax incentives and credits.

Financial Reporting: Transparent Communication

Transparent financial reporting is critical for establishing trust among stakeholders, such as investors, regulators, and the general public. Accountants gather and present financial data in a clear and accurate manner, allowing for informed decision-making and encouraging confidence in the mining industry.

For the sake of your company’s growth and development, Contact Meru Accounting, a CPA firm that not only provides certified bookkeepers but also a variety of online accounting services.

FAQs

- Why do mining companies need accountants?

Mining companies spend a lot of money and handle many tasks. Accountants track money, plan budgets, and keep records correct. They also help ensure compliance with the law and avoid costly errors.

- How do accountants help with mining budgets?

Accountants make budgets for mining costs like digging, processing, and transport. They predict profits and losses to help companies plan. This keeps operations safe even when prices change.

- Can accountants improve mining efficiency?

Yes. Accountants check all costs and find waste. They show ways to save money and speed up work. This boosts profit without extra spending.

- What role do accountants play in mining tax planning?

Taxes can be tricky for mining firms. Accountants find legal ways to reduce taxes. This saves money and lets firms reinvest in tools, safety, and the environment.

- How do accountants manage risk in mining operations?

Mining has many risks, like price swings and hazards. Accountants spot financial dangers and suggest plans to protect funds. This helps firms survive surprises.

- Are accountants needed for mining compliance?

Yes. Mining laws change often. Accountants make sure records, reports, and taxes follow rules. This avoids fines and keeps investors’ trust.

- How do accountants help investors trust mining companies?

Investors want clear data. Accountants make simple reports showing profit, loss, and costs. This builds confidence in the company.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 203 868 2860

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2026 Meru Accounting. All Rights Reserved.

Privacy Policy

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds