How much does a personal accountant cost in the UK?

Navigating the complexities of personal finances can feel like traversing a tangled jungle gym, even the most organized individual can be left feeling at a loss. This is where the invaluable role of a personal tax accountant UK comes into play. But one crucial question often hangs in the air: how much does it cost to secure this financial guidance? The answer, like many things in life, is “it depends.” The cost of a personal accountant UK varies widely based on several factors, including your specific needs, the complexity of your finances, and the location and experience of the accountant.

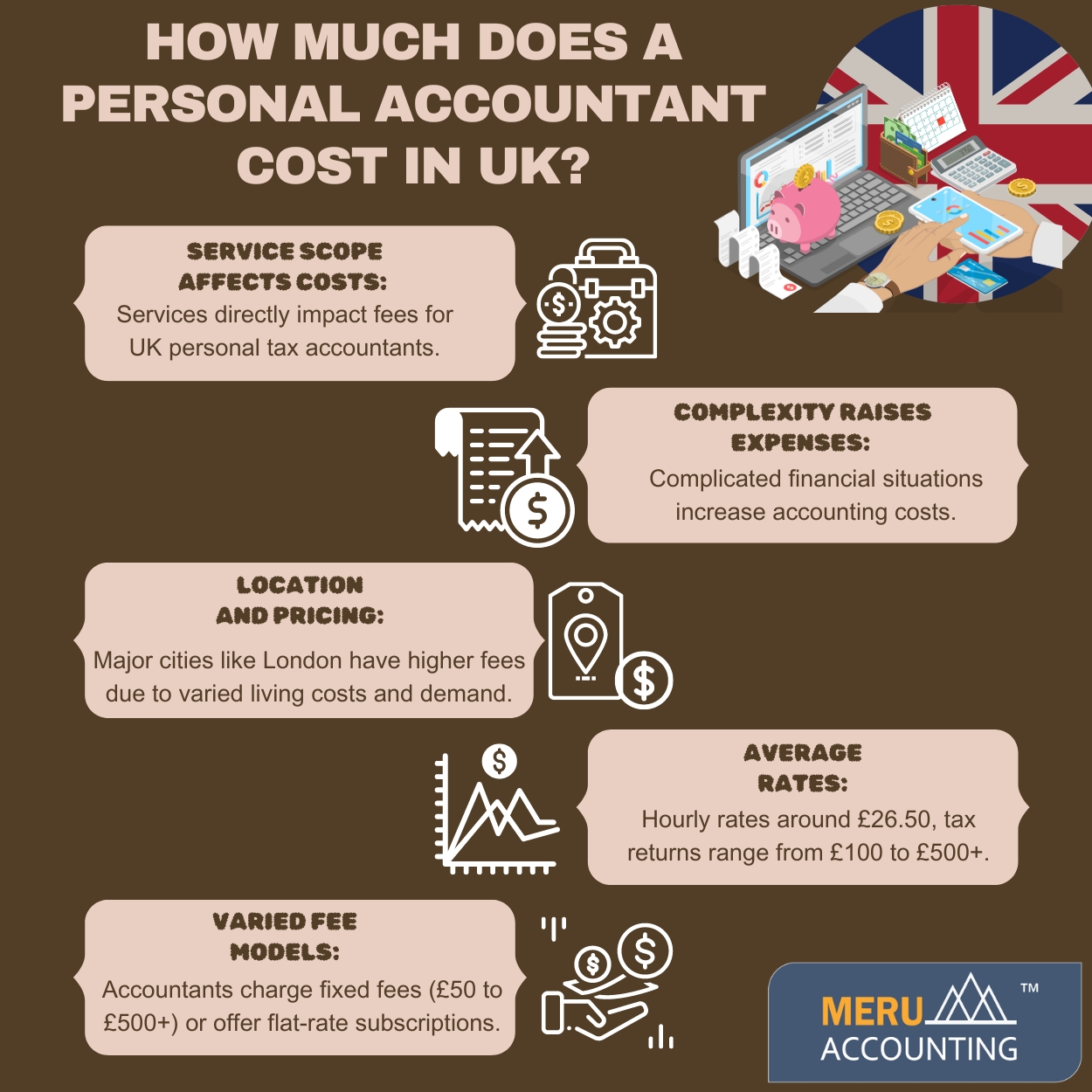

Factors influencing the pricing models:

Services Required

The scope of services you need significantly impacts the cost. Whether it’s basic tax filing or a comprehensive financial management service including investment handling, tax optimization, and ongoing financial advice, the extent of services directly correlates with the fees charged.

Complexity of Financial Situation

A more complex financial situation, such as multiple income streams, rental properties, capital gains, or self-employment, will require greater time and expertise from your accountant. Consequently, the complexity of your financial affairs tends to raise the cost of accounting services.

Geographic Location

Geographical location matters, especially in the UK. Accountants in major cities like London typically charge higher fees compared to those in regional areas due to differences in living costs and market demand.

Average rates:

Understanding the various pricing models for personal tax accountant UK and personal accountant UK can help you navigate the financial landscape with confidence. According to the Association of Chartered Certified Accountants (ACCA), the average hourly rate for accountants in the UK is £26.50.

However, this rate can vary depending on the type of service you need. For example, a basic personal tax return can cost around £100, while a more complex one can cost up to £500 or more. Similarly, a monthly bookkeeping service can cost between £50 and £100, while a full-service accounting package can cost between £150 and £250 per month.

Varied fee structure:

A personal tax accountant UK may also charge a fixed fee for certain services, such as setting up your accounting software, registering your business, or filing your VAT returns. These fees can range from £50 to £500 or more, depending on the service and the accountant. Alternatively, some accountants may offer a monthly or annual subscription that covers all or most of the services you need for a flat rate.

While cost is crucial, remember that a skilled personal accountant UK can save you money in the long run. They can help you claim eligible tax deductions, minimize your tax liability, and make informed financial decisions that contribute to your overall financial well-being.

So, how can you find the right personal tax accountant UK who balances expertise with affordability? Research, compare quotes, and prioritize transparency.

Meru Accounting is a CPA firm that provides remote bookkeeping and accounting solutions to businesses and individuals across the US, UK, Canada, Australia, and Europe. It offers quality-driven, cost-effective, and customized services for Bookkeeping payroll, tax preparation, indirect tax, and audit support using QuickBooks, Xero, and other software. Meru Accounting can provide you with a dedicated and professional team of accountants who can handle your accounting tasks efficiently and effectively.

FAQs

- What makes personal accountant fees higher or lower in the UK?

Fees change with the type of work you need, how complex your money case is, and where the accountant is based. A simple tax file is cheaper than full books and tax advice.

- Do I pay less if I only need help once a year?

Yes. If you only need one tax file each year, you can book a one-time job. This is often cheaper than a plan, but you may miss the day-to-day help.

- How much do I pay if I run side jobs or own rental homes?

With more income streams, fees rise. Rent, gains, or side jobs add more work for the accountant, so you should plan for higher costs.

- Is it smart to pick a monthly plan instead of one-off fees?

A monthly plan may cost more upfront, but it spreads out fees and keeps your books in check all year. It can save you stress and help you avoid tax fines.

- Do accountants in London charge more than those outside the city?

Yes. Due to high demand and rent, London firms often ask for higher fees. If cost is key, you may want to look at firms in smaller towns.

- Can a personal accountant help me save more than their fee?

In most cases, yes. A skilled accountant can spot tax breaks, cut waste, and guide smart spend choices. The money saved may be more than what you pay.

- How do I check if the fee is fair for my case?

Ask for a full quote with what is and is not in the deal. Compare two or three firms, and pick one that is clear on fees, not just cheap.

- Can I cut fees if I keep my records neat?

Yes. If you track spend, file bills, and log income, your accountant will spend less time on your case. The less effort they need, the more savings you gain.

We are a unique team of experts with specialization in MYOB, Xero Silver Champion & Advisors, and QB Pro Advisors.

- 3rd Floor 207 Regent Street, London, W1B 3HH.

- Phone: +44 203 868 2860

TAX RETURN SERVICES

Join Our Newsletter Now

Be the First to Know. Sign up for our newsletter today.

© 2013-2026 Meru Accounting. All Rights Reserved.

Privacy Policy

Request Call Back

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Request Call Back OnClick

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office )

Meru Accounting

First Month Bookkeeping Free !

- Free Trial for First month Bookkeeping services worth $95

- Get Monthly Financial Statement( Click here )

- Dedicated Accountant with Backup person for each Business

- Latest Infrastructure with Great IT security

( Virtual Tour to our office ) - Tax Filing Starting at just $350 ( Federal + 1 State )

( Check pricing for Business Owners)

Error: Contact form not found.

This will close in 0 seconds

Calendly

This will close in 0 seconds

office video

This will close in 0 seconds